【Calcined Petroleum Coke】Favorable Raw Material Prices, CPC Prices Remain Firm

【Calcined Petroleum Coke】Favorable Raw Material Prices, CPC Prices Remain Firm

Market Overview

On September 4, the average price of calcined petroleum coke was 3,097 RMB/ton, up 5 RMB/ton from the previous working day, a rise of 0.16%. Currently, the low-sulfur calcined petroleum coke market is weak but stable, with insufficient demand support. Downstream shipment pressure remains, and enterprises generally seek stable order prices. The medium- to high-sulfur calcined petroleum coke market trades relatively well, with most enterprises fulfilling long-term orders at stable prices. Some calcined petroleum coke enterprises, facing increased cost pressures, have raised prices on new orders. Following the end of the military parade, some previously reduced production capacities in certain regions have returned to normal production.

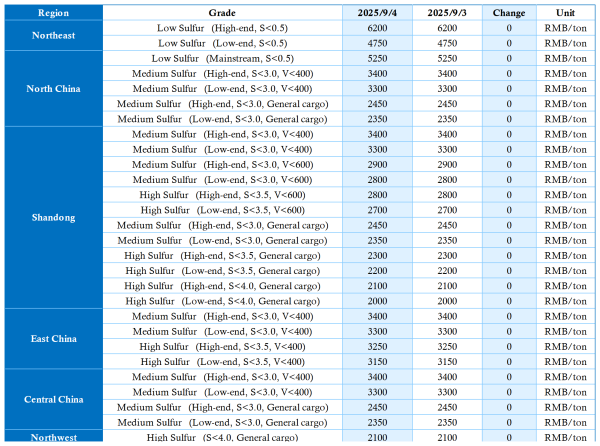

Main Regional Market Transaction Prices

Market Prices

Low-sulfur calcined petroleum coke (Jinxi, Jinzhou petroleum coke as raw material): mainstream transaction prices 5,050–5,300 RMB/ton

Low-sulfur calcined petroleum coke (Fushun petroleum coke as raw material): factory mainstream transaction prices 6,100–6,200 RMB/ton

Low-sulfur calcined petroleum coke (Liaohe, Binzhou Zhonghai petroleum coke as raw material): mainstream transaction prices 4,750–5,300 RMB/ton

Medium- to high-sulfur calcined petroleum coke (S 3.0%, no trace element requirements): previous mainstream contract cash price 2,350–2,450 RMB/ton; current discussed factory cash price 2,350–2,450 RMB/ton

Medium- to high-sulfur calcined petroleum coke (S 3.5%, no trace element requirements): previous mainstream contract cash price 2,200–2,300 RMB/ton; current discussed factory cash price 2,200–2,300 RMB/ton

Medium- to high-sulfur calcined petroleum coke (S 3.0%, V 400): previous contract cash price 3,300–3,400 RMB/ton; current discussed factory cash price 3,300–3,400 RMB/ton

Supply Situation

Currently, China's daily commercial calcined petroleum coke supply is 26,243 tons, with a utilization rate of 55.35%. The current market supply of calcined coke has increased 0.38% compared with the previous working day.

Upstream Market

Petroleum Coke: Most Sinopec refineries have good trading activity. Since yesterday, many refineries have raised prices. Along the Yangtze River, Anqing Petrochemical increased by 30 RMB/ton, Hunan Petrochemical by 20 RMB/ton, other refineries increased anode-grade coke by 40 RMB/ton and general coke by 20 RMB/ton. In East China, Jinling Petrochemical increased medium-sulfur coke and Yangzi Petrochemical increased by 30 RMB/ton; other refineries maintain stable prices. In North China, refineries generally raised prices by 30–110 RMB/ton, including Luoyang Petrochemical's incremental production this month. Shandong refineries increased by 30–100 RMB/ton. In South China, Guangzhou Petrochemical partially increased by 20–60 RMB/ton, and Beihai Refining increased by 30 RMB/ton. PetroChina refineries maintain stable prices; trading in Northeast China is active, and Northwest refineries maintain stable shipment. Aluminum-grade carbon is mainly shipped. CNOOC refineries deliver according to orders.

Downstream Market

Graphite Electrodes: Downstream demand has not been significantly released, especially from steel mills. Recent tendering demand is limited, with only a few inquiries. Insufficient demand release results in slow order signing and low production enthusiasm among graphite electrode enterprises. The graphite electrode market operates at low production levels with cautious quotations, while mainstream enterprises maintain price floors.

Electrolytic Aluminum: Social inventory of aluminum ingots continues to rise. Coupled with previously moderate market absorption and weakened effects of macro policies on the market, spot aluminum prices have fallen.

Anode Materials: The market is temporarily stable, with downstream demand generally moderate. Inquiry activity has not increased significantly. The market concentration is high, and mid- and small-sized enterprises have limited market share. To maintain basic operating rates and ensure stable cash flow, some small- and medium-sized enterprises still compete for limited orders using low-price strategies. This "low-price competition" market pattern is unlikely to change in the short term, keeping anode material prices at low levels.

Future Forecast

Low-Sulfur Calcined Coke: Raw material support remains, downstream demand is weak but stable. Prices are expected to remain firm.

Medium- to High-Sulfur Calcined Petroleum Coke: The market is expected to operate steadily, with downstream procurement driven mainly by rigid demand, and orders executed at stable prices.

(Source: Baiinfo)

Feel free to contact us anytime for more information about the calcined petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies