【CPC】Supply & Demand Both Decline! Steeper Downtrend in May, Even Greater Pressure in June?

【Calcined Petroleum Coke】"Supply and Demand Both Decline"! Steeper Downtrend in May, Even Greater Pressure in June?

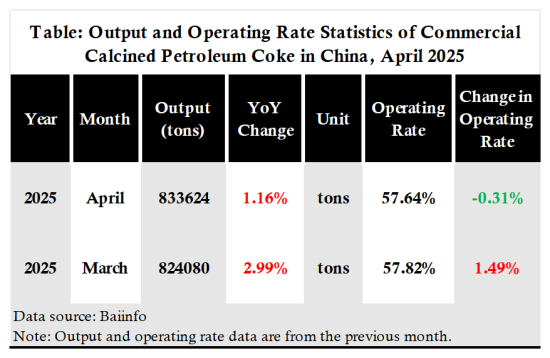

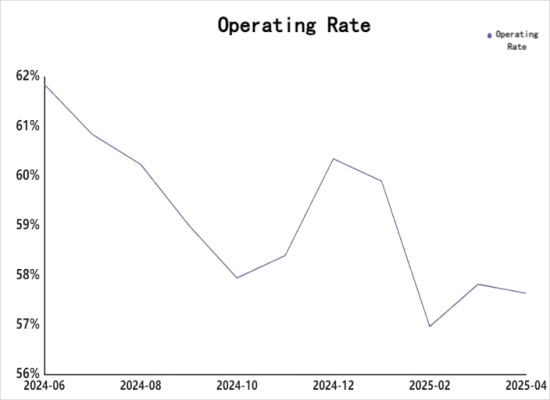

Calcined Petroleum Coke Supply in May

Low-sulfur CPC

The supply of low-sulfur calcined petroleum coke (CPC) decreased compared to last month. Due to insufficient demand and increased losses in sales, some enterprises shut down, while most reduced production to the minimum load.

Medium- and high-sulfur CPC

Overall, the supply of medium- and high-sulfur CPC declined from the previous month. With sales obstructed and outbound shipments under pressure, two enterprises that had planned to resume production postponed their restart due to poor market conditions. Some enterprises in Shandong and Jiangsu had to cut production due to losses.

One company in Hunan reduced monthly output by about 6,000 tons.

Another enterprise in Henan plans to discharge coke around mid-June, increasing monthly output by about 4,500 tons.

Calcined Petroleum Coke Demand in May

Low-sulfur CPC

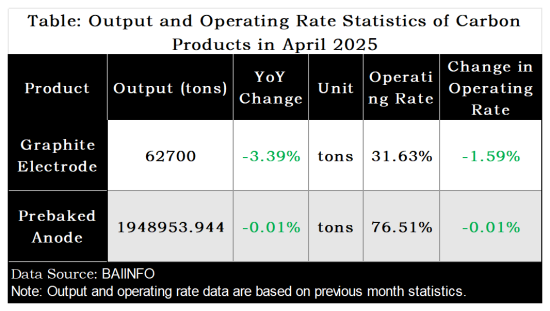

Operating enthusiasm in the graphite electrode market remained low this month. End-user steel plants had poor profits and weak demand. Electrode companies saw poor shipments and lacked confidence in the future price trend of low-sulfur CPC, showing very little intention to stockpile. Most companies maintained raw material inventory at levels just enough for normal operations.

Transactions in the aluminum cathode market were flat. Raw material support was insufficient, cathode block prices remained weak, and purchases of low-sulfur CPC were made on an as-needed basis. Demand was weak and stable.

Medium- and high-sulfur CPC

Overall downstream demand in May was below expectations. Some electrolytic aluminum enterprises switched to prebaked anodes, reducing demand for specification-grade CPC. Most aluminum plants continued to rely on long-term orders, and under cost-reduction policies, they maintained a strong stance on price suppression.

Supply in the anode material market remained sufficient. Downstream battery cell manufacturers had average procurement needs. Anode producers became increasingly cautious, and prices for outsourced graphitization continued to face pressure and remained low. As a result, demand for regular medium- and high-sulfur CPC declined.

Feel free to contact us anytime for more information about the calcined petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies