【Petroleum Coke】Price Overview

【Petroleum Coke】Price Overview

Market Overview

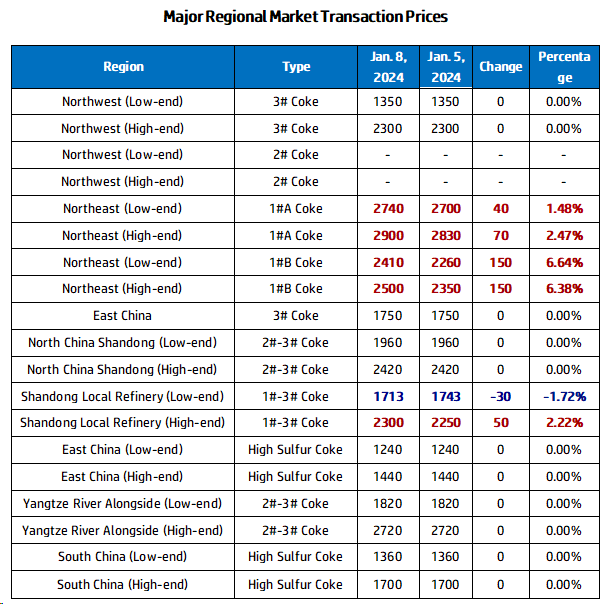

On January 8th, the average market price was 1798 yuan/ton, up 6 yuan/ton from the previous working day, with an increase of 0.33%. At present, some low-sulfur petroleum coke from PetroChina's Northeast region has risen, and shipments of local refinery petroleum coke are still good, with prices rising by 10-150 yuan/ton, and the price of graphitized petroleum coke product for reference...

Regarding Sinopec, the refineries under its banner mainly execute orders with shipments as the main focus. In the East China region, shipments of medium to high sulfur petroleum coke are still good. Shanghai Petrochemical, Gaoqiao Petrochemical, and Yangzi Petrochemical execute orders based on 4#B petroleum coke, while Zhenhai Refining & Chemical executes orders based on shot coke. In the South China region, shipments of high sulfur petroleum coke are stable. Maoming Petrochemical's petroleum coke is all for self-use, and Guangzhou Petrochemical mainly produces 4#B, while Beihai Refining & Chemical mainly produces 4#A. From the weekend, the petroleum coke market prices in PetroChina's Northeast region have been raised again by 40-200 yuan/ton, and most refineries maintain low inventories. Refineries in the Northwest region stabilize trading. CNOOC's refineries continue to ship according to orders. Due to the reduction in the supply of low-sulfur petroleum coke, downstream stocking enthusiasm has increased, stimulating some coke prices to rise this week.

On the local refinery side, from the weekend, the overall shipments of local refinery petroleum coke are still good, and market coke prices are still mainly rising, with a range of 10-150 yuan/ton. The demand for replenishing stocks from downstream carbon enterprises continues, entering the market for continuous procurement, stimulating refinery shipments, and driving up coke prices. However, some refineries have lowered coke prices for transition due to the consecutive rise in coke prices and adjustments to their own indicators. Current market fluctuations: Shandong Haihua Group's petroleum coke sulfur content has dropped to around 3.8%, and Xinyue Refining & Chemical's sulfur content has risen to around 4.6-5%.

In terms of imported coke, there are more inquiries in the downstream market. Coupled with the rise in the price of domestic petroleum coke, the shipment of imported sponge coke has improved. High-sulfur shot coke is supported by the southern fuel market and the silicon carbide market, and shipments are still good, with a stable market for medium and low-sulfur shot coke.

Supply Situation

As of January 8, there is currently one conventional overhaul of coking units nationwide, with a daily production of 91,328 tons of petroleum coke, and a coking operating rate of 72.02%, unchanged from the previous working day.

Demand Situation

Downstream aluminum carbon enterprises still have procurement demand for petroleum coke; the inventory reduction sentiment of downstream battery factories is obvious, the demand for negative electrode materials is slightly sluggish, and the overall market orders are declining; the production willingness of graphite electrode enterprises has decreased, and shipments are selected based on orders, with a weak market operation; the carbonization silicon industry and the southern fuel market still have demand for high-sulfur shot coke.

Future Market Forecast

The petroleum coke market is expected to maintain a steady overall shipment, with continued purchasing sentiment from downstream sectors and sustained market orders. However, as petroleum coke prices have been consistently rising recently, downstream enterprises are approaching purchases cautiously, limiting their support for the petroleum coke market. Therefore, it is anticipated that tomorrow's market coke prices will likely stabilize, with some potential for upward movement, ranging from 10 to 50 yuan per ton. The market demand for pelletized coke remains stable, and it is expected that pelletized coke prices will maintain stability in the short term. Feel free to contact us for more analysis on the petroleum coke market and related products.

No related results found

0 Replies