【Recarburizer】Price Update! Steel Mills Procure Cautiously, Market Signals for December

【Recarburizer】Price Update! Steel Mills Procure Cautiously, Market Signals for December

Price Update

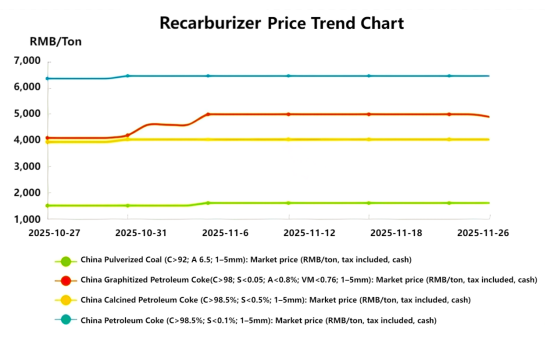

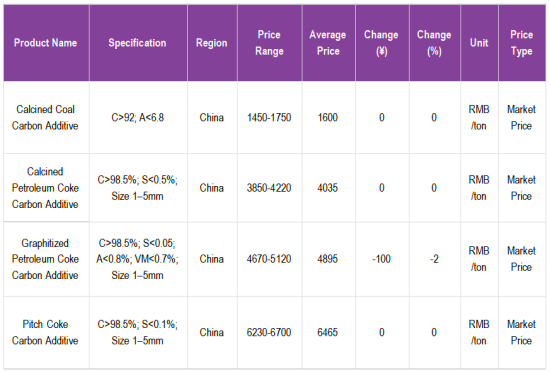

Today, the market price for China's general calcined coal recarburizer (C>92; A<6.8) remains stable, currently at 1450–1750 RMB/ton, with an average of 1600 RMB/ton, unchanged from yesterday.

Today, the market price for calcined petroleum coke recarburizer (C>98.5%; S<0.5%; particle size 1–5mm) remains stable, currently at 3850–4220 RMB/ton, with an average of 4035 RMB/ton, unchanged from yesterday.

Today, the market price for graphitized petroleum coke recarburizer (C>98.5%; S<0.05%; A<0.8%; VM<0.7%; 1–5mm) has declined, currently at 4670–5120 RMB/ton, with an average of 4895 RMB/ton, down 100 RMB/ton from yesterday.

Today, the market price for pitch coke recarburizer (C>98.5%; S<0.1%; particle size 1–5mm) remains stable, currently at 6230–6700 RMB/ton, with an average of 6465 RMB/ton, unchanged from yesterday.

Overview

Today, domestic recarburizer ex-factory prices experienced partial declines, with the market showing a weak adjustment trend. Supply remains at normal production levels, but persistent weak downstream demand has led to increased inventory pressure, prompting some enterprises to slightly reduce prices to boost shipments. Cost support has weakened as petroleum coke prices softened, and rising bearish sentiment has increased traders' willingness to sell. Recently, the National Development and Reform Commission strengthened monitoring and early-warning of key raw material prices, leading to more cautious market expectations.

Raw Material Market

The raw material market as a whole shows weak performance. Petroleum coke prices have ended the high-level consolidation trend and began a slight pullback, with independent refineries slowing shipment rates. Calcined coke market trading sentiment has cooled as anode material enterprises slow procurement, weakening price support. Although anthracite supply remains restricted by policy, weak downstream demand has limited price growth. Overall, raw material cost support has weakened compared to earlier periods.

Downstream Market

Demand remains sluggish. Steel enterprises are further reducing procurement willingness; some electric-arc-furnace mills have lowered operating rates due to profit pressure, maintaining extremely cautious raw material purchasing strategies. The foundry industry has seen no improvement in new orders, and companies mainly rely on existing inventory. Infrastructure construction has slowed due to weather and other factors, resulting in limited demand pull. In export markets, international demand remains weak, with continued low levels of inquiries from foreign buyers.

Market Outlook

In the short term, recarburizer prices are expected to continue weak adjustments. With weakening cost support and continuously sluggish demand, market downside pressure remains significant. Participants are advised to closely monitor raw material price changes and adjustments in downstream procurement rhythm, as these will be key factors affecting future pricing. Market players should remain cautious, strictly control inventory levels, and wait for clearer market stabilization signals.

Feel free to contact us anytime for more information about the graphitized petroleum coke carburant (GPC) market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies