【Petroleum Coke】Market Trading Remains Stable, Some Price Fluctuations Seen

Calcined petroleum coke, with its high carbon content, low sulfur, and low impurities, plays a vital role in modern manufacturing, especially in the aluminum and steel industries.

【Petroleum Coke】Market Trading Remains Stable, Some Price Fluctuations Seen

Market Overview

On July 25, the average price of petroleum coke was 2,576 yuan/ton, remaining stable compared to the previous working day. Today, petroleum coke market trading was relatively steady, with major refineries shipping according to demand. Overall prices remained mainly stable, with some price adjustments up and down at local refineries. The market operated in a generally steady manner, with port inventories slowly depleting. Recently, driven by domestic demand, low-sulfur sponge coke shipments performed well.

Sinopec-owned refineries maintained stable prices and shipments. Yanshan Petrochemical in North China is under shutdown maintenance and expected to resume operations in August. Other refineries' indicators fluctuated slightly, with stable pricing and trading. In South China, Beihai Refining ships according to demand, and Guangzhou Petrochemical mainly produces 2#B grade; along the Yangtze River region, shipments are mainly for anode-grade coke, with good purchase orders from downstream anode material companies.

PetroChina's Northeast refineries shipped steadily with generally no inventory pressure. Dagang Petrochemical in North China executed orders with stable prices.

CNOOC-owned refineries delivered goods on an order basis.

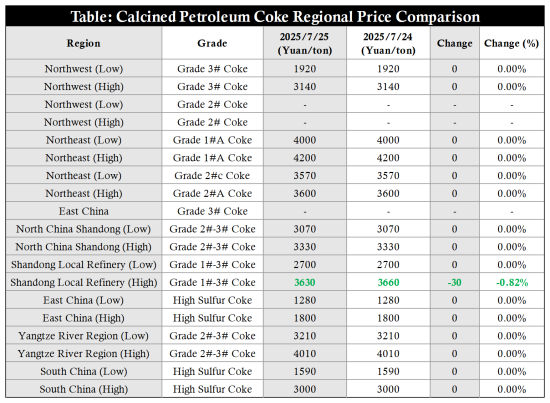

Regarding local refineries, petroleum coke market trading was mediocre. Some refinery coke prices started downward adjustments. Downstream purchasing demand still exists but with limited support. Most refineries ship according to demand; some refineries reduced coke prices by 20–100 yuan/ton as adjustments. Additionally, a few refineries with better indicators maintained relatively good shipment performance, with coke prices slightly rising by 30–40 yuan/ton. Market fluctuations today include: Shandong Haike Ruilin coking unit has resumed operation with coke output; indicators are pending. Tianhong Chemical petroleum coke sulfur content rose to 3.6%, vanadium content increased to 560 PPM, resulting in a 90 yuan/ton price reduction.

Imported coke prices at ports remained stable, with smooth shipments. Among them, Saudi Arabian shot coke continues to be traded in small orders. The low operating rate of silicon carbide plants weakens port shot coke trading.

Supply Situation

As of July 25, there are 24 domestic coking units currently shut down for maintenance. Chinese petroleum coke daily output is 84,300 tons, with coking operation rate at 65.36%, an increase of 0.39% compared to the previous working day.

Demand Situation

Downstream aluminum carbon and anode material enterprises maintain stable demand, providing rigid support for the petroleum coke market. Graphite electrode companies mostly ship according to existing orders, generally holding a wait-and-see attitude, resulting in weak procurement demand for raw petroleum coke. Silicon carbide enterprises show moderate production enthusiasm and purchase cautiously in the petroleum coke market.

Market Outlook

Supply-side fluctuations in the petroleum coke market are limited. Downstream enterprises still have purchasing demand, providing certain support for the petroleum coke market. It is expected that petroleum coke prices will remain generally stable in the short term, with the possibility of slight downward adjustments in coke prices at some local refineries.

(Source: Baiinfo)

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies