【Needle Coke】Market Faces Price Pressure - Can September Bring a Turning Point?

【Needle Coke】Market Faces Price Pressure - Can September Bring a Turning Point?

Source: Oilchem

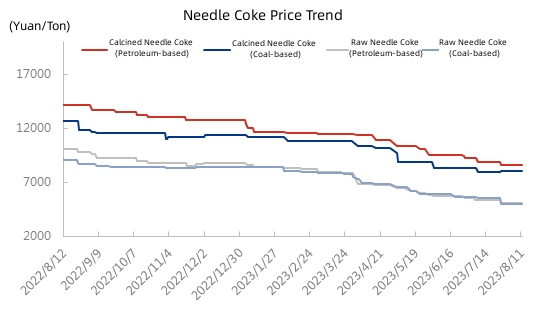

In August and September 2022, the continued impact downstream resulted in a shift of negative electrode production towards energy storage, further reducing the usage of needle coke. This led to a significant decrease in needle coke prices, approaching cost levels. Some enterprises even halted production or reduced output to alleviate inventory pressure. By late September and early October, there was a slight rebound in negative electrode demand coupled with sustained increases in raw material prices, providing support to needle coke prices. From late October to the end of the year, the electrode and negative electrode markets stabilized relatively, entering a period of price stability for needle coke. Since 2023 began, the needle coke market has experienced fluctuating declines in prices. As of now, the mainstream prices for raw needle coke range from 5000 to 5500 yuan/ton, and for calcined needle coke, 8000 to 9500 yuan/ton, representing a decline of 32% to 40% compared to the end of 2022.

Source: Oilchem

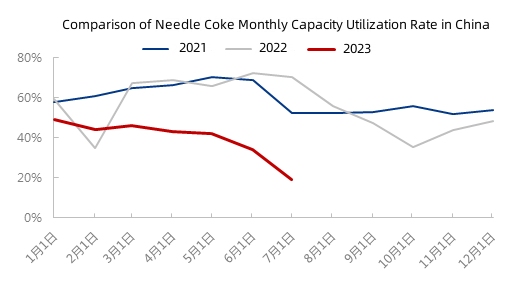

With declining profits in needle coke production, coal-based enterprises are in a loss state, while petroleum-based enterprises are experiencing thin profits. Consequently, this month's operating rate for needle coke enterprises has dropped to 19%, a 15-percentage-point decrease on a month-on-month basis and a 51-percentage-point decrease year-on-year. Many coal-based needle coke enterprises have suspended production or shifted to producing pitch coke, and their resumption of production remains uncertain. Petroleum-based enterprises are maintaining low-load operations. From the current downstream situation, there has been a marginal increase in production at negative electrode material factories, primarily based on orders. The demand for needle coke is limited as a result, and the production and shipment of needle coke face obstacles. In terms of graphite electrodes, low-load production has been prevalent this month, with the operating rate dropping to around 30%. This has led to a subdued usage of needle coke and calcined coke. Furthermore, the prices and market conditions for calcined coke exports have also weakened. Overall, the downstream demand for needle coke is showing signs of weakness.

It is anticipated that in September, with the gradual recovery of downstream negative electrode demand, the positive effects of favorable policies in the new energy vehicle market, and the slow revival of demand in the steel industry, needle coke might experience some limited positive changes. However, these changes might be modest, given the presence of numerous uncertain factors. A cautious and observant approach could remain the predominant theme. Forecast needle coke market trend, feel free to contact us.

No related results found

0 Replies