【Steel】"Golden September" Fades, EU Implements Strictest Steel Import Ban! ...

Graphite electrodes are vital to EAF steelmaking—acting as the "core component" for arc heating. With excellent conductivity and heat resistance, they're key to improving steel quality and output. Master them, master EAF steelmaking!

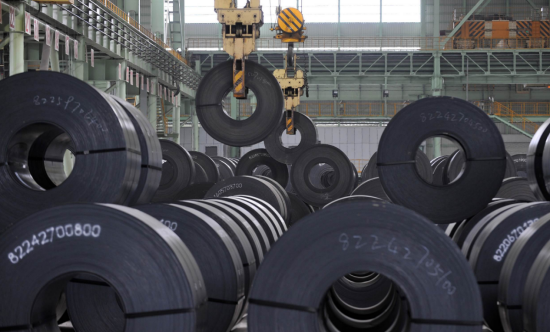

【Steel】"Golden September" Fades, EU Implements Strictest Steel Import Ban! How Will Steel Prices Move on the First Trading Day?

The market is being repeatedly pulled between "policy expectations" and "realistic weakness," while steel traders are caught between "production cuts to support prices" and "insufficient demand," hesitating to act. At the start of October, the national steel market did not experience the traditional "Silver October" opening boost. Although policy signals indicated support for prices, the continued weakness in end-user demand caused steel prices to fluctuate amid multiple forces.

During the National Day holiday, mainstream prices for construction steel across the country remained stable, but market transactions were thin, with merchants mostly taking a wait-and-see approach. Meanwhile, international markets are turbulent: the EU officially announced the strictest steel import ban in history, reducing duty-free import quotas to 18.3 million tons per year—a 47% decline from 2024. For volumes exceeding the quota, tariffs on steel imports rise from 25% to 50%. The U.S. also announced that starting November 1, a 25% tariff will be imposed on imported medium and heavy trucks, escalating global trade barriers once again.

The traditional peak-season pattern of "Golden September and Silver October" is being disrupted. In September, the national comprehensive steel price averaged 3,563 CNY/ton, down 54 CNY/ton from the previous month.

The steel market shows signs of a "peak season without peak." Taking hot-rolled coil as an example, the weekly decline reached 1.74%, closing at 3,383.33 CNY/ton on September 30. Cold-rolled coil was relatively more resistant but still in a slight downward trend.

During the holiday period, market transactions were thin. In Chengdu's construction steel market, mainstream prices remained stable, but trading activity was muted, and holiday transactions were weak.

A market participant revealed that downstream funding improvements are limited, and pre-holiday stocking willingness is low.

The imbalance between supply and demand is the core factor pressuring steel prices.

On the supply side, steel mill profit margins remain under pressure. For electric arc furnaces (EAF), the nationwide EAF off-peak electricity cost reached 3,202 CNY/ton, with a loss of 134 CNY per ton of steel. For blast furnace production, profits for mainstream products like rebar and hot-rolled coil have generally narrowed to below 100 CNY/ton.

Under loss-driven pressure, a "self-regulated production cut storm" is brewing. Several steel mills in Yunnan have jointly issued letters against internal competition, and more steel companies are expected to join the anti-involution trend in October.

On the demand side, the real estate sector continues to drag. Although the "guaranteed delivery" policy is being promoted, newly started construction areas continue to decline, and steel demand shows little improvement. In September, the average daily trading volume of construction steel in 20 key cities was 105,000 tons, up 0.95% month-on-month, but still down 10.9% year-on-year.

High-level fluctuations in raw material costs provide some support for steel prices.

Iron ore prices are showing a volatile rebound. By the end of September, the 61.5% Australian fines price at Rizhao Port was 785 CNY/ton, up 10 CNY/ton from the end of the previous month.

For coke, September saw two rounds of price reductions. In Tangshan, the price of secondary metallurgical coke was 1,330 CNY/ton, down 100 CNY/ton from the end of the previous month. However, with the first round of pre-holiday price increases underway, there is some spot market support.

Cost monitoring data indicate that the pig iron cost index calculated using raw materials purchased at the end of September was 104.0, down 1.5% from the same period last month.

Inventory levels are a key variable affecting steel price trends in October.

By the end of September, social steel inventories in 29 key cities reached 9.881 million tons, up 5.2% month-on-month and 13.8% year-on-year.

Among them, construction steel inventories were 4.985 million tons, up 6.1% month-on-month and a substantial 46.2% year-on-year increase. After the National Day holiday in October, social steel inventories are expected to accumulate again due to the holiday factor. If demand recovers continuously, social steel inventories may decline.

Although social inventories are declining, the pace of destocking is slow, reflecting weak downstream buying willingness. If destocking accelerates in October, prices are likely to stabilize and rebound; otherwise, the market will remain under pressure.

Policy Variables

The biggest uncertainty for the steel market in October comes from policy.

The latest central bank monetary policy meeting indicated that further interest rate cuts in Q4 still require an opportunity, but reserve requirement ratio (RRR) cuts are highly probable. If implemented, liquidity will improve, boosting sentiment in the black metal sector.

Special bond issuance is accelerating. By September 28, the issuance of new special bonds reached 3.66 trillion CNY, accounting for 83.2% of the planned scale. Coupled with the progressive start of special national bond projects, Q4 is expected to generate substantial physical work.

The Fourth Plenary Session of the 20th Central Committee will be held from October 20 to 23, involving long-term strategic plans. The market has high expectations for substantial policy measures.

Export Pressure

Previously strong steel exports are now facing pressure.

In August, China exported 9.51 million tons of steel, up 0.1% year-on-year, but the growth rate dropped sharply by 25.5 percentage points compared with the previous month.

Even more concerning, trade protectionism is rising. Since September, Indonesia has initiated an anti-dumping investigation on Chinese hot-rolled coil; Australia has launched an anti-circumvention probe on Chinese welded pipe; Egypt has initiated safeguard measures on imported billets.

Reports indicate that the European Commission plans to impose punitive tariffs of up to 50% on Chinese steel products in the coming weeks. The implementation of these tariffs will further constrain China's steel exports.

The market generally holds a cautious view of steel prices in October. Most analysts believe that October steel prices are likely to fluctuate within the 3,000–3,200 CNY/ton range, lacking the basis for significant rises or falls.

If policies are implemented quickly and destocking accelerates, prices may rise toward 3,200–3,300 CNY/ton; if demand remains weak and raw material costs ease, it is possible to test the 3,000 CNY/ton level again.

Ultimately, steel price trends will depend on the degree of improvement in supply-demand conditions and whether supportive policies can dispel market pessimism.

Feel free to contact us anytime for more information about the EAF Steel market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies