【Carburant】Raw Material Prices Drop, Low-Sulfur Calcined Coke Profits Hover Near Break-even

【Carburant】Raw Material Prices Drop, Low-Sulfur Calcined Coke Theoretical Profits Hover Near Break-even

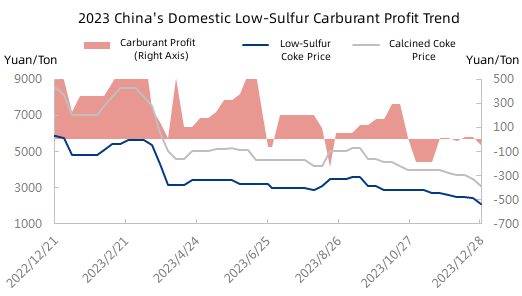

Since December, the market price of petroleum coke in China has continued to fluctuate within a narrow range, especially in the low-sulfur coke market, where the bearish sentiment has increased, leading to a continuous decline in prices. Under this influence, the market price of low-sulfur calcined coke carburant has also followed suit, with the profit margin continuously shrinking.

Data Source: Oilchem

According to statistical data, as of the time of writing, the theoretical profit of the low-sulfur calcined coke carburant market is -60 yuan/ton, a month-on-month decrease of 10 yuan/ton or 20%; a year-on-year decrease of 288 yuan/ton or 126.3%. In 2023, the market profit of low-sulfur calcined coke carburant was mainly profitable. Before and after the National Day, influenced by market sentiment, the profit of calcination plants declined slightly. As a screening material, the theoretical profit of low-sulfur calcined coke carburant turned negative, reaching the lowest value of -185 yuan/ton in early October. In November, the theoretical profit of calcination plants recovered slightly, and the theoretical profit of low-sulfur calcined coke carburant remained near the breakeven line, continuing to the present.

Data Source: Oilchem

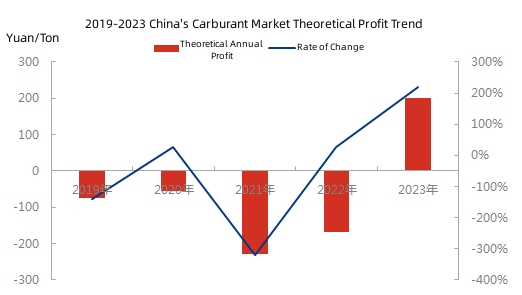

As shown in the above figure, from 2019 to 2022, the annual theoretical profit of the low-sulfur calcined coke carburant market was mostly negative. In 2021, it reached the lowest value in nearly five years, at -228 yuan/ton. The continuous rise in raw material prices increased the pressure on calcination and screening enterprises, leading to a continuous decline in the competitiveness of the low-sulfur calcined coke market and a further reduction in market share, resulting in a sharp drop in theoretical profits. In 2023, the theoretical profit of low-sulfur calcined coke enterprises reached the highest value in five years, at 199 yuan/ton. As raw material prices declined, the production pressure on calcination enterprises eased, the market price of low-sulfur calcined coke returned to rationality, and the market share of enterprises also showed signs of recovery, leading to a continuous increase in theoretical profits.

From the current market situation, the domestic supply of low-sulfur calcined coke resources has slightly decreased, and downstream graphite electrode enterprises are cautious in entering the market, mainly focusing on just-in-time restocking. The market atmosphere is somewhat subdued. The theoretical profit of low-sulfur calcined coke manufacturers may remain stable in the first quarter of 2024, and the theoretical profit of the low-sulfur calcined coke carburant market may continue to fluctuate above and below the breakeven line. Contact us for the latest carburant product market news.

No related results found

0 Replies