【Petroleum Coke】Prices Decline ↘️ as Downstream Buyers Remain Cautious ...

Calcined petroleum coke is an important material in modern manufacturing, especially in the aluminum and steel industries. Its high carbon content, low sulfur content, and low impurities make it an ideal choice for various applications.

【Petroleum Coke】Prices Decline ↘️ as Downstream Buyers Remain Cautious; Local Refinery Coke Still Faces Downward Pressure

Market Overview

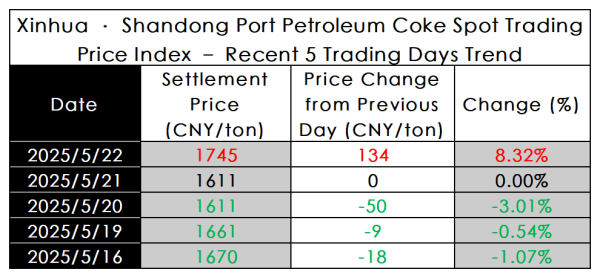

This week, the trading pace in the local refinery petroleum coke market slowed, with weaker transactions compared to previous weeks. Coke prices trended downward, with fluctuations ranging from RMB 20 to RMB 350/ton. As of May 22, 2025, the average market price in Shandong was RMB 2,238/ton, down RMB 51/ton from last week, a decrease of 2.22%.

Recently, prices for low-sulfur coke from major suppliers have continued to fall. Downstream buyers are increasingly cautious, and procurement activity has slowed. In order to maintain sales, most refineries have slightly lowered their prices in line with the market, leading to a generally subdued trading atmosphere.

High-sulfur coke prices fluctuated frequently throughout the week. While prices saw brief increases earlier, mounting pressure to move product prompted downward adjustments of RMB 20–350/ton. Occasional slight increases of RMB 10–50/ton occurred, but due to market constraints, the overall magnitude remained limited. For some medium- and low-sulfur coke, prices gradually declined into a range acceptable to downstream buyers, enabling stable shipments with minor price fluctuations.

On the whole, petroleum coke prices trended downward this week. In Northeast China, shipment activity was moderate at refineries such as Jincheng Beiran and Haoye, with declining prices, while Huajin Tongda maintained steady sales and slightly raised its prices. Along the Yangtze River, Jin'ao Technology's coking unit has yet to resume operations, with startup delayed to June. In Northwest China, asphalt coke continued to face shipment pressure, and prices remained unchanged.

Supply Side

As of May 22, there were 22 instances of routine maintenance across local refinery coking units, with one new unit beginning maintenance this week. Output fluctuated at some facilities.

Local refinery petroleum coke daily output stood at 33,040 tons, with an operating rate of 60.63%, up 1.01% from the previous week.

Profitability of Coking Units

This week, the average weekly gross margin for local refinery coking units was negative RMB 123/ton, further declining from last week.

Crude oil prices showed mild fluctuations, with limited guidance from market news. Supply-demand dynamics dominated. Refineries had moderate shipments yesterday and lacked strong pricing confidence. Some major vacuum residue suppliers raised prices, with a few refiners tentatively following the trend.

For gasoline, downstream inventory remains high and cost support is limited, leading to weak prices. For diesel, stable operations in industrial and mining sectors and cyclical restocking by gas stations led to stronger refinery price support and some price increases during the week.

Prices for other by-products of coking units were mixed. Overall, refinery margins continued to decline this week.

Inventory

Local refinery petroleum coke shipments underperformed versus previous periods. Downstream demand was limited, with most buyers purchasing only as needed. Refineries generally adjusted prices flexibly in line with the market to maintain sales. Inventories remained at relatively low levels.

Prices (as of May 22):

Low-sulfur coke (approx. S 1.0%): RMB 3,400–3,540/ton (ex-factory mainstream transaction price)

Medium-sulfur coke (S 2.5%, V ~400): RMB 2,603–2,803/ton

High-sulfur coke (S 3.5%, V >400): RMB 1,650–1,950/ton

High-sulfur high-vanadium coke (approx. S 4.5%): RMB 1,443–1,580/ton

Asphalt coke in Northwest China: RMB 3,000–3,600/ton

Other Indicators:

Lianqiao Petrochemical: Sulfur ~3.5%, vanadium ≤650 PPM

Yatong Petrochemical: Sulfur reduced to ~2.8%

Jincheng Petrochemical (Old Plant Pellet Coke): Sulfur increased to ~5.5%

Hebei Xinhai: Sulfur at ~1.7–2.8%

Haike Ruilin: Sulfur increased to ~1.57%

Market Outlook

Next week, one coking unit is expected to undergo maintenance, possibly resulting in a slight supply reduction. However, with the end of the month approaching, downstream procurement enthusiasm may remain low, offering limited support to demand.

Petroleum coke prices from local refineries are expected to generally remain weak or stable next week, with some prices likely to face further downward adjustment in the range of RMB 10–100/ton.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies