【New Publication Overview】the Current Layout of EAF Steel Production Capacity in China

✅Graphite electrodes are indispensable consumables in the electric arc furnace (EAF) steelmaking process. They play a vital role in arc heating, with excellent electrical conductivity and high-temperature resistance, making them a crucial factor in enhancing both the productivity and quality of EAF steel.

【New Publication Overview】Analysis and Outlook on the Current Layout of EAF Steel Production Capacity in China

Status Analysis and Prospect of EAF Steel Production Capacity Layout in China

LI Xinyu1,2, LIN Yan1,2, SU Buxin1,2

(1. Industrial Research Department, Metallurgical Sub-Council of China Council for the Promotion of International Trade, Beijing 100711, China;

2. Industrial Research Department, International Exchange and Cooperation Center of Metallurgical Industry, Beijing 100711, China)

01. Abstract

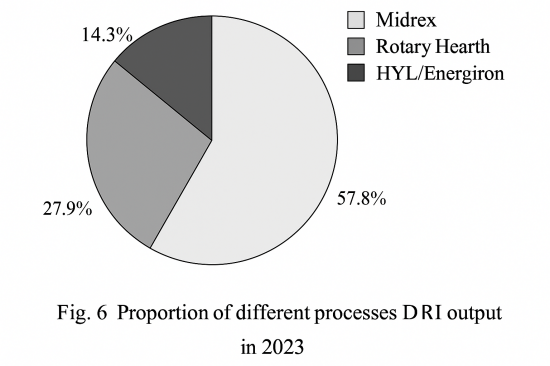

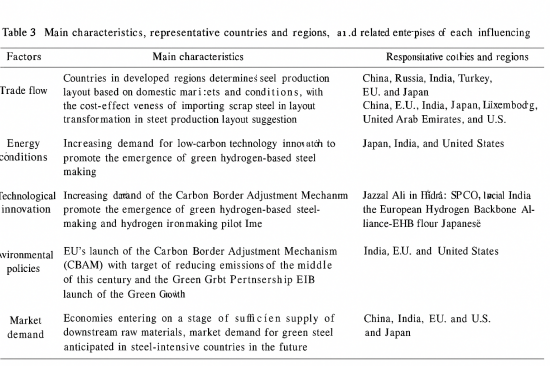

Under the background of the "dual carbon" era, the electric arc furnace (EAF) short-process steelmaking process is considered an effective carbon reduction route. Globally, there has been a move to further expand EAF steelmaking capacity. A study of the global layout of EAF steel production capacity reveals five tiers based on EAF steel output among major countries. Six key factors influence the production capacity layout: trade flow, energy conditions, economic development, technological innovation, environmental policies, and market demand.

An analysis of more than 210 EAF-equipped enterprises in China shows that nearly 200 are located east of the "Hu Huanyong Line." The layout mainly exhibits four characteristics: resource supply dependence, energy reliance, green orientation, and group operation models. Problems include weaker cost competitiveness of short-process enterprises compared to long-process ones in the same region, severe product homogenization, and underrepresented environmental advantages.

Based on the current status, four directions for optimization are proposed, along with two trends for future development. From the perspectives of location, capacity, and time, the paper projects the future layout of EAF steel production capacity. It emphasizes the need to manage both stock and incremental EAF steel production and to fully leverage the key role of EAF in the green and low-carbon transformation of the steel industry. When moderately developing EAF short-process steelmaking, decisions must not be made in isolation but should comprehensively consider the strategic layout across different periods.

02. Keywords

EAF steel; production capacity layout; influencing factors; optimization direction; development trend

03. Introduction

During China's "13th Five-Year Plan" supply-side structural reform in the steel industry, over 150 million tons of crude steel capacity were eliminated, and 140 million tons of "substandard steel" capacity were fully cleared. The scrap steel resources previously directed to substandard steel producers were partly redirected to EAF enterprises. Some companies installed new EAF equipment under the various capacity replacement policies.

In the "14th Five-Year Plan" period, China announced its "dual carbon" targets. In 2022 and 2024, the steel industry released two editions of the Vision for Carbon Neutrality and Low-Carbon Technology Roadmap, in which many researchers proposed vigorously developing full-scrap EAF short-process steelmaking and exploring the "hydrogen-based shaft furnace–EAF" short-process route as key strategies for decarbonization.

Policy documents such as the Implementation Plan for Carbon Peaking in the Industrial Sector and Guiding Opinions on Promoting the High-Quality Development of the Steel Industry proposed that by 2025, EAF steel output should account for 15% of total crude steel output, and 20% by 2030. However, in 2023, the share stood at only 9.7%.

Since the beginning of 2024, 93% of newly announced global steelmaking capacity has been EAF-based, and EAF accounts for 50% of capacity under construction. The global trend toward low-carbon steelmaking is just beginning. Internationally, as the U.S. steel industry evolved from a production-oriented to a consumption-oriented structure, short-process enterprises gradually replaced long-process ones. In the EU, abundant scrap resources, stringent environmental policies, and declining steel demand have kept EAF steel's share consistently high. Turkey, leveraging its geographic location and scrap import advantages, is also vigorously developing EAF steel.

Currently, over 90% of China's crude steel capacity is converter-based. Challenges such as limited scrap supply, slow tax rebates, high industrial electricity costs, and weaker competitiveness of EAF steel products hinder the development of EAF steelmaking in the context of carbon reduction. Addressing these issues will take time and cannot be resolved overnight.

On August 23, 2024, the Ministry of Industry and Information Technology suspended the Implementation Measures for Capacity Replacement in the Steel Industry and began revising it, effectively entering a period of EAF capacity stock management.

Optimizing China's EAF steel production capacity layout must be considered within the broader framework of overall steel industry restructuring while taking into account the distinct characteristics of the EAF industry. To better leverage the overall advantages of China's existing EAF capacity, this paper briefly analyzes the characteristics and issues in both global and domestic EAF capacity layouts and proposes directions and trends for optimizing China's EAF capacity layout, aiming to support strategic planning for its development.

04. Selected Charts

05. Conclusion

1) Based on global EAF steel production in 2023, countries can be categorized into five tiers. China, India, and the United States fall into the top three tiers. The current global layout of EAF steel production capacity is influenced by six key factors: trade flow, energy conditions, economic development, technological innovation, environmental policies, and market demand.

2) China currently has more than 210 EAF-equipped enterprises, nearly 200 of which are located east of the Hu Huanyong Line. The layout characteristics are categorized into four types: resource supply-oriented, energy-dependent, green-oriented, and group-based models. Key issues include: lower cost competitiveness of short-process versus long-process enterprises in the same region; severe product homogenization among regional EAF producers; and the yet-to-be-fully-realized environmental advantages of EAF short-process steelmaking.

3) Optimization and development of China's EAF production capacity layout require coordinated planning. Both stock optimization and forward-looking strategic planning for new EAF capacity must be undertaken in the context of crude steel reduction trends. Policy support for the EAF industry should be enhanced. Investments in technological and industrial innovation should be increased to upgrade EAF steel products, achieve full coverage of steel varieties, and promote international cooperation. The goal is to harness EAF's green and low-carbon attributes to help the steel industry meet carbon targets.

4) From a locational perspective, China's EAF capacity is primarily concentrated in the eastern coastal areas and will gradually form EAF industry clusters. The western region, with its green advantages, is expected to host new and relocated EAF projects. "Urban steel mills" and "capacity going global" will also become important modes of EAF capacity layout. Group-based, multi-base distribution of EAF operations will become a trend, conducive to improving industry concentration. From the perspectives of capacity and timing, as scrap supply stabilizes, direct reduced iron (DRI) supplements, and backward ironmaking capacity phases out, more converter capacity will be replaced by EAFs. With continued green, intelligent, and large-scale development of the EAF sector, both capacity and output will rise. Considering the long-term decline in crude steel output, future EAF production capacity layout strategies must be dynamically adjusted based on actual equipment conditions, financial capability, low-carbon constraints, and other factors.

06. Citation

LI Xinyu, LIN Yan, SU Buxin. Status analysis and prospect of EAF steel production capacity layout in China [J]. China Metallurgy, 2025, 35(5): 22.

(李新宇,林严,苏步新. 中国电炉钢生产力布局现状分析与展望[J]. 中国冶金,2025,35(5):22.)

Feel free to contact us anytime for more information about the EAF Steel market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies