Graphite Electrode Monthly Review--August domestic graphite electrode market trend has diverged.

Graphite Electrode Monthly Review: In August light downstream demand divergence in the graphite electrode market

August domestic graphite electrode market trend has diverged.

Market aspect:

Since August, due to the steel market is still in the off-season, coupled with the influence of factors such as the policy of production reduction in the second half of the year, the graphite electrode market demand is relatively weak, so manufacturers are mainly wait-and-see. Due to the high inventory pressure in the early stage, some manufacturers sold at low prices, driving the price reduction sales of some middlemen and medium and small electrode manufacturers. The market trend fluctuated to a certain extent, and the mainstream price fell slightly.

This month, affected by the continuous rise in the price of petroleum coke, the price of regular power and high-power graphite electrode is relatively strong and rising steadily, with an increase of 500-1000 yuan/ton.

In terms of production, except that a few head factories are still at full capacity, other manufacturers do not operate at full capacity and gradually begin to take measures to reduce production. Recently, the cost of baking and graphitization processing continues to rise, which further increases the electrode cost. However, the electrode manufacturers are not optimistic about the future trend and have to reduce production to reduce risk.

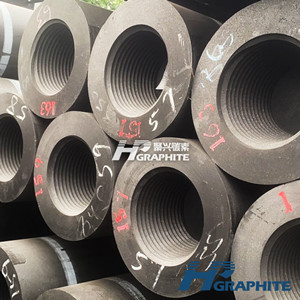

As of August 26, the mainstream price of UHP450mm specification with 30% needle coke content on the market was 18,000-18,500 yuan/ton, down 0.15 million yuan/ton compared to last month, the mainstream price of UHP600mm specification was 22,000-24,000 yuan/ton, down 0.2 million yuan/ton compared to last month, and UHP700mm price remains at 28000-30000 yuan/ton.

Export aspect:

In July, China exported 32,000 tons of graphite electrodes in July, up 61.6 percent year on year. According to some export enterprises feedback, the containers exported to European routes were particularly tight. Although the domestic electrode export situation in the first half of the year was fairly well, the overall situation has not recovered to the pre-epidemic level, and there is still some uncertainty in the second half of the year.

Raw materials aspect:

In August, the price of domestic petroleum coke rose sharply again. Fushun No. 2 plant, Daqing Petrochemical, Jinxi Petrochemical and other plants continuously increased the factory price. As of August 26, the quotation of Fushun Petrochemical 1#A petroleum quoted at 4300 yuan/ton, and low sulfur calcined coke quoted at 5800-6000 yuan/ton, up about 800 yuan/ton compared with last month. After digesting the inventory in the downstream market, the goods were taken actively, the shipment was fairly well, and the price adjustment of petroleum coke factory was positive.

In August, the price of domestic needle coke was stable, but the downstream electrode customers were not willing to take the goods, and the price had a trend of adjustment. As of August 26, the mainstream price of domestic coal and oil products was 8000-11000 yuan/ton.

Steel factory aspect:

In August, the domestic steel price generally showed the trend of first restraining and then increasing, and the price was basically the same as that in July. Affected by power rationing in some areas, the output of electric furnace steel is affected to a certain extent. The overall market transaction is general. In July, the domestic average daily output of crude steel, raw iron and steel was 2.7997 million tons, 2.35 million tons and 3.5806 million tons respectively, down 10.53%, 6.97% and 11.02% respectively compared with June. As of August 26, 2021, the capacity utilization rate of 92 independent electric furnace steel factories was 69.87%, down 2.03% from the previous month.

Future forecast:

Recently, the price of petroleum coke has rebounded again, some medium and small electrode manufacturers production enthusiasm is not high, and the capacity utilization rate has been reduced. In the later stage, there are still uncertain factors for steel factories to reduce and limit production, and the graphite electrode market is still divided in the short term. However, the scope for callback is extremely limited, contact us for more technical news.

No related results found

0 Replies