【Anode Materials】Golden September, Silver October Demand Pull — How Will Anode Prices Move?

The rapid growth of the EV and energy storage industries is boosting demand for high-performance lithium batteries, driving the market for quality petroleum coke and synthetic graphite. The quality and particle size of calcined petroleum coke directly affect synthetic graphite performance, especially in anode production.

【Anode Materials】"Golden September, Silver October" Demand Pull — How Will Anode Prices Move?

Introduction

Currently, the anode materials market is fulfilling previous contract deliveries. Production of anode materials remains stable, with leading enterprises operating at high capacity utilization, some even running at full capacity. With the continuous rise in low-sulfur petroleum coke prices, the production cost of artificial graphite anode materials is expected to increase, thereby narrowing production margins.

I. Increase in Anode Material Supply in August

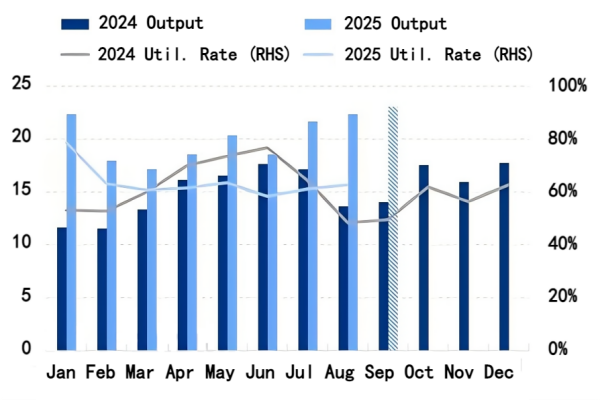

Figure 1: Comparison of China's Anode Material Output and Capacity Utilization (Unit: 10,000 tons)

Source: Oilchem

In August 2025, anode material output reached 223,500 tons, a year-on-year increase of 63.5% and a month-on-month increase of 3.19%. Capacity utilization stood at 62.71%, up 1.7 percentage points month-on-month. In August, anode production continued at a high level. Output was determined by sales, with production scaled up according to order volumes. During the wet season, electricity discounts supported operations. Leading enterprises maintained full production and built up a certain level of product inventory.

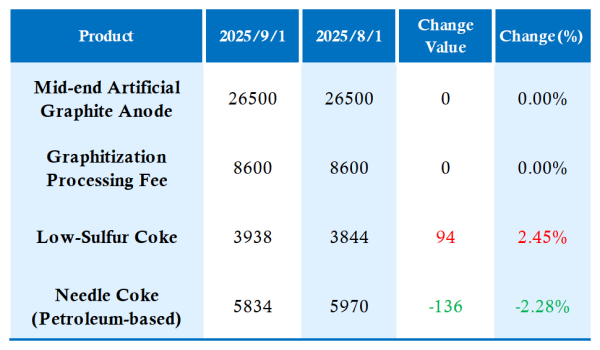

II. Rising Low-Sulfur Coke Prices, Expected Decline in Production Margins

In August, domestic low-sulfur petroleum coke prices fluctuated upward from 3,500–3,600 RMB/ton to 3,600–3,700 RMB/ton, with high-quality resources holding at 4,000 RMB/ton.

On the graphitization side, as leading anode enterprises continue to expand integrated capacity, oversupply contradictions in outsourced graphitization persist. Anode enterprises still show strong willingness to depress outsourced processing fees. However, the profit margins of outsourced graphitization companies are already approaching cost thresholds. If prices fall further, many would face significant losses. As such, the downside room for prices is limited, and outsourced graphitization prices are expected to remain stable.

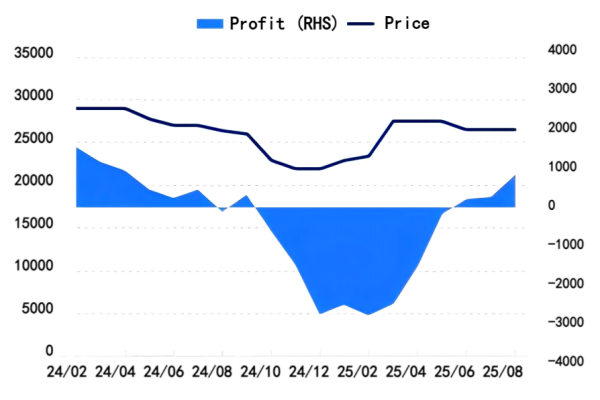

Figure 2: Domestic Artificial Graphite Prices and Profits (Unit: RMB/ton)

Source: Oilchem

In August, the per-ton profit of mid-range artificial graphite reached 854.88 RMB/ton, up 588 RMB/ton from last month. The gross profit margin stood at 3.23%, an increase of 2.22 percentage points month-on-month. The decline in raw material prices used for production was significant, leading to a clear improvement in anode production margins.

Cost details:

Outsourced graphitization processing: 8,600 RMB/ton

Needle coke (petroleum-based green coke): 6,090 RMB/ton

Low-sulfur petroleum coke: 3,516 RMB/ton

Coating asphalt: 5,100 RMB/ton

Overall production cost: 25,645 RMB/ton

III. September Traditional Peak Season Arrives, Downstream Demand Expected to Improve

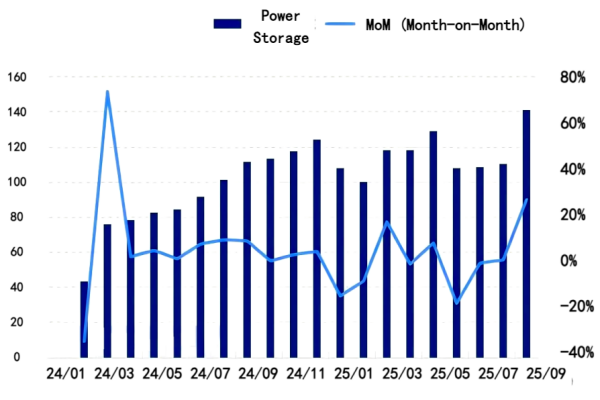

Figure 3: Comparison of China's Mainstream Battery Production

Source: Oilchem

In September, lithium battery production is expected to reach 141 GWh, representing a month-on-month increase of 27.83%.

In August, demand-side activity showed positive changes. Power cell manufacturers, preparing for the upcoming "Golden September, Silver October" peak sales season, accumulated certain finished product inventories. In the energy storage sector, large-capacity cells (500Ah+) entered accelerated mass production. Companies such as CATL and Hithium have already realized mass production of 587Ah and 560Ah large cells, driving technological upgrades in the industry.

Meanwhile, after the phase-out of China's mandatory storage allocation policy, demand has been supported by computing infrastructure projects (e.g., "East Data, West Computing") and thermal power flexibility retrofits.

Conclusion

In summary, anode enterprises remain supported by both stable costs and recovering demand, and the willingness to raise prices persists. However, competition in the artificial graphite anode material market remains fierce, limiting the upward momentum of price adjustments. As a result, prices are expected to remain stable in the near term.

Feel free to contact us anytime for more information about the Anode Material market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies