【Carburant】Analysis of Carburant Market Trends in Mid-August

【Carburant】Analysis of Carburant Market Trends in Mid-August

Data Source: Oilchem

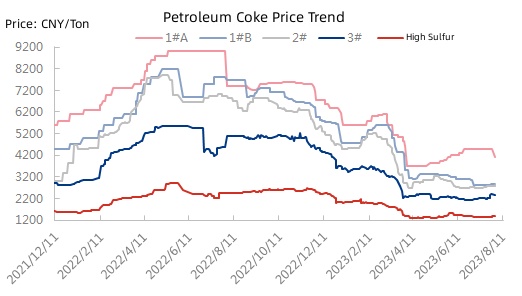

Cost Aspect: As of the time of writing, in the petroleum coke sector, the average price for 1# petroleum coke is 3490 CNY/ton, marking an increase of 124 CNY/ton or 3.68% compared to the previous period. The price for 2# coke is 2858 CNY/ton, showing a decrease of 50 CNY/ton or 1.72% from the previous period. In recent times, the petroleum coke market has seen robust trading activity, driven by positive support from downstream essential demands. In terms of supply, the operating rate has decreased by 1.31% compared to the previous week, as refineries are undergoing maintenance and restarting gradually. Despite this, the overall supply remains ample, and port inventories remain at a high level. On the demand side, the increase in electrolytic aluminum production provides a favorable support for petroleum coke prices. Short-term prospects suggest a potential upward trend in petroleum coke prices. Regarding calcined coal, the price of raw material anthracite coal has remained stable in recent times, with low inventory levels. The supply side may experience slightly tightened conditions, leading to a continuation of the upward price trend. However, the demand side displays a somewhat subdued trading atmosphere.

Data Source: Oilchem

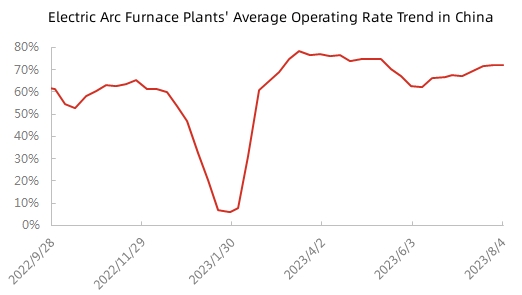

Downstream Demand: Based on the data, the electric arc furnace (EAF) operating rate remains stable, with a slight increase in capacity utilization. This marginal increase in capacity utilization can be attributed to the resumption of production in multiple electric furnace plants. Some steel plants, having experienced prolonged shutdowns, are gradually improving production efficiency and increasing operating time after resuming normal production. However, they are still in staggered production states. Looking at the next week, with the conclusion of the Grand Games, steel plants in regions like the Southwest are expected to resume production. Overall, it is anticipated that the independent EAF operating rate and capacity utilization will continue to see a minor upward trend in the coming week.

Data Source: Oilchem

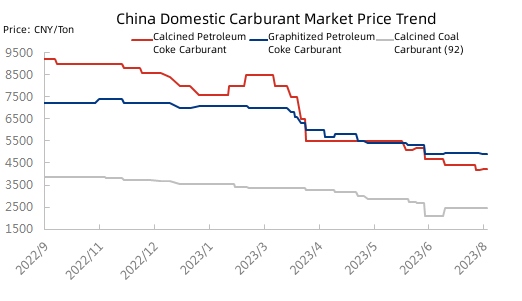

Price Aspect: The market quotation for low-sulfur calcined carburant is 4250 CNY/ton, showing an increase of 50 CNY/ton from the previous period. Graphitized carburant is quoted at 4900 CNY/ton, indicating a decrease of 50 CNY/ton. The market quotation for calcined coal carburant ranges from 2090 to 3300 CNY/ton, remaining stable compared to the previous period. Currently, there is a clear supply-demand imbalance in the carburant market. The supply far exceeds the downstream demand. Given the current situation of low steel plant operating rates and low profits, there is no favorable support for carburant prices. Short-term expectations do not suggest a significant upward trend in carburant prices; instead, they are likely to remain stable. Contact us for more industrial news on carbon market.

No related results found

0 Replies