【Carbon Electrodes】Annual Growth of 26.4%! South Africa Emerges as Africa's Fastest-Growing...

Graphite electrodes are the essential consumables in EAF steelmaking. Due to their outstanding electrical conductivity and excellent high-temperature resistance, they play a critical role in ensuring efficient and stable furnace operation, thereby improving steel production capacity and product quality.

【Carbon Electrodes】Annual Growth of 26.4%! South Africa Emerges as Africa's Fastest-Growing Dark Horse

Before 2035, carbon electrode consumption in Africa is projected to grow at a compound annual growth rate (CAGR) of 1.3%, reaching 398,000 tons;

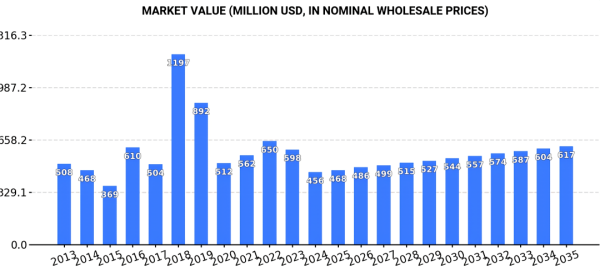

Market value fell to USD 456 million in 2024 and is expected to grow at a CAGR of 2.8% through 2035, reaching USD 617 million;

Egypt, Tanzania, and South Africa are the largest consuming countries, accounting for a combined 44% of total market consumption;

Imports declined to 51,000 tons in 2024, mainly electric arc furnace (EAF) carbon electrodes, with Egypt, South Africa, and Algeria as the top three importers;

Exports remained low at only 454 tons, with South Africa as the largest exporter. The export unit price surged to USD 3,803 per ton.

Market Outlook

Driven by growing demand for carbon electrodes in Africa, market consumption is expected to maintain an upward trajectory over the next decade. From 2024 to 2035, total consumption is projected to expand at a CAGR of 1.3%, reaching 398,000 tons by the end of 2035.

In terms of market value, from 2024 to 2035 the market is projected to grow at a CAGR of 2.8%. Calculated at nominal wholesale prices, total market value is expected to reach USD 617 million by the end of 2035.

Market Value (USD Billion, at Nominal Wholesale Prices)

Consumption

Overall African Consumption

In 2024, carbon electrode consumption in Africa increased slightly by 1.8% to 344,000 tons. From 2013 to 2024, total consumption recorded an average annual growth rate of 2.1%, with a generally stable trend and only minor fluctuations. Consumption reached a historical peak in 2024 and is expected to continue growing in the short term.

In 2024, African carbon electrode market revenue declined sharply to USD 456 million, down 23.8% year-on-year. This figure represents the combined revenues of producers and importers (excluding logistics costs, retail marketing costs, and retailer margins, which are included in final consumer prices). Although consumption contracted slightly, the market had previously peaked at USD 1.2 billion, and growth from 2019 to 2024 failed to regain prior momentum.

Country-Level Consumption

In 2024, the countries with the highest carbon electrode consumption were Egypt (59,000 tons), Tanzania (52,000 tons), and South Africa (38,000 tons), together accounting for 44% of total consumption. Uganda, Angola, Ghana, Cameroon, Côte d'Ivoire, Mali, and Chad followed, collectively representing 37%.

From 2013 to 2024, Angola recorded the fastest CAGR in consumption among major consuming countries at 3.5%, while growth in other key markets remained relatively moderate.

In terms of market value, Egypt (USD 77 million), Tanzania (USD 68 million), and South Africa (USD 50 million) ranked as the top three markets in 2024, accounting for 43% of Africa's total market value. Uganda, Angola, and the other aforementioned countries accounted for a combined 36%.

Among major consuming countries, Angola recorded the highest market value CAGR at 0.9% from 2013 to 2024, while other core markets experienced relatively moderate growth.

In per capita consumption, Tanzania (779 kg per 1,000 people), Chad (671 kg per 1,000 people), and Uganda (656 kg per 1,000 people) ranked highest in 2024. From 2013 to 2024, Cameroon recorded the highest CAGR in per capita consumption at 0.1% among major countries, while other nations showed mixed trends.

Production

Overall African Production

In 2024, carbon electrode production in Africa reached approximately 293,000 tons, up 5.7% year-on-year. From 2013 to 2024, total production grew at an average annual rate of 3.3%, with an overall stable trend and only minor fluctuations. Production increased by 11% year-on-year in 2014, the fastest growth during the period. Output reached a historical peak in 2024 and is expected to continue rising in the short term.

Calculated at export prices, production value surged to USD 1.4 billion in 2024. Overall, output value showed moderate growth. In 2018, production value increased by 145% year-on-year, marking the fastest growth. Production value peaked at USD 3.2 billion in 2020, but remained at relatively low levels from 2021 to 2024.

Country-Level Production

In 2024, the largest producers were Tanzania (52,000 tons), Egypt (43,000 tons), and Uganda (33,000 tons), accounting for 44% of total production. South Africa, Angola, Ghana, and others accounted for 40%.

From 2013 to 2024, South Africa recorded a CAGR of 26.4% in production, far outpacing other major producers, whose growth remained relatively moderate.

Imports

Overall African Imports

In 2024, Africa's carbon electrode imports declined sharply by 15.9% to 51,000 tons. Overall imports showed a significant downward trend. In 2018, imports surged 102% year-on-year, reaching a peak of 107,000 tons. From 2019 to 2024, import growth failed to recover.

Import value fell to USD 212 million in 2024. In 2018, import value surged 204% year-on-year to USD 563 million, the highest level during the period. From 2019 to 2024, import value growth remained weak.

Country-Level Imports

In 2024, the main importing countries were Egypt (16,000 tons), South Africa (12,000 tons), and Algeria (9,200 tons), accounting for 73% of total imports. Libya (3,500 tons), Mozambique (3,500 tons), and Morocco (3,000 tons) followed, accounting for 19%. Angola imported only 1,600 tons.

From 2013 to 2024, Angola recorded the fastest import volume CAGR at 24.2% among major importers, while other countries grew more moderately.

In value terms, Egypt (USD 71 million), South Africa (USD 51 million), and Algeria (USD 40 million) ranked top three, accounting for 76% of total import value. Mozambique, Morocco, and others accounted for 20%.

From 2013 to 2024, Angola recorded the fastest import value CAGR at 18.5%.

Imports by Product Type

EAF carbon electrodes were the dominant import category, reaching 47,000 tons in 2024 and accounting for 93% of total imports. Non-EAF carbon electrodes totaled 3,800 tons, representing 7.4%. From 2013 to 2024, imports of EAF electrodes declined at an average annual rate of 4.8%, while non-EAF electrodes declined 3.1%.

In value terms, EAF carbon electrodes reached USD 196 million in 2024 (92% of total), while non-EAF electrodes accounted for USD 16 million (7.6%). From 2013 to 2024, EAF electrode import value grew at an average annual rate of 1.2%.

Import Prices by Product Type

In 2024, the average import price was USD 4,146 per ton, up 13% year-on-year. In 2021, import prices surged 64% year-on-year, the highest growth during the period. The historical peak of USD 5,317 per ton was recorded in 2019. From 2020 to 2024, prices remained below peak levels.

Non-EAF electrodes had a higher average import price of USD 4,276 per ton in 2024, compared to USD 4,135 per ton for EAF electrodes. From 2013 to 2024, EAF electrode prices recorded the highest CAGR at 6.4%.

Import Prices by Country

In 2024, the overall average import price was USD 4,146 per ton, up 13% year-on-year. Algeria recorded the highest import price at USD 4,408 per ton, while Angola had the lowest at USD 2,822 per ton. From 2013 to 2024, South Africa recorded the fastest import price CAGR at 12.9%.

Exports

Overall African Exports

In 2024, Africa's carbon electrode exports declined slightly to 454 tons, remaining largely flat year-on-year. Exports have shown a significant downward trend. In 2017, export volume surged 153% year-on-year, while exports peaked at 19,000 tons in 2013. From 2014 to 2024, export growth failed to recover.

Export value reached USD 1.7 million in 2024. In 2021, export value grew 54% year-on-year, while the peak of USD 37 million was recorded in 2013. From 2014 to 2024, export value remained at low levels.

Country-Level Exports

In 2024, South Africa (167 tons) and Cameroon (122 tons) together accounted for 63% of total African exports. Egypt exported 75 tons (16%), followed by Morocco (12%) and Mozambique (6.8%).

From 2013 to 2024, Morocco recorded a CAGR of -8.0% in export volume, while other major exporters also showed declining trends.

In value terms, South Africa led with USD 1.1 million (62% share), followed by Egypt (USD 224,000, 13%) and Cameroon (11%). From 2013 to 2024, South Africa's export value CAGR was -26.5%, Egypt's was 5.4%, and Cameroon's was -16.7%.

Exports by Product Type

In 2024, non-EAF carbon electrodes dominated exports at 254 tons, while EAF electrodes accounted for 200 tons. From 2013 to 2024, non-EAF electrode export volume declined at a CAGR of -17.8%.

In value terms, non-EAF electrodes reached USD 1 million, while EAF electrodes totaled USD 724,000. From 2013 to 2024, non-EAF electrode export value declined at a CAGR of -12.3%.

Export Prices by Product Type

In 2024, the average export price was USD 3,803 per ton, up 5.3% year-on-year. In 2018, prices surged 495% year-on-year, while the historical peak of USD 7,562 per ton was recorded in 2021.

Non-EAF electrodes had a higher export price of USD 3,949 per ton in 2024, compared to USD 3,617 per ton for EAF electrodes. From 2013 to 2024, non-EAF electrode export prices recorded the highest CAGR at 6.7%.

Export Prices by Country

In 2024, Africa's average export price was USD 3,803 per ton, up 5.3% year-on-year. South Africa recorded the highest export price at USD 6,423 per ton, while Morocco recorded the lowest at USD 1,226 per ton. From 2013 to 2024, Egypt recorded the fastest export price CAGR at 15.8%, while other countries saw moderate growth.

Feel free to contact us anytime for more information about the EAF Steel market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies