The rise of electric vehicles and energy storage is boosting demand for lithium batteries, increasing the need for high-quality petroleum coke and artificial graphite. Calcined petroleum coke quality directly impacts graphite performance, making it key for battery anode production.

【Anode Materials】Profits Rebound, but the Road to Cost Reduction Remains Long

【Anode Materials】Profits Rebound, but the Road to Cost Reduction Remains Longg

Introduction

Although low-sulfur coke prices have declined and anode material profits have rebounded, the prices of anode materials remain at the bottom. Profit margins for anode enterprises are narrow, making cost reduction and efficiency improvement the main theme.

I. Technological Advancements and Equipment Optimization Can Effectively Reduce Graphitization Costs

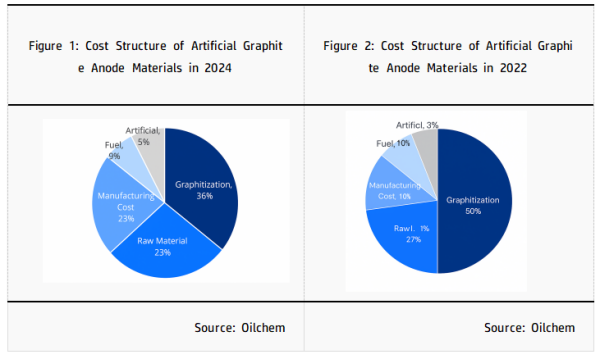

Graphitization is the costliest stage in the production of anode materials. Through technological upgrades and equipment optimization, graphitization costs can be effectively reduced. For example, using new box-type furnaces, optimizing graphitization processes, and improving furnace utilization can significantly reduce electricity consumption and maintenance costs.

In 2024, the proportion of graphitization costs dropped by 14% compared to 2022, accounting for about 36% of total costs. Therefore, cost reduction starts with graphitization. Processing fees for graphitization fell from 27,451 yuan/ton in 2022 to 8,700 yuan/ton in 2025, a 68.3% decrease. This was mainly due to anode manufacturers relocating to regions with cheaper electricity such as Southwest, Northwest, and North China.

Additionally, companies continue to update graphitization technologies. For example, Kuntian New Energy has developed a continuous graphitization furnace process that features lower energy consumption, higher intelligence, shorter production cycles, and better environmental performance. The process shortens production time to 10–12 days, improves automation by over 50%, reduces auxiliary material consumption by 50%, and cuts carbon emissions by 75%.

II. Enhancing Raw Material Development and Seeking Cost-Effective Substitutes Can Effectively Control Raw Material Costs

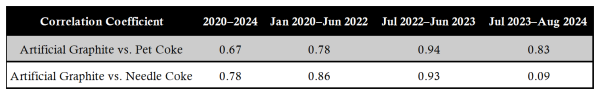

Raw material costs are also crucial, accounting for 27% of anode production costs. Before mid-2022, high-end anode materials required the use of needle coke due to its superior performance metrics.

Since the second half of 2022, price reductions in new energy vehicles prompted a cost-cutting trend across the supply chain. The industry began using cheaper petroleum coke as a substitute or blending it with needle coke. As a result, the correlation between low-sulfur coke and artificial graphite increased during this period, and prices for low-sulfur coke began to rise.

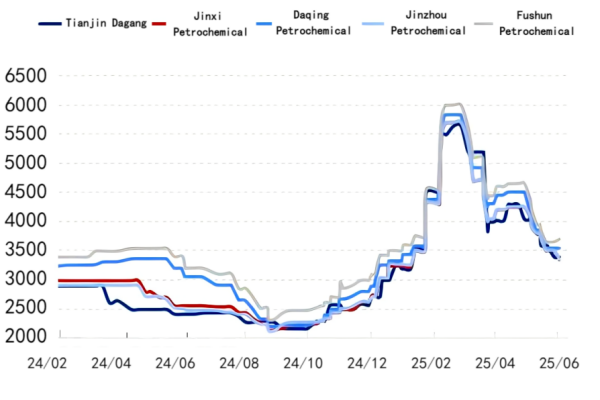

Figure 3: Low-Sulfur Petroleum Coke Price Trend (Unit: yuan/ton)

Source: Oilchem

After peaking in February 2025, low-sulfur coke prices began to decline. In Q1, prices surged and then plummeted. In Q2, prices entered a slow and sustained downward trend. From the end of March to late May, average prices fell by about 15%, and prices are expected to continue declining in June.

However, compared to the same period last year, prices remain significantly higher — with Grade 1 and 2A low-sulfur coke rising over 46%. Current prices are still far from historical lows.

III. Cost Control Has Enabled Profit Recovery

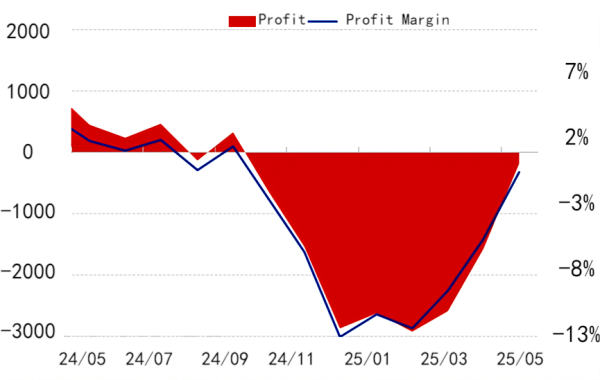

Figure 4: Artificial Graphite Profit and Profit Margin (Unit: yuan/ton)

Source: Oilchem

In May, the average monthly profit for mid-end artificial graphite sample companies was -183 yuan/ton, an increase of 88.26% month-on-month. The gross margin was -0.67%, up 5.01 percentage points.

Anode material profits have clearly rebounded. Market demand remains weak, driving coke prices down. In the Southwest, during the flat water season, graphitization activity has picked up, increasing output. However, processing profits are limited, making further price drops difficult. Raw material costs are now effectively under control, helping to restore production profitability.

Feel free to contact us anytime for more information about the Anode Material market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies