【Graphite Market Update】Graphite Prices Stabilize after Halt in Decline

【Graphite Market Update】

Graphite Prices Stabilize after Halt in Decline

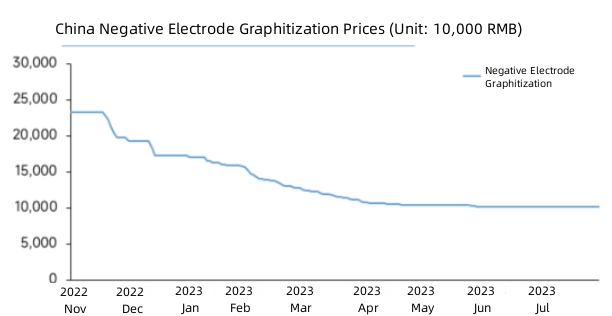

Currently, graphite prices have stabilized after a period of decline, with an average monthly price of 10,150 yuan/ton. This represents a flat change compared to the previous month, but a 61% year-on-year decrease. The current round of graphite price adjustments is mostly complete, and the market prices are stabilizing at lower levels. Mainstream contract manufacturing prices for Aicheson's capacity range between 10,000 to 11,000 yuan/ton, while for box-type manufacturing capacity, prices are in the range of 9,000 to 10,000 yuan/ton. Graphitized petroleum coke products for your reference.

Source: SMM

Demand Side: Terminal demand has only slightly recovered this month. Due to urgent cost-cutting demands this year, the supply side of artificial graphite has seen predominantly integrated layouts with major manufacturers entering the field. This has further diminished the survival space for independent graphite manufacturers. However, due to the impact of the Sichuan region, negative electrode manufacturers have shifted graphite contract orders ahead of time to other graphite-producing regions, primarily Inner Mongolia. This has led to an adjustment in regional demand structure and a slight overall increase in contract manufacturing demand.

Supply Side: Currently, independent monthly graphite production capacity is at 43,600 tons, with accompanying graphite capacity at 165,900 tons, resulting in a total capacity of 209,500 tons. It is anticipated that in August, independent monthly graphite production capacity will remain at 43,600 tons, with accompanying graphite capacity at 185,500 tons, totaling 229,100 tons. This month, due to environmental controls related to the 2023 Sichuan Universiade, production has been restricted for some regional manufacturers. Although the effective market capacity has slightly decreased overall, the remaining capacity is still sufficient to cover the demand from new orders. In terms of actual production, with gradual recovery in terminal demand and incomplete matching of integrated capacity for negative electrode manufacturers, orders for independent graphite manufacturers have seen a slight increase, resulting in a modest supply increase.

Future Price Forecast: While box-type furnaces have advantages in terms of energy consumption and lower per-tonne costs, their product stability and degree of graphitization are relatively inferior to Aicheson furnaces. In the context of cost reduction in the terminal market this year, the utilization of box-type furnaces has risen to some extent. However, in some cases of artificial graphite production, they cannot fully replace Aicheson furnaces. In this round of price reductions, Aicheson furnace prices have approached the cost line, and manufacturers are maintaining minimal profit margins. Although manufacturers are accelerating their cost-reduction efforts, the immediate tangible benefits are not substantial. Consequently, Aicheson furnace contract prices are likely to remain stable. Currently, most of the newly added capacity is in the form of box-type capacity, and its relative cost is lower. With no significant boost in downstream negative electrode demand, there might be potential for downward pressure on prices in the future. Contact us for more reports on Graphite Market.

No related results found

0 Replies