【China Iron and Steel Association】Makes Suggestions! Major Departments Issue Documents!

Graphite electrodes are vital consumables in EAF steelmaking, mainly used for arc heating. With superior electrical conductivity and high-temperature resistance, they are key to improving both the output and quality of EAF steel.

【China Iron and Steel Association】Makes Suggestions! Major Departments Issue Documents! Dual Forces at Play—Where Are Steel Prices Heading?

This week, the ferrous sector continued to rise. The Black Chain Index increased by 1.43 points, closing at 109.37, a gain of 1.33%. At the beginning of the week, due to the impact of the Urban Work Conference, prices dipped sharply. However, they subsequently rebounded strongly across the board as five major product categories and molten iron production data exceeded expectations, combined with the Ministry of Industry and Information Technology's (MIIT) growth stabilization plan. Spot market sentiment turned bullish, and prices rose rapidly. What's in store for steel prices next week? Here's a detailed analysis from our experts…

Factors Influencing Steel Prices

01. Proposal to Establish a New Mechanism for Capacity Governance

The China Iron and Steel Association (CISA) has made several proposals, including: strictly controlling new capacity while enabling smooth market exits; following the guiding principles of "strict control of new capacity, optimization of existing capacity, mergers and reorganizations, and smooth exits"; studying and establishing a new capacity governance mechanism to prevent further aggravation of overcapacity in the steel industry; breaking the cycle of "involution"-style competition; and maintaining a healthy and orderly development environment for the steel industry.

Recently, issues related to anti-involution and optimizing existing capacity have been hot topics in the steel sector and have sparked speculative activity in the market. Based on CISA and higher-level statements, production cuts this year are confirmed, and control over incremental capacity has already been in progress since last year. What's important now is when the mechanisms for mergers, reorganizations, and market exits will be fully established. If implemented in the short term, they could support recent price increases.

02. Supply of Crude Steel from Electric Arc Furnaces Recovers

This week, the average operating rate of independent electric arc furnace (EAF) steel plants nationwide was 65.08%, up 1.49 percentage points from the previous week. The average capacity utilization rate was 51.79%, up 1.43 percentage points. The proportion of EAF steel plants operating at marginal profits increased by 9.09% week-on-week, with 30.58% of EAF steel plants currently seeing marginal profitability. This led to a 2.83% increase in daily crude steel output from EAFs.

Due to the recent strength in the finished product market and the suppressed price-performance ratio of scrap steel, the spread between rebar and scrap, as well as coil and scrap, has widened. As profits improved for EAF producers, some plants have chosen to resume operations or extend production hours to increase production saturation. In terms of downstream segmentation, this is expected to increase supply of construction materials and industrial wire rods in the coming weeks.

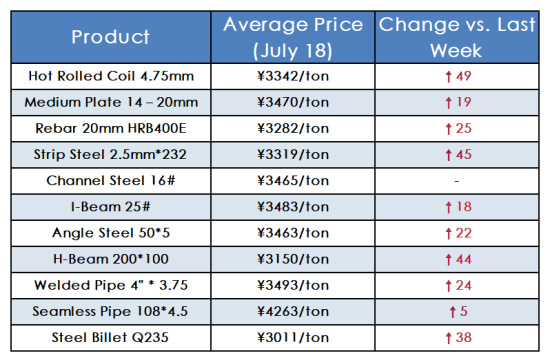

Spot Prices See Increase

According to data from the Zhonggang Network APP:

1. Among 24 construction material markets, the average price of 20mm HRB400E rebar was 3,282 yuan/ton, an increase of 25 yuan/ton from last week.

2. Among 24 hot-rolled coil markets, the average price of 4.75mm hot-rolled coil was 3,342 yuan/ton, an increase of 49 yuan/ton from last week.

3. Among 21 medium-thick plate markets, the average price of Q235B standard plate was 3,470 yuan/ton, an increase of 19 yuan/ton from last week.

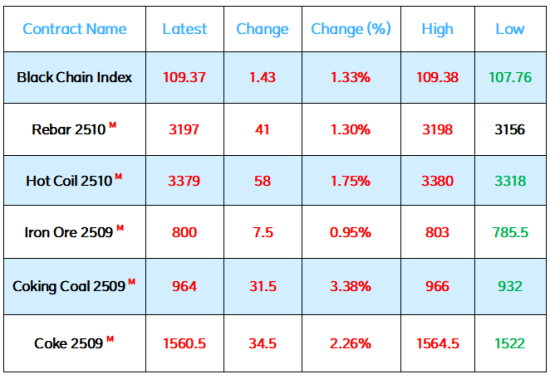

Futures Continue to Rise

On the evening of July 18, major contracts in the ferrous sector showed gains:

1. Rebar main contract rose by 41, closing at 3,197, an increase of 1.3%.

2. Hot coil main contract rose by 58, closing at 3,379, an increase of 1.75%.

3. Coking coal main contract rose by 31.5, closing at 964, an increase of 3.38%.

4. Coke main contract rose by 34.5, closing at 1,560, an increase of 2.26%.

5. Iron ore rose by 7.5, closing at 800, an increase of 0.95%.

Summary and Outlook

The main reasons for this week's market rally in the latter half include continued speculative momentum around the anti-involution narrative, resilient supply-demand data for finished products and inventories, a rebound in molten iron output on the raw materials side, and policy signals from the MIIT and CISA. From a fundamentals perspective, strong data on five key materials and molten iron output support the strength in both finished products and raw materials—this forms a positive feedback loop. From the speculative angle, the anti-involution and exit mechanism narratives are bearish for raw materials but bullish for finished products.

Under the combined influence of reality and market speculation, raw materials have shown some weakness, and there may be a gradual shift where finished products begin to drive raw material prices. As a result, steel prices are expected to remain strong with slight fluctuations next week, with an estimated increase of 10–30 yuan.

Feel free to contact us anytime for more information about the EAF Steel market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies