【Petroleum Coke】Market Trend in October

【Petroleum Coke】Market Trend in October

1. Market Overview

Following a relatively positive petroleum coke market in August, China domestic petroleum coke market experienced a slight downturn in September. As domestic refinery maintenance concluded and delayed coking unit startups improved in September, the domestic petroleum coke market witnessed an increase in supply. On the demand side, carbon enterprises showed good enthusiasm for production in September, with decent profits for calcined petroleum coke (CPC) and anode materials. Demand for petroleum coke remained stable in the negative electrode materials sector, and industries like silicon carbide saw an uptick in demand for petroleum coke. In September, petroleum coke imports continued to shrink, and port petroleum coke inventories were still in a destocking phase.

2. Price Trends

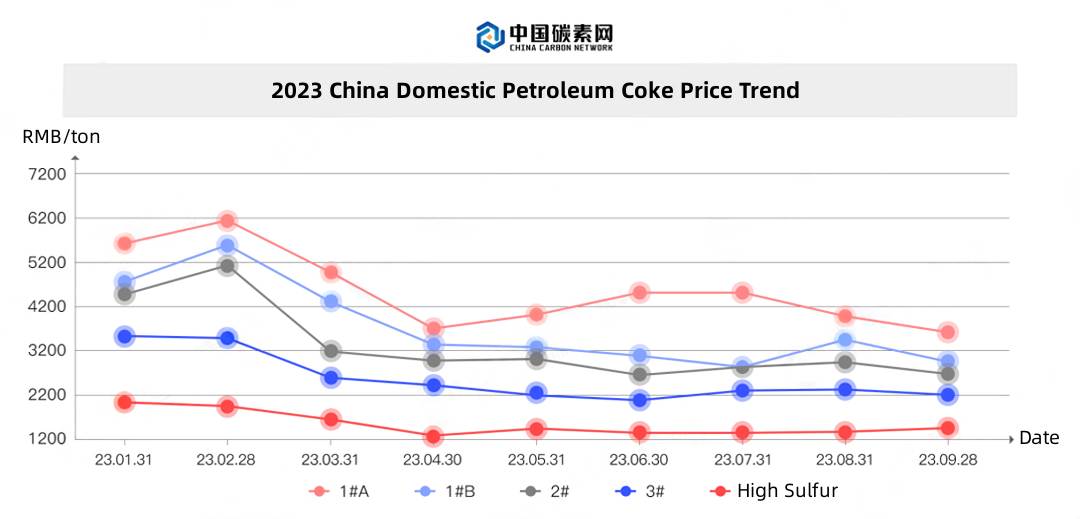

In September, trading in the petroleum coke market slowed down, and transaction prices saw sporadic adjustments. Shipments in the domestic petroleum coke market were sluggish in September, with mainstream transaction prices for low-sulfur coke ranging from 3000 to 3700 yuan/ton, middle-sulfur coke prices ranging from 1500 to 3350 yuan/ton, and high-sulfur coke prices ranging from 1153 to 2680 yuan/ton.

3. Future Predictions

As for prices, supply and demand issues continue to be the main contradictions in the domestic petroleum coke market in September. However, as refinery maintenance in China concludes in October, domestic petroleum coke resources may increase. In terms of port petroleum coke, the execution of pre-sale order contracts has led to reduced arrivals of newly imported petroleum coke, and downstream industries, affected by the decline in domestic coke prices, have shown a less enthusiastic attitude toward entering the market. The price advantage of imported petroleum coke has diminished, and the actual clearance rate has slightly slowed down. Downstream electrolytic aluminum companies and negative electrode materials exhibit strong demand. It is expected that domestic petroleum coke prices in October may remain relatively stable with some fluctuations.

As for demand, the increased supply of petroleum coke in September and high port inventories have led to an overall downward trend in coke prices, with fluctuations in prices in the middle and high sulfur coke markets. The overall trading activity in the petroleum coke market was subdued in September, and downstream market consumption enthusiasm was low, with a significant wait-and-see attitude. Influenced by downstream enterprise procurement, the demand for domestic petroleum coke in the market may still decline somewhat in October. Contact us to learn the latest reports on petroleum coke market.

No related results found

0 Replies