【Petroleum Coke】Market Overview at the End of December 2023

【Petroleum Coke】Market Overview at the End of December 2023

Market Overview:

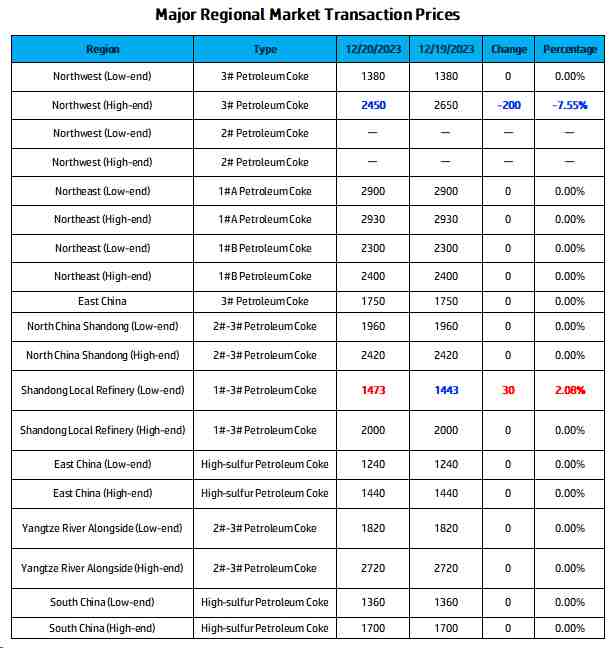

As of December 20th, the average price of petroleum coke in China is 1749 yuan/ton, with a slight increase of 2 yuan/ton, representing a 0.11% rise. The petroleum coke market remains generally stable, with fluctuations in prices from individual refineries such as PetroChina and CNOOC. Prices in local refineries show minor fluctuations.

Regarding Sinopec, shipments of petroleum coke from its refineries remain stable, with a focus on fulfilling orders and maintaining stable shipments. In the Yangtze River alongside region, medium-sulfur petroleum coke sees stable shipments, with Anqing Petrochemical shipping 3#A petroleum coke and Jingmen Petrochemical shipping 3#B and 3#C. In North China, shipments of medium to high-sulfur petroleum coke remain stable, with Cangzhou refinery shipping 3#C/4#A, Tianjin Petrochemical shipping 5#, and Shijiazhuang refinery shipping 4#A. PetroChina's refineries in the Northeast maintain overall stability in trading and are at a low inventory level. In Northwest China, Karamay Petrochemical's petroleum coke prices have been adjusted down by 200 yuan/ton, and other refineries are currently stabilizing prices for shipments. In South China, Huizhou Petrochemical, under CNOOC, maintains stable coke prices, and inventory remains at a low level. As the year-end approaches, although the prices of low-sulfur coke have already fallen to a low level, downstream enterprises have a weaker ability to turn over funds at the end of the year, and the wait-and-see attitude is the main factor affecting active stocking.

Local Refinery Perspective: Regarding local refinery prices, the petroleum coke market remains generally stable. Downstream enterprises have gradually entered the market for stocking and replenishing inventory. Most refineries are stabilizing prices for shipments, and the pressure on high-priced petroleum coke shipments has increased. The prices of petroleum coke have been slightly adjusted downwards by 20-30 yuan/ton, and the shipment of high-sulfur coke (with pellets) with a sulfur content of around 6.0% has improved, with prices slightly falling by 30 yuan/ton. Market fluctuations: The sulfur content of Yatong Petrochemical's petroleum coke has dropped to around 2.1%, while the old plant of Dongming Petrochemical has seen an increase to around 3.5-3.7%.

Imported Coke Perspective: Regarding imported coke, the cost of most imported sponge coke is mostly inverted, and the shipment of traders is blocked. Most traders have a strong reluctance to sell, and the delivery speed of sponge coke at ports is slow. The shipment of high-sulfur pellet coke is still acceptable, and the trading of medium to low-sulfur pellet coke is stable.

Supply Perspective:

As of December 20th, there is one conventional overhaul of coking units in the country, with a daily production capacity of 93,248 tons of petroleum coke, and a coking operation rate of 73.53%, an increase of 0.24% from the previous working day.

Demand Perspective:

The downstream carbon market for aluminum is weak, maintaining just-in-time procurement of petroleum coke; the cost-reducing mentality is strong among downstream battery manufacturers, and the overall market trading is weak; the silicon carbide industry still has demand for the high-sulfur pellet coke market; new orders for the graphite electrode sector are limited, and the market operates weakly and steadily.

Future Forecast:

The trading in the petroleum coke market is relatively stable, with sufficient market supply. However, despite the remaining demand from downstream enterprises, the overall market performance is weak, and demand for petroleum coke is limited. It is expected that the price of petroleum coke will be stable with fluctuations tomorrow, with a range of 10-50 yuan/ton. The spot resources of pellet coke are still tight, and it is expected that the price of pellet coke will stabilize in the transition. For more information on the petroleum coke market, feel free to contact us.

No related results found

0 Replies