【Petroleum Coke】Insight into market trends and sentiment in December

【Petroleum Coke】Insight into market trends and sentiment in December

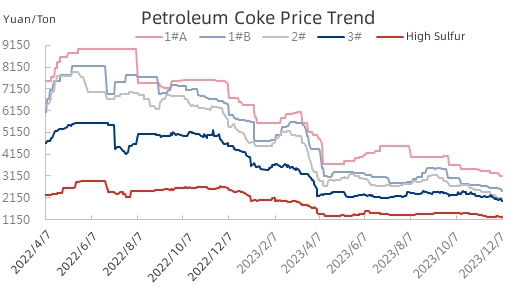

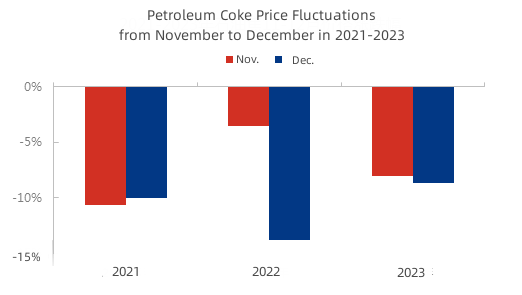

In December, Chinese petroleum coke market has experienced fluctuating prices with an average daily price for 3B petroleum coke reaching 1942 yuan/ton as of December 7th, representing a decrease of 240 yuan/ton or 10.1% compared to early November. This week, most of the main refinery coke prices have undergone downward adjustments, while the prices for petroleum coke at regional refineries have seen mixed trends, with no apparent positive news supporting the market.

Source: Oilchem

Currently, participants in the petroleum coke industry exhibit a cautious and uncertain sentiment, with many adopting a bearish outlook for the future market. Bearish views are primarily based on the relatively acute supply and demand imbalance in the petroleum coke market, with several bearish factors prevailing:

Recent downstream demand for petroleum coke has been weak, with carbon enterprises approaching the year-end market cautiously. In December, the benchmark price for pre-baked anodes was lowered by 100 yuan/ton, and aluminum smelters in the southwestern region entered the low-water period, resulting in smaller profit margins. This, coupled with lower operating rates for graphite electrode and graphite cathode enterprises, contributes to the prevailing bearish sentiment, weakening support for various grades of petroleum coke indicators.

The domestic prices of gasoline and diesel have mainly been characterized by fluctuation. On one hand, crude oil prices have shown a weakening trend, with OPEC+ meetings providing unclear signals and the added risk of supply expansion. On the other hand, the shipments from various refineries for gasoline and diesel have yet to reach a balance, and the market's trading atmosphere is weakening.

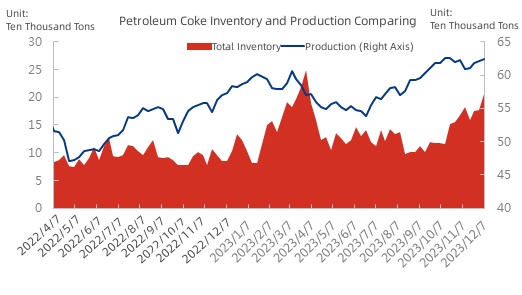

Several refineries that underwent maintenance earlier have gradually resumed production in December, increasing the domestic supply of petroleum coke. Inventories remain at high levels, and although the quantity of imported petroleum coke at ports has decreased, the prices are still inverted. As a result, the price of petroleum coke may decline.

Source: Oilchem

At the same time, some optimistic participants believe that demand in the downstream silicon and fuel sectors remains strong. This could potentially support expectations for an increase in the prices of fuel coke and high-sulfur coke.

However, there are also market participants who anticipate a period of consolidation, primarily due to the following concerns: 1) low inventory of gasoline and diesel, providing some pricing support for refineries, and 2) the overall downward trend in petroleum coke prices in November, with mainstream coke prices improving after the downturn, suggesting that refineries in December may focus more on executing order contracts, actively shipping goods, and adjusting prices in a stable and fluctuating manner.

Source: Oilchem

In summary, the demand for petroleum coke in December is not expected to experience significant fluctuations. The trajectory of petroleum coke prices may depend more on the improvement in downstream demand. It is recommended that industry participants exercise caution in their trading activities and closely monitor news from the gasoline and diesel markets while keeping an eye on market turning points. Contact us to learn more about carbon market reports.

No related results found

0 Replies