【Steel】Analysis of Continuous Profit Contraction and Future Trends

Graphite electrodes are the "lifeline" of EAF steelmaking! As the core material for arc conduction and heating, they feature high conductivity and heat resistance, directly affecting molten steel quality and output. Mastering graphite electrodes means mastering the initiative in EAF steelmaking!

【Steel】Analysis of Continuous Profit Contraction and Future Trends

Since August, steel profits have continued to shrink. As of September 5, the profit for rebar blast furnaces was -24 yuan/ton, down 220 yuan/ton from the end of July, and hot-rolled coil profits fell 149 yuan/ton compared with late July. Cold-rolled coil and medium-thick plate profits declined by 131 yuan/ton and 124 yuan/ton, respectively. The profitability of 247 steel enterprises fell 4.33 percentage points compared with the end of July.

I. Clear Supply-Strong and Demand-Weak Situation in the Steel Market

(A) High Production

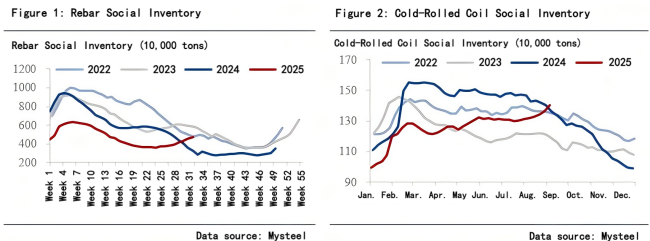

In August, the surveyed 247 steel mills nationwide had an average daily hot metal output of 2.4047 million tons, a slight month-on-month decrease of 0.3%, but a year-on-year increase of 6.2%. In August, the weekly average production of the five major steel products was 8.759 million tons, up 0.8% from July's 8.688 million tons and 12.3% higher than August last year's 7.798 million tons. By product, plate production exceeded last year's level. In August, weekly hot-rolled coil production was 3.2012 million tons, up 5% year-on-year; weekly cold-rolled coil production increased 5.3% year-on-year; medium-thick plate weekly output rose 11% year-on-year. Long steel production also increased significantly from last year's low base. In August, rebar output rose 33% year-on-year, and wire rod output increased 7% year-on-year.

Steel mill profitability was relatively high, driving hot metal output to remain at high levels. This year, steel mill profitability rose significantly, directly boosting production enthusiasm. Since the beginning of the year, the profitability of 247 steel mills has been above 50%, reaching the highest level in nearly four years, climbing above 60% by mid-July. As of September 5, the profitability of the 247 steel mills was 61.04%, still at a relatively high level. Daily hot metal output in August rose over 6% year-on-year, and driven by relatively high profitability, steel mills maintained high-intensity production, with blast furnace capacity utilization around 90% in August.

(B) Weak Demand

Construction steel demand remains sluggish. According to surveys, apparent demand for construction steel from January to August fell 6.0% year-on-year, becoming the core drag on steel demand. Real estate demand remains weak. From January to July, newly started real estate projects declined 19.4% year-on-year, and real estate investment fell 12% year-on-year, still showing a large decline. The downward cycle in real estate has not ended, forming the main pressure point for steel demand.

Manufacturing demand growth slows. Regarding the "replacement subsidy" policy, two batches totaling 162 billion yuan of central funds were issued in January and April; in July and October, funds for the third and fourth quarters totaling 138 billion yuan were issued. The consumption-pulling effect of "replacement subsidy" in the second half of the year shows a slowing trend. Due to the replacement subsidies starting from the third quarter last year, the consumption base was relatively high, and the promotion effect on total retail sales in the second half will decrease. Additionally, durable goods such as home appliances and automobiles cannot be repeatedly consumed in the short term, leading to diminishing marginal effects.

Steel export growth slows. In August 2025, China exported 9.51 million tons of steel, down 0.326 million tons from the previous month, a month-on-month decrease of 3.3%. Since July, under the "anti-involution" policy, steel prices have risen significantly, narrowing the domestic and international price gap and affecting export orders. Rising domestic raw material prices have pushed up steel costs, and future steel export growth is expected to decline.

Apparent consumption by product

By product, according to survey sample data, in August, weekly average apparent consumption of rebar was 1.999 million tons, down 0.5% year-on-year; wire rod 810,000 tons, down 7.6%; hot-rolled coil 3.157 million tons, up 4.3%; cold-rolled coil 849,000 tons, up 2.7%; medium-thick plate 1.653 million tons, up 9%. Overall, construction steel consumption has declined from last year's low base, reflecting sluggish demand, while plate consumption continues to grow from last year's high base, reflecting relatively strong manufacturing demand.

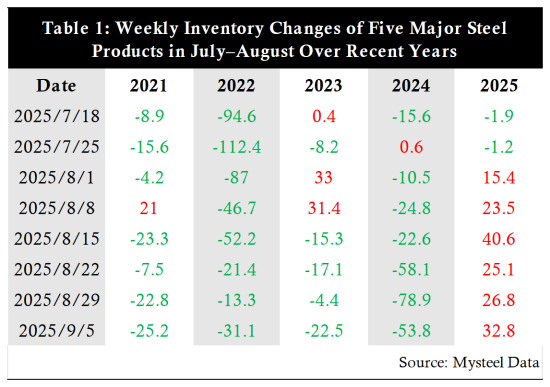

(C) High Inventory Pressure

Oversupply has led to continuous accumulation of steel inventories, reaching the highest level in nearly five years. As of September 5, inventories of the five major steel products totaled 15.007 million tons, up 1.49 million tons from early August, an 11% increase, with social inventory increasing 14%.

By product, construction steel shows clear off-season characteristics, with high production leading to rapid inventory accumulation in July-August. Plate inventories are high due to sustained elevated production. As of September 5, social inventory of rebar reached 4.687 million tons, up 845,000 tons from early August, an increase of 22%. Social inventory of cold-rolled coil reached 1.404 million tons, up 7% from early August; the absolute value exceeded last year's level, reaching a near five-year high, up 2.9% year-on-year.

(D) Strong Raw Material Prices

In August, the weekly average profitability of 247 steel mills was 64.7% (up 61.9 percentage points year-on-year), production enthusiasm was high, and capacity utilization was around 90%, supporting strong raw material demand.

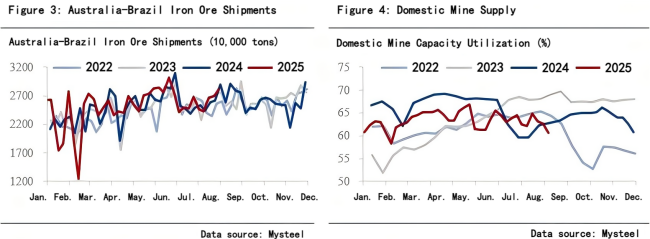

Iron ore prices remained firm due to high demand and supply growth falling short of expectations. Mainstream Australian and Brazilian ores were affected by berth maintenance at Hedland Port, keeping overall shipments at median levels of the past three years; marginal supply contraction occurred from non-mainstream suppliers such as India and South Africa. Domestic port inventory of imported ore fluctuated little in August, with total inventory rising about 1.06 million tons from early August, remaining at 138 million tons, down 10.5% year-on-year. Domestic concentrate supply slightly contracted, with incremental iron ore supply falling short of expectations.

Coking coal prices initially rose then fell in August, overall fluctuating at high levels with limited volatility; some mines showed strong resistance to price declines. Disturbances such as overproduction inspections and environmental production restrictions in North China affected supply, which did not return to first-half levels. As of August 29, daily coking coal output from 523 mines fell 4.5% year-on-year. In August, the supply-demand situation for coking coal showed no major conflicts, with prices fluctuating at high levels.

II. Steel Production Reduction Remains the Breakthrough Path

In the first half of the year, steel mill profits improved mainly due to raw material concessions, especially the decline in coke prices. In the first half, coke prices fell sharply: by June 30, coking coal and coke prices dropped 20% and 31.6% from the beginning of the year, respectively. In June, about 60% of coal enterprises nationwide suffered losses; all mines under 2 million tons in Shanxi province were loss-making, and loss-making mines in Shandong and Anhui exceeded 70%. Benefiting from falling coking coal prices, steel enterprise profitability improved. From January to July, total profits in ferrous metal smelting and rolling reached 64.36 billion yuan, compared with -2.76 billion yuan in the same period last year.

However, relying on raw material concessions is unlikely to continue. Future raw material supply is not expected to increase significantly, and continued oversupply cannot persist, limiting the ability to squeeze upstream profits. Regarding coke, from September to December, after environmental production restrictions end in September, Shanxi coal mines will resume production, bringing some supply growth. However, due to "overproduction inspections," domestic coal output in Q4 is unlikely to increase significantly, with coking coal production expected to grow only about 7.5 million tons in 2025.

For iron ore, the four major mines sold a total of 525 million tons in H1 2025, down 1.02% year-on-year (down 5.42 million tons). Among them, FMG sales increased 3.5%, BHP remained largely unchanged, VALE and RIO both reduced output and shipments. Looking at H2 2025, based on mine shipment targets, the four major mines' shipments may increase about 8 million tons year-on-year, but declining ore grades limit actual iron content gains.

Steel production reduction remains the breakthrough path. Currently, China's steel supply is excessive, and "involution" competition results in high output but low efficiency. "Low-price competition" wastes production resources and triggers raw material price premiums, trapping steel enterprises in a thin-margin squeeze. The "Steel Industry Stable Growth Work Plan" (2025-2026) points out that the current total steel supply is excessive, effective demand is insufficient, and supply-demand imbalance is the main contradiction affecting industry quality and profitability. Over the past four years, steel prices experienced a long downward process, with prolonged losses for steel enterprises, reflecting industry downturn caused by supply-demand mismatch. During 2016-2018 supply-side reforms and 2021-2022 "dual-carbon" target-driven production controls, steel prices rebounded significantly. It is evident that resolving oversupply remains the best way to improve industry profitability, and proactive production reduction is necessary for the industry to overcome difficulties.

Feel free to contact us anytime for more information about the EAF Steel market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies