【CPC】Market Snapshot: Low-Sulfur Holds Steady, Mid-High Sulfur Competition Intensifies

【Calcined Petroleum Coke】Market Snapshot: Low-Sulfur Holds Steady, Mid-High Sulfur Competition Intensifies

Market Overview

On August 26, the average market price of calcined petroleum coke in China was 3,057 RMB/ton, stable compared with the previous working day. At present, the low-sulfur calcined petroleum coke market is generally stable, with downstream demand relatively flat. Electrode enterprises are operating at low levels, and their procurement of low-sulfur calcined petroleum coke is mainly to maintain production. Low-sulfur calcined petroleum coke producers' quotations remain stable. The prices of mid- and high-sulfur calcined petroleum coke are also steady for the moment, but downstream buyers are cautious. Most enterprises focus on long-term contract prices with downstream customers. Under the influence of downstream cost-reduction strategies, the implementation of higher offers from calcined petroleum coke producers remains limited.

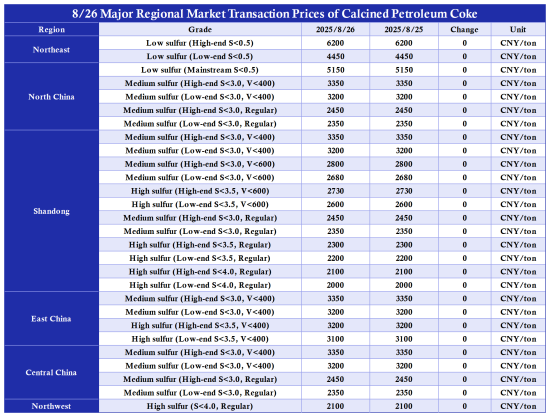

Main Regional Market Transaction Prices

Market Prices

1) Low-sulfur calcined petroleum coke (using Jinxi, Jinzhou petroleum coke as raw material): mainstream transaction prices at 4,900–5,200 RMB/ton;

2) Low-sulfur calcined petroleum coke (using Fushun petroleum coke as raw material): mainstream ex-works prices at 6,100–6,200 RMB/ton;

3) Low-sulfur calcined petroleum coke (using Liaohe, Binzhou CNOOC petroleum coke as raw material): mainstream transaction prices at 4,450–5,300 RMB/ton.

4) Mid-high sulfur calcined petroleum coke (S 3.0%, no requirements on trace elements): previous mainstream contract ex-works cash prices at 2,350–2,450 RMB/ton; current negotiation prices remain at 2,350–2,450 RMB/ton.

5) Mid-high sulfur calcined petroleum coke (S 3.5%, no requirements on trace elements): previous mainstream contract ex-works cash prices at 2,200–2,300 RMB/ton; current negotiation prices remain at 2,200–2,300 RMB/ton.

6) Mid-high sulfur calcined petroleum coke (S 3.0%, V 400): previous mainstream contract cash prices at 3,200–3,350 RMB/ton; current negotiation ex-works cash prices at 3,200–3,350 RMB/ton.

Supply Situation

At present, the national daily commercial supply of calcined petroleum coke is 26,180 tons, with an operating rate of 55.22%. The overall supply of calcined coke has declined by 0.30% compared with the previous working day.

Upstream Market

1. Petroleum coke: Most Sinopec refineries maintain stable prices. In North China, Yanshan Petrochemical's coking unit resumed production on the 25th, and daily output is gradually recovering. In South China, Guangzhou Petrochemical mainly produces 2#B, while Beihai refinery has raised prices by 50 RMB/ton. In Shandong, Qingdao Petrochemical ships normally, while other refineries maintain stable ex-factory prices.

2. CNPC refineries in Northeast China maintain stable prices, with sales made on a per-order basis and no inventory pressure. In Northwest China, refinery transactions are stable; in Southwest China, Yunnan Petrochemical alternates between producing medium- and high-sulfur coke.

3. CNOOC refineries: Zhoushan Petrochemical and Huizhou Petrochemical have not released significant auction volumes yet, while Taizhou Petrochemical and CNOOC Asphalt have not announced final prices.

Downstream Market

1. Graphite electrodes: From the production side, graphite electrode enterprises are operating normally, production is basically steady, and output is scheduled on a per-order basis, avoiding inventory build-up. On the demand side, the expectation of improved downstream demand is insufficient, and procurement remains mainly rigid tendering. On the pricing side, actual transaction prices are scattered, though mainstream quotations remain stable. Overall, the graphite electrode market is running steadily.

2. Electrolytic aluminum: Shanghai has optimized and adjusted real estate policy measures, allowing qualified households to purchase unlimited numbers of houses outside the Outer Ring, which helps boost real estate consumption. However, the domestic auto market entered the traditional off-season in July, with both production and sales falling month-on-month. Positive and negative factors coexist, and spot aluminum prices remain flat.

3. Anode materials: The trading atmosphere in the anode materials market is showing a positive trend. According to some anode enterprises, downstream energy storage demand is gradually being released, driving a slight increase in anode material demand. However, due to overcapacity in the anode materials market, a fundamental turnaround is unlikely in the short term. In addition, downstream battery cell enterprises maintain strong price suppression, keeping actual transaction prices for anode materials at low levels.

Market Outlook

In the near term, low-sulfur calcined petroleum coke transactions will likely remain weakly steady, with limited downstream demand improvement. Overall calcined petroleum coke prices are expected to remain stable. For mid-high sulfur calcined petroleum coke, long-term contracts dominate, and some enterprises have started negotiating next month's orders. Monthly contract prices are expected to trend upward.

(Source: Baiinfo)

Feel free to contact us anytime for more information about the calcined petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies