【Petroleum Coke N-Shaped Fluctuation】August Mixed Movements, Supply Tightening + Stable Imports...

Calcined petroleum coke, with its high carbon content, low sulfur, and low impurities, plays a vital role in modern manufacturing, especially in the aluminum and steel industries.

【Petroleum Coke N-Shaped Fluctuation】August Mixed Movements, Supply Tightening + Stable Imports, Can the "Golden September" Trend Continue?

In August 2025, the domestic petroleum coke market overall showed a trend of steady trading, with price movements displaying both oscillating upward trends and slowing increases under different institutional observations. Refinery maintenance led to tightened supply, and it is expected that market bullish sentiment will persist in September; however, with increased supply and stable demand, price movements are likely to stabilize.

Market Overview

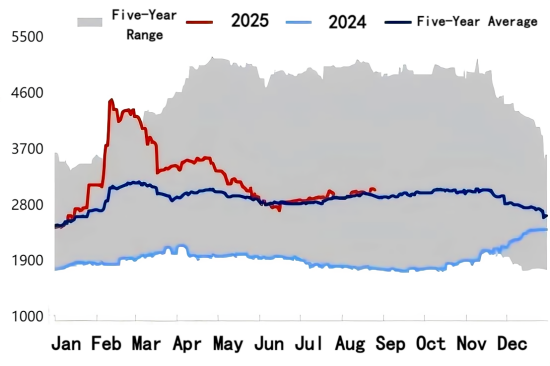

In August, domestic petroleum coke prices generally exhibited a fluctuating trend, especially strong at the beginning of the month, leveling off or slightly declining in the mid-to-late month. The monthly price amplitude was about 5.2%, and market trading became more rational.

As of August 26, the average price of petroleum coke was 2,634 CNY/ton, up 2.25% from the previous month. The average price in Shandong for local refineries was 2,398 CNY/ton, down 3.19% from the previous month. Overall prices from major refineries rose, but the increase was less than last month; trading at local refineries weakened, with prices first rising and then falling. Data shows that in August, driven by market supply and demand, petroleum coke prices overall exhibited an "N"-shaped trend.

Five-Year Petroleum Coke Market Price Trend Chart (CNY/ton) from Longzhong Information

Supply Side: Maintenance and Import Changes

In August, the supply side of petroleum coke was affected by refinery maintenance and import volume changes, showing a slight decline or limited increase overall.

Refineries:

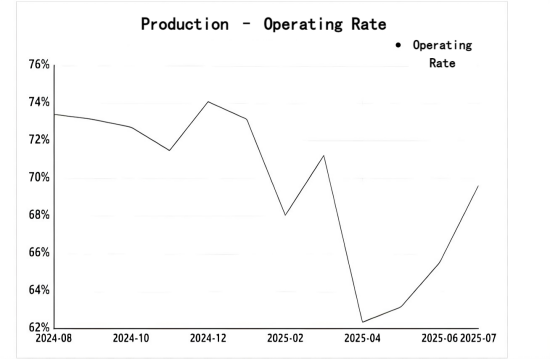

Data shows that monthly petroleum coke losses due to maintenance were about 530,000 tons, an increase of 19.42% compared with July.

As of August 26, there were 25 routine maintenance events for coking facilities in China, with 6 new units starting production and 5 units stopping. Chinese daily petroleum coke output was 82,150 tons, and the coking operating rate was 64.42%, down 0.94% month-on-month.

Monthly Petroleum Coke Production Operating Rate, from Baiinfo

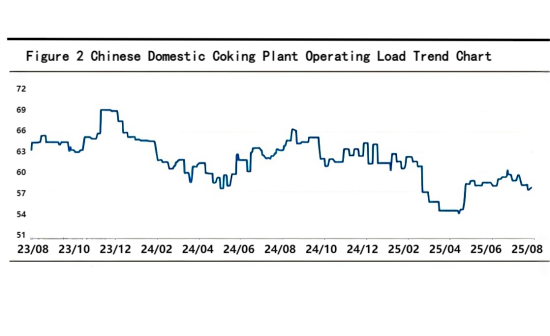

As of August 27, the average operating load of domestic coking units in August was 58.32%, down 0.53 percentage points month-on-month. Among them, Sinopec increased by 0.32 percentage points, CNPC decreased by 3.19 percentage points, and Shandong local refineries decreased by 1.97 percentage points.

Image from Zhuochuang Information

In summary, refinery maintenance was the main reason for the tightened supply in August, causing partial capacity loss and a reduction in operating load.

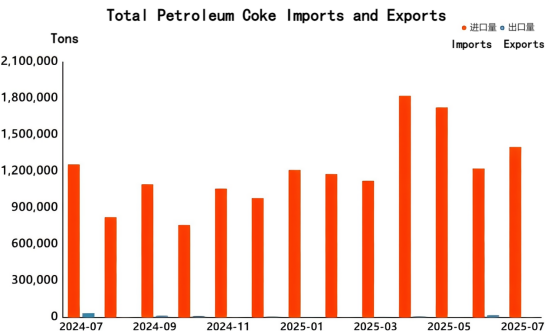

Imports and Exports:

The speed of petroleum coke inventory reduction from imports accelerated, newly arrived volumes decreased, and overall domestic supply slightly declined.

In July 2025, China imported 1.4025 million tons of uncalcined petroleum coke, up 14.43% month-on-month; exports were 6,300 tons, down 38.11% month-on-month. From January to July, cumulative imports were 9.6986 million tons, up 11.84% year-on-year; cumulative exports were 69,300 tons, down 48.81% year-on-year.

It is expected that import volumes in August will remain basically flat compared with July, mainly for carbon-grade coke. Port coke prices rose steadily, shipments were smooth, and inventories declined.

In summary, although July imports increased month-on-month, port inventories continued to be consumed, and import volumes in August are expected to remain flat. Imported varieties such as high-sulfur coke from Russia, Saudi coke, and low-sulfur coke from Brazil and Argentina traded actively, enhancing port circulation.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies