【Calcined Petroleum Coke】Price Stability, Increased Demand

【Calcined Petroleum Coke】Price Stability, Increased Demand

Market Overview:

On April 15th, the average price of calcined petroleum coke(cpc) in Chinese market was 2,308 RMB/ton, holding steady compared to the previous working day. Currently, low-sulfur cpc market is stable, with prices in the Northeast region remaining firm due to strong raw material prices. Most transactions in the cpc market are based on long-term customer orders, with some enterprises facing pressure on shipments. Mainstream transaction prices for medium to high sulfur cpc are stable, with most enterprises focusing on stability in shipments. While future market demand is expected to grow, current demand in the negative electrode material market is limited, with most enterprises primarily executing previous orders.

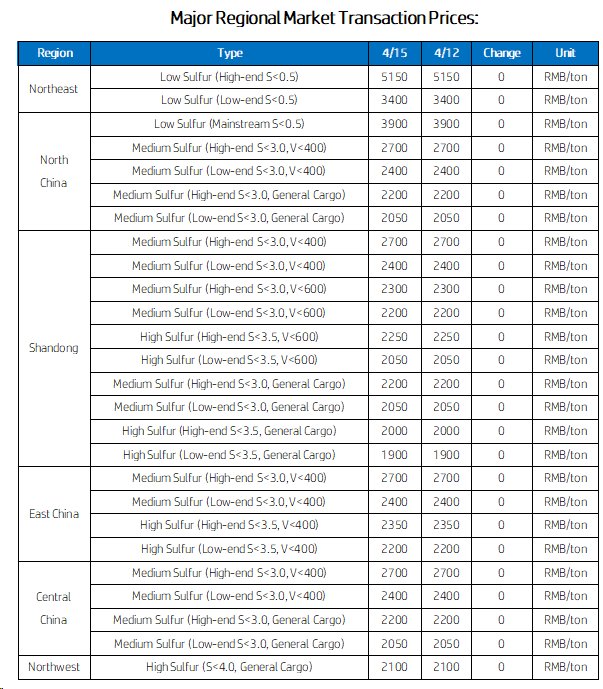

Market Prices:

Low-sulfur cpc (using Jinxi and Jinzhou petroleum coke as raw materials) has a mainstream transaction price of 3,700-3,900 RMB/ton. Low-sulfur cpc (using Fushun petroleum coke as raw material) has a mainstream transaction price of 5,050-5,150 RMB/ton. Low-sulfur cpc (using Liaohe and Binzhou Zhonghai petroleum coke as raw materials) has a mainstream transaction price of 3,300-3,450 RMB/ton.

Medium to high sulfur cpc (3.0% sulfur, no specific requirements for trace elements) previously had a mainstream contract price of 2,100 RMB/ton. Currently, the mainstream factory cash price is negotiating between 2,100-2,150 RMB/ton. Medium to high sulfur cpc (3.5% sulfur, no specific requirements for trace elements) previously had a mainstream contract price of 1,900 RMB/ton. Currently, the mainstream factory cash price is negotiating between 1,900-1,950 RMB/ton. Medium to high sulfur cpc (3.0% sulfur, vanadium 400) previously had a contract price of 2,400 RMB/ton. Currently, the negotiated factory cash price is between 2,500-2,600 RMB/ton.

Supply Situation:

Currently, the daily supply of commercial cpc in China is 27,026 tons, with an operating rate of 63.91%. The market supply of cpc is relatively stable compared to the previous working day.

Upstream Market:

Petroleum coke: Currently, main refineries are steadily delivering, with regional refinery coke prices fluctuating by 10-130 RMB/ton. Recently, there have been frequent fluctuations in the indicators of regional refinery petroleum coke. The carbon market downstream still appears to be average, with cautious purchases of petroleum coke as raw materials, mainly for immediate needs.

Downstream Market:

Graphite electrodes: With profits gradually recovering in downstream steel mills, demand for graphite electrodes has shown a slight rebound. However, overall procurement still needs to be released, and shipments from graphite electrode companies remain average. The market support is relatively weak, and actual transaction prices in the market are stabilizing.

Aluminum electrolysis: In China, driven by the overseas market and the release of policies such as the "Action Plan for Promoting the Replacement of Old Consumer Goods," which was officially launched during research on real estate discussions, terminal consumption sentiment has been boosted, leading to a rise in spot aluminum prices.

Negative electrode materials: With continuous consumption in the terminal new energy vehicle market, the overall order volume in the negative electrode material market is increasing. However, due to the higher bargaining power downstream, the actual transaction prices of negative electrode materials remain low, and the dilemma of enterprise profitability has not changed significantly. Follow us for updates on the calcined coke market.

No related results found

0 Replies