【Petroleum Coke】Market Analysis

Calcined petroleum coke, with its high carbon content, low sulfur, and low impurities, plays a vital role in modern manufacturing, especially in the aluminum and steel industries.

【Petroleum Coke】Market Analysis

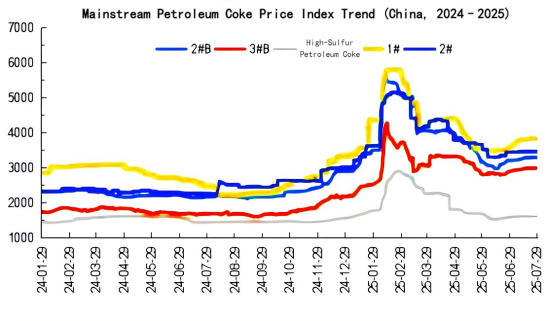

China Petroleum Coke Index Analysis

On July 29, the domestic mainstream petroleum coke 2#B index stood at 3303.33; the 3#B price index was 2993.33, down 6.67 from the previous day; the high-sulfur coke market index was 1622.5; the 1# price index was 3843; and the 2# price index was 3475.

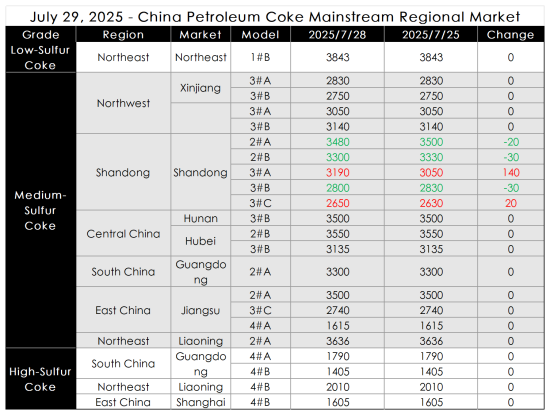

Petroleum Coke Prices in Major Domestic Regions

Today, the domestic petroleum coke market saw decent trading activity, with mainstream prices largely stable and some narrow adjustments. In Shandong, refiners were actively delivering, with mixed price movements. The quoted prices for 2#A, 2#B, and 3#B ranged from 2800–3480 RMB/ton, down by 20–30 RMB/ton from yesterday; 3#A and 3#C were quoted at 3280 RMB/ton, up by 20–140 RMB/ton from yesterday. In East China, the Shanghai 4B was quoted at 1605 RMB/ton, with refineries executing contract orders and maintaining steady sales; downstream buyers mainly engaged in procurement based on immediate needs. In Northeast China, the market performed well, with 1# coke quoted at 3843 RMB/ton; goods with qualified specifications were selling well, and transaction prices remained unchanged.

Unit: RMB/ton

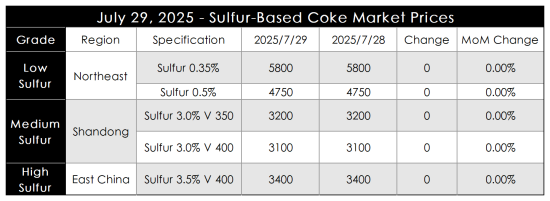

Calcined Petroleum Coke Prices in Major Domestic Regions

Unit: RMB/ton

Market Outlook

Recently, trading activity in the local refining market has been moderate, with refinery transaction prices mostly declining. As of now, domestic supply remains ample, and imported coke arrivals are relatively concentrated, while port clearance speeds are sluggish. Downstream purchasing enthusiasm remains fair; in the negative electrode sector, procurement sentiment is positive, providing strong support for raw material demand. In the carbon industry, procurement is primarily based on rigid demand. The carbon materials market for steel applications continues to show decent trading performance, contributing to favorable momentum in the raw material market. It is expected that in the short term, the domestic petroleum coke market will remain stable with slight upward adjustments. Further attention should be paid to refinery operations and downstream demand follow-up.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies