【Petroleum Coke】East China accounts for 40%! Key consumption regions and driving factors analysis

Graphitized petroleum coke is widely used in producing high-end graphite electrodes, lithium battery anode materials, and carbon products. Its high conductivity, purity, and graphitization make it a vital raw material in metallurgy, energy, and advanced materials industries.

【Petroleum Coke】East China accounts for 40%!

Key consumption regions and driving factors analysis for 2025

Ⅰ. Core Consumption Region Distribution

East China (Shandong, Jiangsu, Zhejiang, etc.)

Consumption Scale: The largest consumption market in the country, accounting for over 40% of total national demand.

Driving Factors: Concentration of traditional industries such as steel, chemicals, and cement—Shandong's steel capacity leads nationwide; Jiangsu's glass industry has strong demand for petroleum coke. Additionally, port advantages support imports, processing, and distribution of coke.

Challenges: Stricter environmental policies (such as air pollution control plans) are prompting companies to shift towards low-sulfur coke; high-sulfur coke demand is declining.

North China (Hebei, Tianjin, Shanxi, etc.)

Consumption Scale: Accounts for 30%, ranking second.

Driving Factors: Dense steel industry (Hebei accounts for over 20% of national steel capacity), combined with demand from cement and electrolytic aluminum industries; Tianjin Port as an important energy hub in Northern China supports petroleum coke trade.

Policy Influence: Environmental restrictions and production limits urge enterprises to upgrade equipment, driving increased demand for high-quality coke.

Northwest China (Xinjiang, Inner Mongolia, Shaanxi, etc.)

Consumption Scale: Expected to boost demand to become the primary consumption region by 2025, exceeding 35%.

Driving Factors: Explosive growth of electrolytic aluminum industry (Xinjiang's electrolytic aluminum capacity accounts for 40% of the country), coupled with preferential electricity pricing policies; new energy projects (such as photovoltaic glass) are driving demand for low-sulfur coke.

Logistics Characteristics: Local calcining capacity is insufficient, relying on external imports, leading to higher transportation costs.

South China (Guangdong, Guangxi, Fujian, etc.)

Consumption Scale: Emerging growth pole, accounting for 15% of total demand.

Driving Factors: Infrastructure acceleration (such as the Guangdong-Hong Kong-Macao Greater Bay Area) stimulates demand for steel and cement; port advantages (such as Zhanjiang Port) facilitate imported coke's landing and processing.

Technological Transformation: Deep processing of glass (such as solar photovoltaic glass) promotes demand for specialty coke.

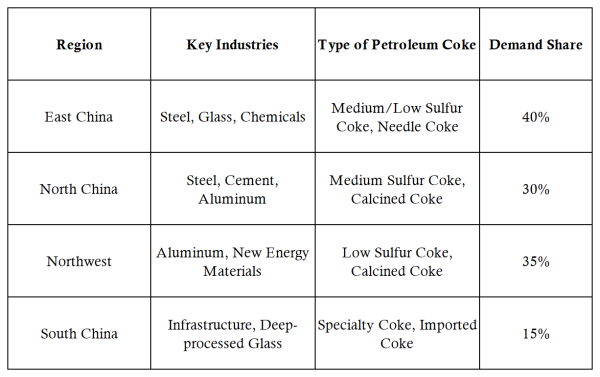

Ⅱ. Regional Demand Structure and Key Industries

Ⅲ. Emerging Consumption Potential Regions

Southwest China (Sichuan, Yunnan, etc.)

Growth Points: Rich hydropower resources attract the westward migration of electrolytic aluminum industries. By 2025, Yunnan's electrolytic aluminum capacity will surpass 5 million tons, driving demand for low-sulfur coke.

Bottlenecks: Insufficient calcining capacity, relying on imports from East and Northwest China, with transportation costs accounting for up to 20%.

Northeast China (Liaoning, Jilin, etc.)

Traditional Demand: Supported by steel industries (such as Anshan Iron and Steel Group), but demand has shrunk due to environmental restriction-induced production cuts.

Transformation Direction: Upgrading production of carbon products (such as graphite electrodes) to high-end, increasing needle coke demand.

Ⅳ. Consumption Trends and Policy Relationships

Environmental Drivers:

The proportion of high-sulfur coke (sulfur > 4%) consumption nationwide has decreased from 45% in 2020 to 25% in 2025—demand for low-sulfur coke grows at an average annual rate of 12%.

Regional Policy Differences:

Northwest China benefits from "dual-control" exemption policies, supporting expansion of high-energy-consuming industries; East China pilots carbon trading to push enterprises toward low-carbon coke procurement.

International Competition:

Designed by imports of Middle Eastern low-sulfur coke (average price about $8-10/ton lower than domestic), the import volume in Q1 2025 increased by 5.5% YoY, with coastal regions such as South and East China utilizing imports to fill gaps.

Ⅴ. Typical City Case Analyses

Binzhou, Shandong:

The world's largest electrolytic aluminum base (Weiqiao Group) consumes over 2 million tons of petroleum coke annually, 90% of which is low-sulfur coke.

Foshan, Guangdong:

Glass industry cluster (accounting for 30% of the country's capacity), annual demand for specialty coke reaches 500,000 tons, with over 60% dependence on imports.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies