【Calcined Petroleum Coke】Export Volume Expected to Rise by 40%!

【Calcined Petroleum Coke】Export Volume Expected to Rise by 40%!

December Imports and Exports Declined MoM, January Exports Expected to Increase

Import and Export Data Overview

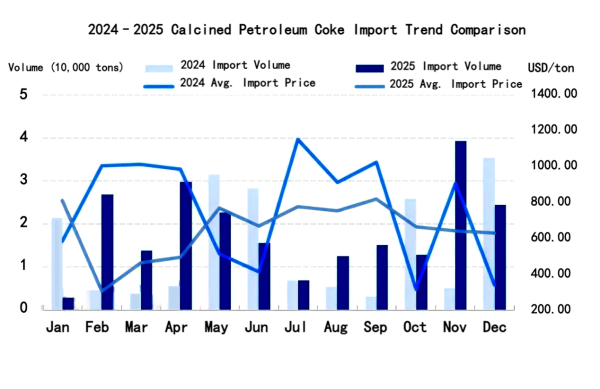

In December 2025, China's calcined petroleum coke imports totaled 24,500 tons, down 14,900 tons month-on-month, representing a 37.82% decline.

For the full year of 2025, China's calcined petroleum coke imports reached 223,400 tons, an increase of 46,200 tons year-on-year, up 26.07%.

Image source: Oilchem

Data source: General Administration of Customs

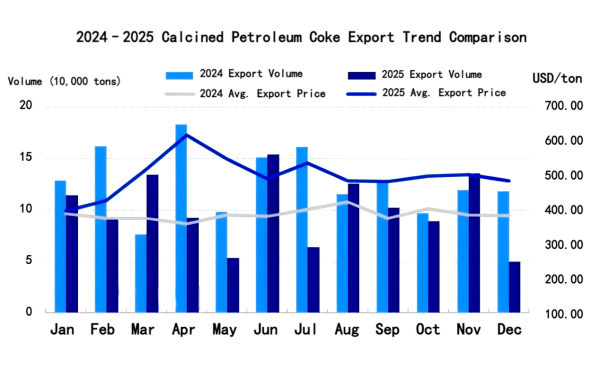

In December 2025, China's calcined petroleum coke exports stood at 50,100 tons, down 85,200 tons month-on-month, a decrease of 62.97%.

Total exports in 2025 amounted to 1.2057 million tons, down 334,500 tons year-on-year, a decline of 21.72%.

Image source: Oilchem

Data source: General Administration of Customs

Key Influencing Factors

Imports:

In December, calcined petroleum coke imports declined sharply by 37.82%, mainly due to stricter environmental regulations in some domestic regions, which slowed downstream purchasing activity and led to reduced import demand.

Exports:

December exports dropped by 62.97%, primarily affected by the heating season, during which some producers reduced operating rates. At the same time, weaker overseas demand further constrained export volumes.

Import and Export Trade Partners

In December 2025, China's calcined petroleum coke imports by trade partner were mainly from the United States, Russia, and China, with a combined volume of 17,400 tons, accounting for approximately 71% of total monthly imports.

In the same period, China's calcined petroleum coke exports were mainly destined for Indonesia, the United Arab Emirates, and India, with a combined export volume of 47,900 tons, representing about 95.6% of total exports.

Outlook

In January, China's calcined petroleum coke imports are expected to be around 20,000 tons, down approximately 18% month-on-month. Exports are expected to recover to around 70,000 tons, up about 40% month-on-month.

The main reasons include the continued impact of the heating season and ongoing environmental controls, while demand from the prebaked anode sector is still expected to weaken, leading to reduced import demand.

Note: The above data are based on customs statistics. As customs import and export codes include other products under the same HS code—such as oil-based needle coke classified as calcined petroleum coke with sulfur content <0.8%, and coal-based needle coke classified as pitch coke—the data do not fully represent the actual import and export volumes of the products mentioned above and are for reference only.

Feel free to contact us anytime for more information about the calcined petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies