【Negative Electrode Materials】2023 Graphitization and Raw Material Market Overview

【Negative Electrode Materials】2023 Graphitization and

Raw Material Market Overview

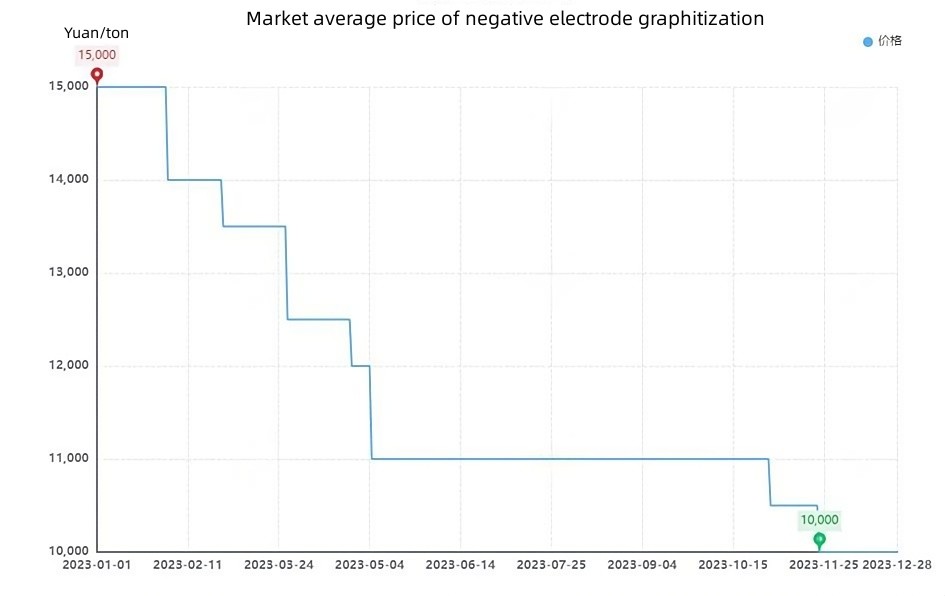

Graphitization: The supply of negative electrode graphitization in China is sufficient, with negative electrode enterprises accelerating the construction of integrated capacity, resulting in a reduction in the order share for graphite processing companies. Also, as most negative electrode material enterprises clear their inventory at the end of the year, the demand for negative electrode graphitization decreases. In a situation of supply-demand imbalance, the overall capacity utilization rate of the negative electrode graphitization industry is less than 50%, making it challenging to absorb the capacity. Learn more about the prices of graphitized petroleum coke. The processing prices for graphite are continuously compressed and have approached the cost line. As of December 28, 2023, the mainstream transaction price for graphite processing is in the range of 9,000-11,000 yuan/ton. Some downstream negative electrode material enterprises quote lower, around 8,000 yuan/ton. The processing cost for negative electrode graphitization using Acheson crucible furnaces is in the range of 10,000-12,000 yuan/ton, using box-type graphitization furnaces is in the range of 8,000-9,500 yuan/ton, and using lengthwise graphitization furnaces is in the range of 13,500-14,500 yuan/ton.

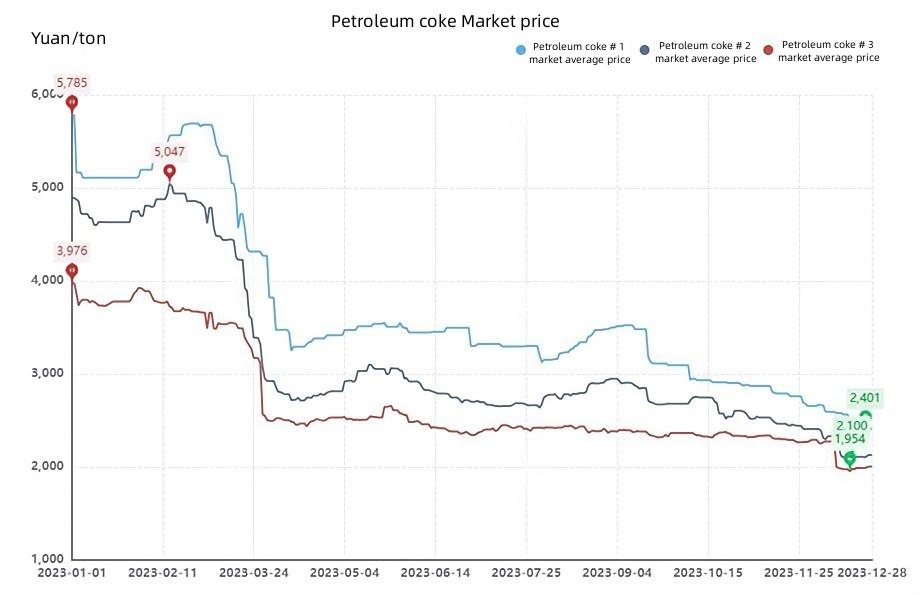

Petroleum Coke: The low-sulfur petroleum coke market has poor trading, with the overall terminal mainly focusing on digesting inventory and just-in-time procurement. The operating conditions of negative electrode material enterprises continue to decline, and with continuous downward adjustments in coke prices, downstream bearish sentiment increases. The low-sulfur petroleum coke market is relatively passive as of December 28, 2023, with the average prices for petroleum coke 1# at 2,410 yuan/ton, petroleum coke 2# at 2,130 yuan/ton, and petroleum coke 3# at 2,005 yuan/ton.

Supply Side: In December, petroleum coke import vessels concentrated at the port, and the cost of sponge coke was inverted. The enthusiasm of traders for shipments was generally low, and overall petroleum coke inventory at ports increased. In the first half of December, northern rain and snow weather affected logistics to some extent, causing a relatively tight supply of medium-sulfur petroleum coke in the refining process, but downstream demand still exists. In the second half of December, the shipment of medium-sulfur petroleum coke was under pressure, and refineries reduced prices for shipments.

Demand Side: In December, the silicon metal market rose, and the fundamentals of silicon metal belonged to a weak supply-demand situation. The supply side continued to shrink, mainly because of environmental restrictions on the load in the northern region, and silicon plant inventories in the Xinjiang region were relatively low. The Southwest region officially entered the dry season, with a low operating rate. Currently, the demand for petroleum coke in the metal silicon market is still acceptable, supporting the petroleum coke market.

Graphitization of Domestic Refineries: The market for delayed coking in domestic refineries is maintained at a relatively high level. Except for individual units that are temporarily shut down or adjust production levels, other units maintain full-load operation. Currently, enterprises have good profit consolidation, and the possibility of a significant reduction in market operations in the short term is small. Moreover, imported vessel goods continue to arrive at the port, and considering the current inverted cost of imported coke, overall shipment willingness is not strong. Coupled with the general follow-up of downstream market demand, port inventory is slowly decreasing. Currently, with the end of the year approaching, the enthusiasm for active stocking by some downstream before the holiday is acceptable. Under the influence of stable demand for just-in-time consumption, it is expected that the market price will be stable and slightly upward in the short term. In the later period, it is necessary to closely monitor the operation of on-site units and the stocking situation before the holiday on the downstream side.

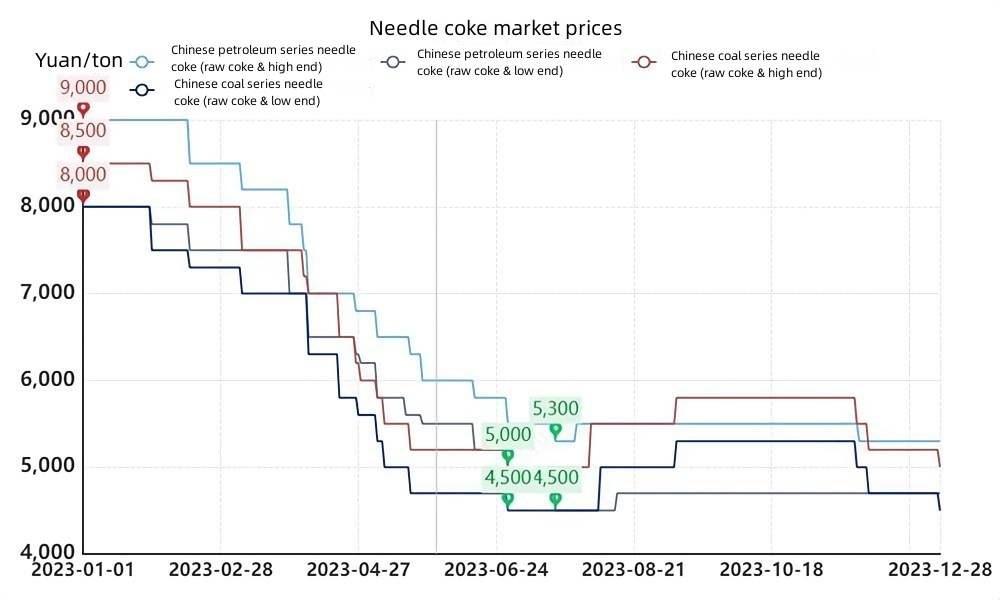

Needle Coke: At the end of the year, some enterprises sell at low prices to complete annual sales targets and relieve inventory pressure, leading to a continued downward pressure on needle coke prices. Trading is weak, and prices have fallen by 200-600 yuan/ton. As of December 26, the mainstream transaction price for domestically produced needle coke in Baichuan Yingfu is in the range of 4,700-5,300 yuan/ton for green coke and 6,500-8,800 yuan/ton for calcined coke. The mainstream transaction price for imported oil-based needle coke is 450-1,250 USD/ton for green coke and 950-1,700 USD/ton for calcined coke. The mainstream transaction price for imported coal-based needle coke is 600-850 USD/ton.

Since the end of November, market prices have continued to fall, with a decline of 100-600 yuan/ton. As of December 15, the mainstream transaction price range for domestically produced needle coke in Baichuan Yingfu was 6,500-8,800 yuan/ton for calcined coke and 4,700-5,300 yuan/ton for green coke. The mainstream transaction price range for imported oil-based needle coke is 450-1,250 USD/ton for green coke and 950-1,700 USD/ton for calcined coke. The mainstream transaction price for imported coal-based needle coke is 600-850 USD/ton. Graphitization and its products market information, follow us for our upcoming updates.

No related results found

0 Replies