Shipping News: Three major shipping alliances cancelled 44 flights, space shortage

Shipping News: Three major shipping alliances cancelled 44 flights, space shortage

From Asia to North America: The large-scale spread of new mutated strains has led to the worsening of the epidemic in the United States, with the number of new COVID-19 cases reaching 1 million per day. Juxing UHP graphite electrode made in high quality needle coke. The renewed outbreak of the epidemic has an adverse impact on the economic recovery, which is likely to remain weak in the future. Transport demand remained high after the new year.

Due to the serious shortage of transport capacity/equipment, the shipping space is tight. Before the Spring Festival, the freight peak further pushed up the priority transportation price, and some urgent shippers were willing to pay sky-high prices to ensure shipping space. Relative demand, transport capacity and voyage are relatively limited, mainly due to serious congestion in the port, resulting in voyage delay, continuous accumulation of delay and multiple suspension. The price increase was implemented in the first half of January, and part of the increase was close to the high GRI freight rate in summer. In view of the high demand before the Spring Festival, it is expected that there may be a significant price increase in January; More and more shippers and importers are shifting booking services from standard to priority.

From Asia to Europe: The epidemic continues to spread in many European countries, with the daily number of new cases reaching a new high and demand remaining high. The epidemic has slowed down the recovery of the supply chain system, the shipping space continues to be in a tense situation, and the market freight rate hovers at a high level.

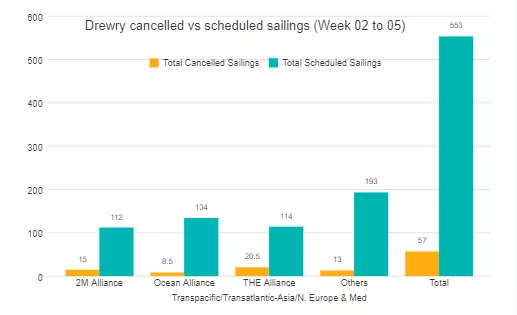

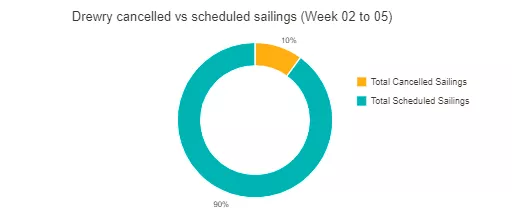

As the shortage of equipment at the Asian departure port continues, the shipping space is also extremely tight. Market demand has always exceeded supply and prices have remained stable at high levels for a long time. Frequent stoppage and port hopping still lead to a shortage of shipping space and equipment. Carriers have overbooked and have begun to restrict the acceptance of booking or arrange the dumping of containers. Due to the continuous delay and rescheduling of cargo vessels, the reliability of voyage is very low, and the delay of departure before the Spring Festival will seriously affect the post-holiday shipping. Some carriers raised their prices slightly in the first half of January. In view of the traditional peak season of the Spring Festival, it is expected that the price increase may also be implemented in the second half of January. According to the latest data released by Drewry a few days ago, in the next four weeks (week 2-5), the three major shipping alliances in the world have successively cancelled multiple voyages, among which most cancelled voyages are 20.5 sailings by THE Alliance. 2M Alliance cancelled 15 voyages; The fewest sea alliance canceled 8.5 voyages; Total 44 voyages.

Among the 553 scheduled voyages on major routes such as trans-Pacific, trans-Atlantic, Asia-Northern Europe and Asia-Mediterranean, 57 voyages were cancelled from the second week to the fifth week of next year, with a cancellation rate of 10%. According to Drewry current data, during this period, 58% of the blank flights will take place in the trans-Pacific East trade route, mainly to the west coast of the United States.

![]() Approaching the Spring Festival, logistics demand remains strong. The global supply chain is still facing congestion and disruption problems. The sustained COVID-19 situation is also triggering a wide range of economic challenges. As the Chinese Lunar New Year holiday (February 1-7) is coming, some barge services in South China will be suspended. Before the Spring Festival, the freight demand will remain strong and the freight volume will remain at a high level. However, the current global epidemic will still have a certain impact on the supply chain.

Approaching the Spring Festival, logistics demand remains strong. The global supply chain is still facing congestion and disruption problems. The sustained COVID-19 situation is also triggering a wide range of economic challenges. As the Chinese Lunar New Year holiday (February 1-7) is coming, some barge services in South China will be suspended. Before the Spring Festival, the freight demand will remain strong and the freight volume will remain at a high level. However, the current global epidemic will still have a certain impact on the supply chain.

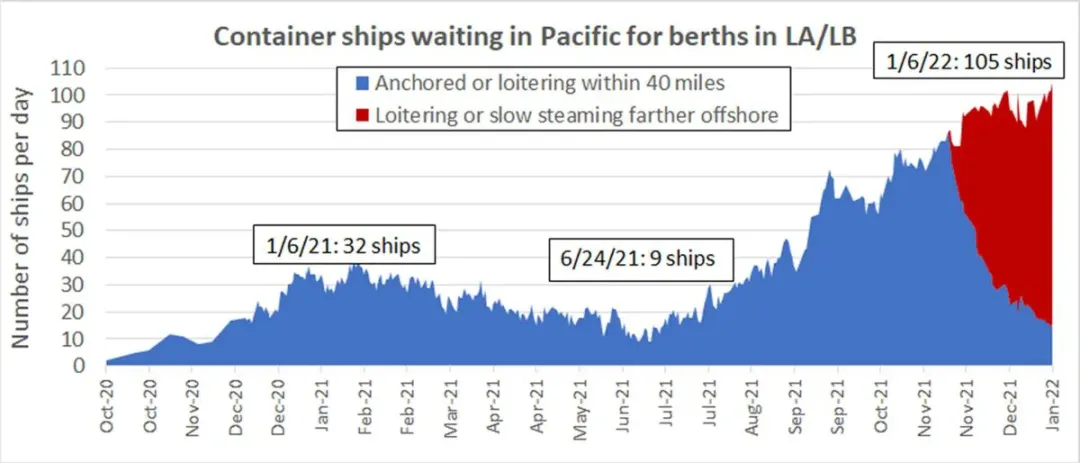

The capacity of the container industry is still limited. The interruption of inland transportation services in the United States has greatly restrained the capacity of the supply chain. At the same time, port congestion has greatly reduced the turnover efficiency of ship capacity. As of Friday, a record 105 container ships were waiting for berths in Los Angeles and Long Beach, according to the Southern California Marine Exchange. Among them, only 16 ships are in the port waters (within 40 miles of Los Angeles and Long Beach), and 89 ships are hovering or cruising slowly outside the newly designated safety and air quality zone, which extends 150 miles west and 50 miles north and south to the port. Vessel location data from maritime traffic confirm that most of these vessels are near the Baja Peninsula, reading more shipping news from us.

No related results found

0 Replies