【Steel Market Weekly Report】Policy Support Strengthens Expectations; Steel Market Operating Firm

Graphite electrodes are the "lifeline" of EAF steelmaking! As the core material for arc conduction and heating, they feature high conductivity and heat resistance, directly affecting molten steel quality and output. Mastering graphite electrodes means mastering the initiative in EAF steelmaking!

【Steel Market Weekly Report】Policy Support Strengthens Expectations; Steel Market Operating Firm

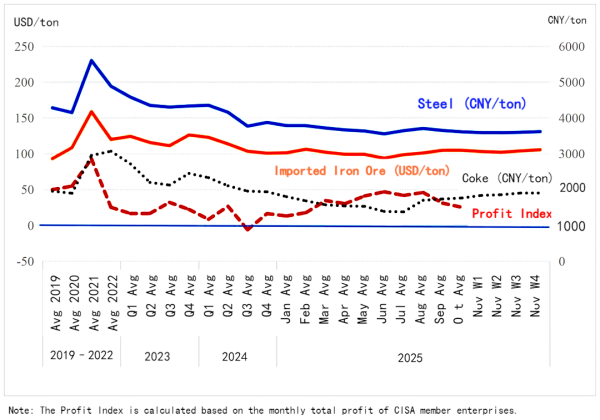

Recently, the Ministry of Industry and Information Technology, together with five other ministries, jointly issued a consumption-stimulus plan aiming to form three trillion-yuan-level consumption sectors and ten hundred-billion-yuan-level consumption hotspots by 2027, providing potential demand support for home appliances and automotive steel. In addition, the National Development and Reform Commission stated that it will continue promoting efforts to address disorderly price competition, which will help maintain market order and boost expectations.

In the steel market, some regions saw year-end construction demand being released; however, the industry is still in the traditional off-season. Overall demand remains soft, while supply has slightly weakened. The supply–demand contradiction persists but is not prominent, and steel prices have rebounded slightly.

In raw materials, iron ore prices were relatively strong last week, scrap prices declined slightly, and coke prices remained unchanged. Considering all factors, steel prices are expected to fluctuate within a narrow range this week.

Steel Production

According to CISA statistics, in mid-November, key steel enterprises' average daily crude steel output was 1.943 million tons, up 0.9% month-on-month; pig iron 1.797 million tons, down 0.4%; steel products 1.924 million tons, up 2.1%.

Based on these figures, nationwide daily crude steel output is estimated at 2.31 million tons (-1.8% MoM), pig iron 2.11 million tons (-0.2% MoM), steel products 3.97 million tons (+1.1% MoM).

Transactions and Inventory

Last week (Nov 24–28, the 4th week of Nov 2025), the weekly average daily trading volume index for construction steel was 44.54, an increase of 1.80 WoW, +4.21% MoM, but -8.05% YoY.

Social inventory of the five major steel categories was 10.0732 million tons, -2.15% MoM, +27.82% YoY; steel mill inventory was 3.9349 million tons, -2.53% MoM, +2.11% YoY.

Recently, steel futures prices have shown increased volatility, with decent trading sentiment. Spot market steel prices rose slightly for some varieties, with marginal improvement in transaction volumes.

However, overall market off-season characteristics remain evident, downstream procurement is demand-driven, and total steel transactions remain at a low level. Steel transaction volumes are expected to fluctuate slightly this week, and inventories are expected to continue a slight decline.

Raw Material Prices

Coke:

Last week, the average ex-factory price of Grade-1 metallurgical coke was 1,904 yuan/ton, unchanged MoM and -0.57% YoY.

Recently, coking coal prices continued to fall, weakening cost support for coke. Steel mill margins remain poor, demand for coke is decreasing, and expectations of price reductions remain strong. Coke prices are expected to operate weakly this week.

Iron Ore:

Last week, the forward price of 62% Australian fines was USD 105.61/ton, +1.54% MoM and +1.51% YoY.

Global iron ore shipments have fluctuated within a narrow band, domestic arrivals increased slightly, port inventories shifted from destocking to restocking, and average daily hot-metal output showed a declining trend. Iron ore prices are expected to fluctuate narrowly this week.

Scrap Steel:

Last week, prices for 6mm-plus scrap across 45 domestic cities averaged 2,041 yuan/ton, -0.74% MoM and -6.57% YoY.

Internationally, European scrap prices rose slightly: Turkey +1.51%, Rotterdam +0.52%; U.S. prices were unchanged.

Considering domestic scrap supply and demand, scrap–hot-metal cost comparison, and steel market demand, scrap prices are expected to fluctuate narrowly this week.

Steel Prices

Last week, steel prices rose slightly.

According to CISA, the average price of the eight major steel categories was 3,619.3 yuan/ton, +0.52% MoM and -4.54% YoY. Among these, angle steel, rebar, and wire rod weekly average prices increased 0.99%, 0.87%, and 0.85% respectively; the other major steel categories saw MoM increases within 0.5%.

Currently, the market shows a supply-and-demand-both-weak structure, but the year-end construction window may provide short-term support to demand. Considering that off-season weak demand limits the rebound space for steel prices, steel prices are expected to fluctuate narrowly this week.

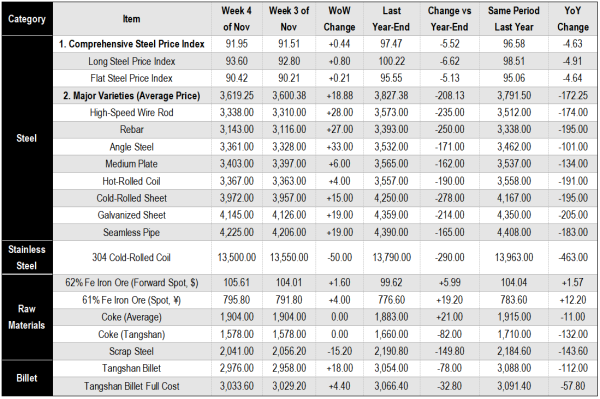

Steel & Raw Materials Weekly Price Table

Data Source: China Iron and Steel Association (CISA), Beijing Iron Ore Trading Center, Mysteel, Metallurgical Industry Information Standards Institute

Feel free to contact us anytime for more information about the EAF Steel market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies