【Graphite Electrode】 Price is Expected to Rise by 1000 yuan/ton

Graphite Electrode Price is Expected to Rise by 1000 yuan/ton

1. Rising prices of some raw materials may drive or boost the graphite electrode market

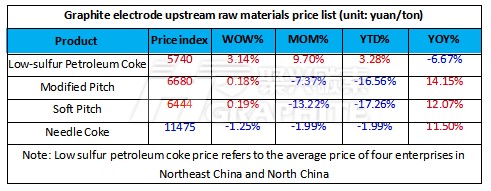

At present, as the upstream raw materials of graphite electrode, Fushun and Daqing low sulfur petroleum coke prices increased by 400 yuan/ton from the Spring Festival, of which, the low sulfur petroleum coke 1# price in a refinery in Northeast China is 6000 yuan/ton, up 7.14% from the Spring Festival; The modified coal tar pitch average market price is about 6680 yuan/ton, down 16.56% from the beginning of the year; The needle coke average market price is about 11620 yuan/ton, down 0.75% from the beginning of the year. Under the pressure of current market production costs, graphite electrode enterprises have insufficient profits.

Overall, graphite electrode raw materials prices fluctuated, but the rising price of low-sulfur petroleum coke still boosted the confidence of graphite electrode enterprises. Based on the current prices of low sulfur petroleum coke, coal tar pitch and needle coke in the graphite electrode market, the graphite electrode market production cost is still about 21000 yuan/ton in theory. Graphite electrode market is currently chaotic, and some orders are priced lower than market averages. It is understood that the ultra-high power 450mm graphite electrode low price is about 19500 yuan/ton. Graphite electrode enterprises still have losses when compared with the actual transaction price of graphite electrode.

2. Market trading is flat, graphite electrode manufacturers control inventory

According to investigation, the major graphite electrode manufacturers are basically maintain normal production, and some processes of the small manufacturers are suspended. Influenced by the poor market demand for graphite electrode, high cost pressure and difficulty in raising the price of graphite electrode before and after the Spring Festival, some manufacturers have controlled their inventory.

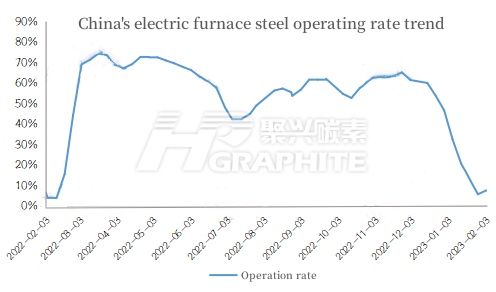

3. Steel plants production recovery is slow, graphite electrode demand is insufficient

Graphite electrode downstream steel plants have not yet been fully put into production, and the demand is still in the slow recovery stage. After the Spring Festival holiday, according to graphite electrode manufacturer, there is currently a lack of orders, only a few state-owned steel plants mainly bid, and the operating rate of private steel plants is low. As of February 3, the average operating rate of independent electric arc furnace steel plants was 7.66%, a month-on-month growth of 1.86% and a year-on-year growth of 3.33%. In March, steel plants are expected to gradually resume normal production; Some electric steel plants have stopped production seasonally and may resume production in mid-late February.

Market forecast

Insufficient demand is still the main factor limiting graphite electrode market. In the short term, the market is in a wait-and-see state. However, the resumption of the downstream steel plants production may bring positive support to the graphite electrode market. In addition, the current cost pressure of graphite electrode enterprises is obvious, which supports the manufactures to maintain a bullish attitude. To sum up, the graphite electrode price will be stable and is expected to rise by 1000 yuan/ton in the later stage. Feel free to contact us for graphite electrode future price analysis

No related results found

0 Replies