【Petroleum Coke】Market Prices After 2023 National Day Holiday

【Petroleum Coke】Market Prices After 2023 National Day Holiday

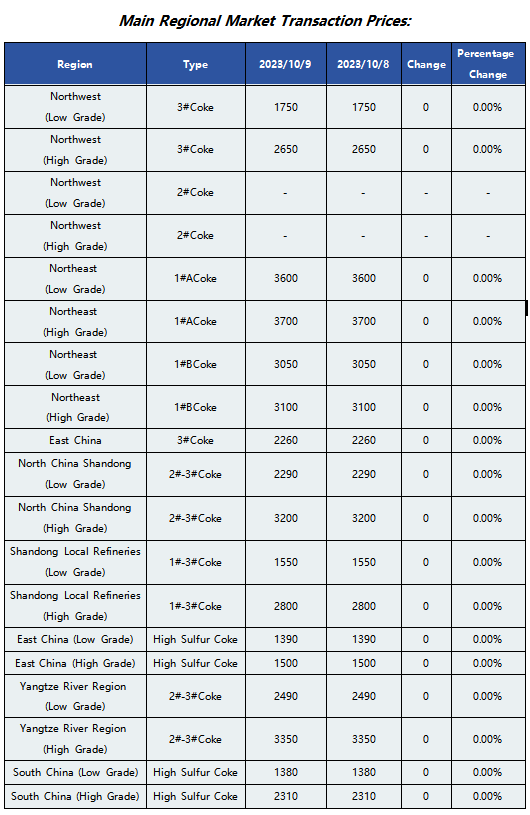

Market Overview: On October 9th, the market average price of petroleum coke in China was 2203 CNY/ton, up by 10 CNY/ton, with an increase of 0.46%. Currently, major refinery transactions are relatively stable, local refineries have moderate deliveries, and most downstream buyers are purchasing on an as-needed basis. Explore the production and price of graphitized petroleum coke products.

In terms of Sinopec, downstream demand for negative electrodes and carbon along the Yangtze River remains stable. Refinery petroleum coke deliveries are stable, with Changling Refinery shipping 3#A/3#B, Wuhan Refinery shipping 3#B/3#C alternately, and Anqing Refinery shipping 3A. In the southern region, high-sulfur petroleum coke deliveries remain stable. Maoming Refinery uses all petroleum coke for internal consumption, while Beihai Refinery ships 4A, and Guangzhou Refinery ships 4#.

In terms of PetroChina, in the northeastern region, low-sulfur coke deliveries have been flat, with most refineries continuing to sell at fixed prices. Recently, there has been a moderate uptick in demand for new energy in the terminal market, with battery factories focusing on depleting their inventories, and no significant increase in procurement activity by negative electrode companies after the holiday. In the northwest region, refineries are currently trading steadily, with inventory at medium to low levels. Under CNOOC, refineries are mainly shipping based on orders, with most pre-holiday orders already executed.

In terms of local refineries, the overall petroleum coke market deliveries are moderate, with some low-priced petroleum coke prices increasing by 10-50 CNY/ton, while high-priced petroleum coke deliveries face pressure, causing prices to continue falling by 30-50 CNY/ton. Current market volatility: The latest sulfur content of Dongming Petrochemical's old factory is around 3.28%; The sulfur content of petroleum coke from Shida Technology has increased to around 3.6%.

In terms of imported coke, the imported sponge coke market has seen stable deliveries, with traders primarily executing shipments based on previous contracts. The high-sulfur pellet coke market has good demand due to supply constraints, and deliveries are smooth, with stable trading in the medium to low sulfur pellet coke market.

Supply-side: As of October 9th, there have been 3 regular maintenance shutdowns of coking units in China, with a daily production of 95,210 tons of petroleum coke and a coking operating rate of 75.26%, an increase of 0.72% from the previous working day.

Demand-side: Demand from downstream carbon and silicon metal companies has remained stable. The negative electrode material market still has sufficient supply, with moderate downstream procurement activity. The silicon carbide industry has increased production, leading to good demand in the high-sulfur pellet coke market.

Future Outlook: The petroleum coke market is expected to remain weak but stable, with stable transactions in major refinery petroleum coke. In the short term, coke prices are expected to remain largely stable. For local refineries, petroleum coke deliveries are moderate, and downstream companies are purchasing as needed. The local refinery market is expected to continue its weak and stable trend, with some refineries still having downward price pressure, with fluctuations of around 20-100 CNY/ton. Price increases are not ruled out for high-sulfur pellet coke. Follow us and stay up-to-date with information on the petroleum coke industry.

No related results found

0 Replies