【Calcined Petroleum Coke】Increased Cost Pressure Drives General Price Rise in Calcined Coke

【Calcined Petroleum Coke】Increased Cost Pressure Drives General Price Rise in Calcined Coke

Market Overview

On November 3, the average market price of calcined petroleum coke was 3,617 yuan/ton, up 10 yuan/ton from the previous working day, an increase of 0.28%.

At present, the price of low-sulfur calcined petroleum coke continues to rise. Over the weekend, the raw material end — low-sulfur green coke — provided positive support, and quotations for low-sulfur calcined coke followed upward. However, downstream electrode enterprises showed a strong wait-and-see sentiment, slowing their procurement of low-sulfur calcined coke under cost pressure.

Currently, the market for medium- and high-sulfur calcined petroleum coke is smooth in terms of shipments. The cost side continues to favor calcined coke market transactions, with in-plant inventories remaining at low levels. Calcined petroleum coke producers have significantly raised their new order quotations.

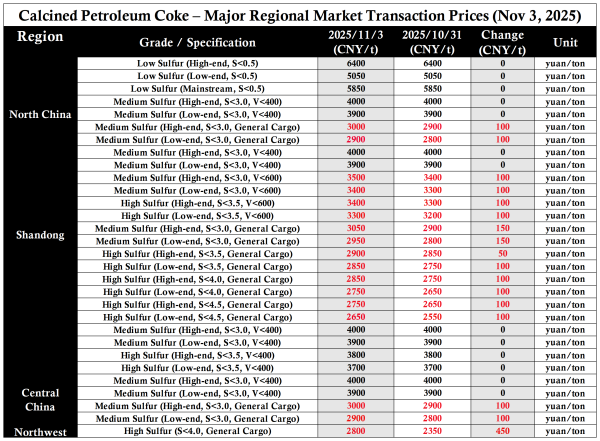

Major Regional Market Transaction Prices

Market Prices

Low-sulfur calcined petroleum coke (using Jinxi and Jinzhou petroleum coke as raw materials) has a mainstream transaction price range of 5,700–5,850 yuan/ton;

Low-sulfur calcined coke (using Fushun petroleum coke as raw material) has an ex-factory mainstream transaction price of 6,300–6,400 yuan/ton;

Low-sulfur calcined petroleum coke (using Liaohe and Binzhou CNOOC petroleum coke as raw materials) has a mainstream market transaction price range of 5,050–6,100 yuan/ton.

Medium- and high-sulfur calcined petroleum coke (sulfur 3.0%, no microelement requirements): the previous ex-factory mainstream contract price was 3,000 yuan/ton cash, and the current negotiation price is also 3,000 yuan/ton cash;

Medium- and high-sulfur calcined coke (sulfur 3.5%, no microelement requirements): the previous ex-factory mainstream contract price was 2,850–2,950 yuan/ton cash, and the current negotiation price remains 2,850–2,950 yuan/ton cash;

Medium- and high-sulfur calcined coke (sulfur 3.0%, vanadium 400): the previous contract price was 3,900–4,000 yuan/ton cash, and the current negotiation price remains 3,900–4,000 yuan/ton cash.

Supply Situation

At present, the national daily supply of commercial calcined coke is 27,487 tons, with an operating rate of 57.55%. The supply volume of calcined coke has increased by 0.07% compared with the previous working day.

Upstream Market Situation

Petroleum Coke:

Refineries under Sinopec reported decent trading activity, with petroleum coke prices raised by 100–250 yuan/ton since October 31. In the Yangtze River region, demand for anode materials remains strong, leading refineries to increase coke prices by 100–180 yuan/ton.

In North China, the coking unit at Luoyang Petrochemical remains shut down, and pricing is temporarily suspended; other refineries raised coke prices by 150–250 yuan/ton.

In East China, refinery coke prices increased by 100–200 yuan/ton; in South China, Guangzhou Petrochemical raised mid- and low-sulfur coke prices by 100–200 yuan/ton, and Beihai refinery raised by 100 yuan/ton.

In Northwest China, Tarim Petrochemical raised its coke price by 200 yuan/ton, focusing mainly on shipments outside Xinjiang.

Currently, refineries under PetroChina are seeing decent sales. In Northeast China, low-sulfur coke supply is tight, with most refineries fulfilling existing orders. In North China, Dagang Petrochemical is selling via auction and maintaining stable shipments. In Northwest China, local demand within Xinjiang is strong, and refinery shipments are smooth.

Refineries under CNOOC are shipping according to orders, while Zhoushan Petrochemical has reduced coking production volumes.

Downstream Market Situation

Graphite Electrodes:

Currently, there are few inquiries and orders in the market, only sporadic restocking. Although mainstream graphite electrode producers have slightly raised quotations, transaction prices have not changed significantly. The overall market remains stable for the time being, with active bullish sentiment and fewer low-price resources than before.

Electrolytic Aluminum:

Driven by external markets, along with China–Korea talks and improving international conditions, plus Xinjiang’s new energy installations exceeding 136 GW, laying a solid foundation for green power transmission, spot aluminum prices have risen.

Anode Materials:

The anode materials market remains stable. Supported by continuous demand release from the energy storage sector, downstream battery enterprises maintain high inquiry activity, pushing steady growth in anode material shipments. Meanwhile, with raw material prices rising slightly, cost support for anode materials has gradually strengthened. Overall, mainstream transaction prices remain stable.

Market Outlook

With low-sulfur calcined coke raw material prices increasing, calcined coke producers are facing higher cost pressures. It is expected that low-sulfur calcined coke prices will mainly follow the upward trend.

For medium- and high-sulfur calcined coke, market shipments remain smooth, inventories are low, and new order prices are expected to increase by 100–200 yuan/ton.

(Source: Baiinfo)

Feel free to contact us anytime for more information about the calcined petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies