【Domestic Refinery Petroleum Coke】"Rising" Voices: Low Inventory at Refiners...

Calcined petroleum coke, with its high carbon content, low sulfur, and low impurities, plays a vital role in modern manufacturing, especially in the aluminum and steel industries.

【Domestic Refinery Petroleum Coke】"Rising" Voices: Low Inventory at Refiners, Ports Under Pressure

Market Dynamics: Fluctuating Rise

Recently, the overall trend in the domestic refinery petroleum coke market has shown an upward movement.

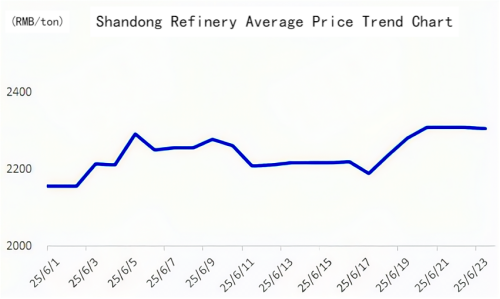

As of June 23, 2025, the average market price in Shandong was 2,306 RMB/ton, an increase of 100 RMB/ton compared to the same period last month, representing a 4.55% rise.

Looking at the overall performance in June, prices have experienced a "stepwise" upward adjustment. The market went through a "rise in early June → correction in mid-month → rebound in late June" process. Downstream companies tend to purchase when prices fall to low levels, which has been a main driver of the price rebound.

Over the past week, the market has shown slight upward movement.

Supply Side

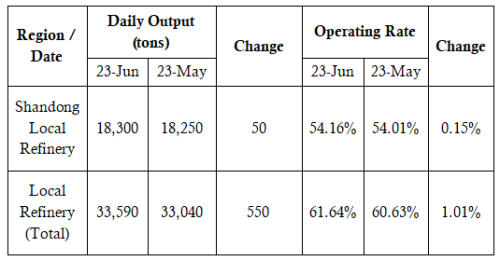

As of June 23, the daily production of domestic refinery petroleum coke was 33,590 tons, with an overall coking capacity utilization rate of 61.64%, a slight increase of 1.01% compared to last month. This is mainly due to the commissioning of two new coking units within the month.

Currently, 22 coking units are under regular maintenance, and in Shandong, two new units from Hualian and Haikeruilin are temporarily shut down for maintenance.

In June, low-sulfur coke accounted for 6% of total output, medium-sulfur coke 26%, remaining roughly flat from May; high-sulfur coke accounted for 58%, down 2% from May.

The total production of domestic refinery petroleum coke in June is estimated at approximately 985,900 tons, about 28,300 tons less than last month. Looking ahead, two units are scheduled for maintenance, while two to three units are planned to resume production, which may result in a slight increase in domestic refinery supply.

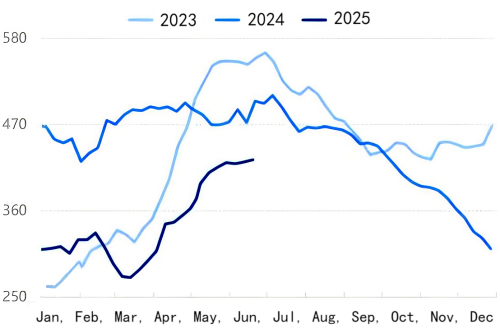

It is noteworthy that recent imported petroleum coke has arrived at ports, leading to increased port inventories, which could pose potential supply pressure in the domestic market. It is expected that port inventories will further rise to around 4.3 million tons by the end of June.

Image: Port Inventory Trend Chart (2023-2025) – Units: 10,000 tons

Demand Side

Downstream demand remains steady but shows some polarization, primarily characterized by "just-in-time procurement" and "stocking on dips."

1. Pre-baked Anodes: Orders and production are healthy, maintaining steady demand for petroleum coke.

2. Calcined Petroleum Coke: Operating rate is 55.24% (down 0.85% MoM), with ample supply and high inventories, resulting in weak demand.

3. Negative Electrode Materials: Operating rate is 45.24% (down 5.42% MoM); most enterprises are fulfilling existing orders with limited new demand, keeping procurement stable.

4. Graphite Electrodes: Companies mostly maintain balanced production and sales, with moderate demand.

5. Silicon Carbide: Operating rate is around 41% (slightly down MoM); many enterprises face stock buildup with limited production enthusiasm and demand.

Overall, downstream demand has not seen significant growth but still has appetite for reasonably priced petroleum coke, especially during price dips, when procurement activity tends to increase.

Upstream Costs and Refinery Inventory

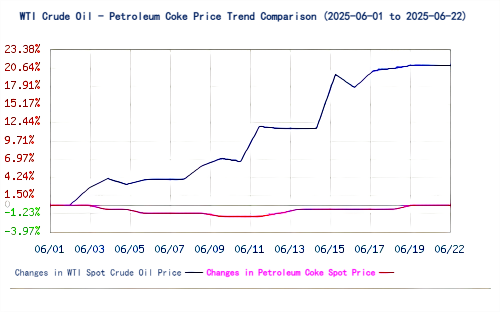

Recently, rising international crude oil prices have been a key external factor supporting higher petroleum coke prices, driven by:

Geopolitical tensions in the Middle East (Israel-Iran conflict) raising supply risk concerns.

Progress in China-US trade negotiations and a surprising drop in US crude stocks providing macroeconomic tailwinds.

Domestic refiners generally adopt flexible pricing strategies to maintain inventory levels at medium-low levels. The low inventory status of some refineries also supports price increases.

Market Outlook

Overall, the current petroleum coke market is characterized by a complex interplay of multiple factors.

In terms of prices, June saw oscillating growth, but the upward momentum waned toward the end of the month.

Cost and supply-wise, high international oil prices and low domestic inventories provide strong support, but future slight increases in domestic supply coupled with continuous port arrivals of imported resources could exert downward pressure.

Demand remains relatively weak overall, but the "buy on dips" approach sustains a market bottom.

It is expected that domestically refined petroleum coke may mainly undergo consolidation in the near term, with some potential for slight upward fluctuation.

Supporting factors: Downstream rigid demand persists, and recent market activity has been quite active, indicating a willingness to purchase cost-effective resources.

Pressuring factors: Imported petroleum coke arriving at ports has led to increased port inventories.

Uncertainties: There is a possibility of a slight increase in future supply; at the same time, close attention should be paid to whether international crude oil prices will continue to surge due to geopolitical tensions, which could impact refinery production and costs.

Market participants need to closely monitor trends in international crude oil prices, changes in port inventories, and the actual order intake and startup conditions of downstream enterprises.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies