【Needle Coke】Analysis of Needle Coke Market Supply in November

【Needle Coke】Analysis of Needle Coke

Market Supply in November

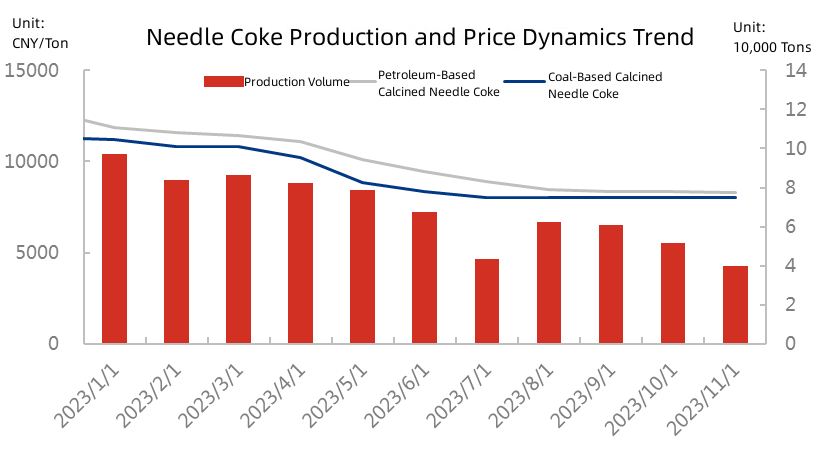

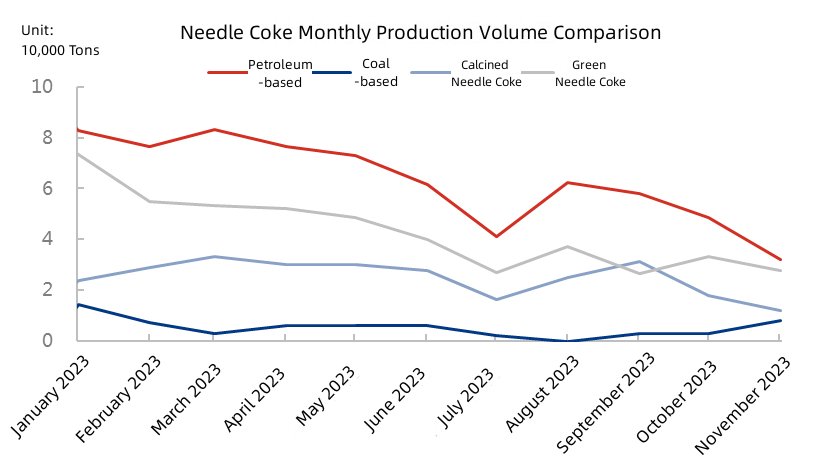

In November 2023, the downstream demand for needle coke remained sluggish, making it challenging to support the market. Some facilities, influenced by cost-profit considerations and factors from both upstream and downstream, maintained low capacity utilization rates, with several units in Shandong, Northeast China, and other regions undergoing shutdowns for maintenance. According to statistics, needle coke production in November was 39,900 tons, a decrease of 11,600 tons or 22.52% compared to the previous month. The production comprised 27,900 tons of green coke and 12,000 tons of calcined coke. Both production volume and capacity utilization rates experienced declines. Learn more about UHP graphite electrode products (needle coke as raw material).

Source: Oilchem

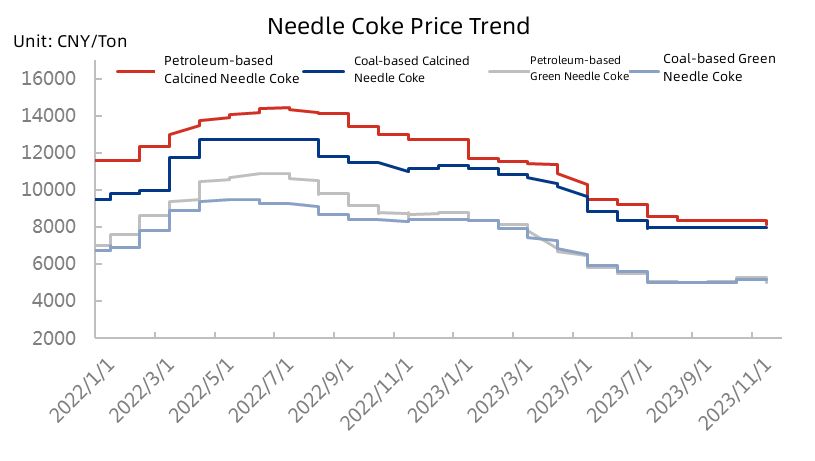

Due to the continuous cost reduction initiatives in downstream industries and poor demand, needle coke enterprises were compelled to offer concessions, leading to a sustained decline in market prices. As of November 30, 2023, the average monthly price for calcined needle coke was 8,273 yuan/ton, showing a 1.21% decrease compared to the previous month and a 55.5% decrease year-on-year. The average monthly price for green needle coke was 5,164 yuan/ton, marking a 0.12% decrease compared to the previous month and a 40.5% decrease year-on-year. For coal-based calcined needle coke, the average monthly price was 8,000 yuan/ton, holding steady month-on-month but declining by 28.3% year-on-year. The average monthly price for coal-based green needle coke was 5,200 yuan/ton, reflecting a 37.5% year-on-year decrease.

Source: Oilchem

Examining the operating status of needle coke production from coal and petroleum perspectives, most coal-based needle coke units were in a state of suspension due to the impact of profit inversion. In November, a coal-based enterprise executed an order for 5,000 tons of green needle coke for negative electrode use, leading to a slight increase in production. In contrast, petroleum-based needle coke production was 31,900 tons, representing a 34.22% decrease compared to the previous month.

Source: Oilchem

In summary, the needle coke market continues to face significant difficulties and challenges, with intensifying industry competition. Regarding prices, as needle coke prices have fallen near the cost line, cost support is evident, limiting the downward space. In the short term, needle coke prices are expected to remain weak but stable. Concerning production capacity, needle coke production capacity itself does not face significant bottlenecks. Future factors influencing the needle coke market will largely depend on raw material availability and demand conditions. Reading more reports on needle coke market, welcome to Follow us.

No related results found

0 Replies