【Petroleum Coke】Post-Dragon Boat Festival Market Outlook (Ⅱ): Weak and Stable Trend Expected, ...

Calcined petroleum coke is an important material in modern manufacturing, especially in the aluminum and steel industries. Its high carbon content, low sulfur content, and low impurities make it an ideal choice for various applications.

【Petroleum Coke】Post-Dragon Boat Festival Market Outlook (Ⅱ): Weak and Stable Trend Expected, Prices to Fluctuate Between RMB 1300–3400/ton

Demand Side: Lack of Strong Support

Downstream buyers mainly rely on rigid demand procurement, focusing on depleting existing inventories.

Calcined Petroleum Coke:

The market remains oversupplied with a pessimistic outlook. As of May 26, general-grade calcined petroleum coke with 3.0% sulfur incurred a loss of RMB 175/ton, down RMB 130/ton from April 30 (a 288.89% decline in profit). The operating rate for the calcined coke sector in May was 56.23%, down 2.44% MoM.

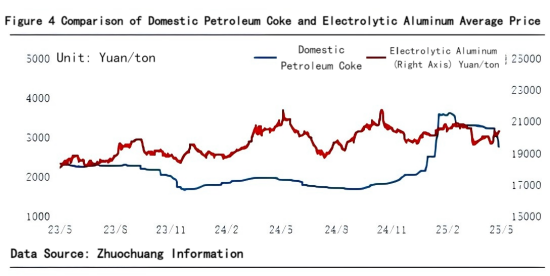

Aluminum (Electrolytic):

Smelters maintained operating rates above 95%, with stable demand for petroleum coke, mostly driven by essential restocking.

Anode Materials:

The NEV (new energy vehicle) end market is highly competitive, passing cost pressure upstream. The support for raw materials remains weak. It reports the operating rate for anode material producers in May was 50.66%, a 3.08% decline from the previous month.

Weak market demand, sluggish sales, and low operating rates persist.

Others (Silicon Metal, Silicon Carbide):

Demand from these sectors is stable or slightly weak.

Apparent Consumption

In April 2025, China's apparent petroleum coke consumption reached 4.1225 million tons, a 1.71% YoY decrease.

For Jan–Apr 2025, cumulative apparent consumption was 15.416 million tons, down 1.14% YoY.

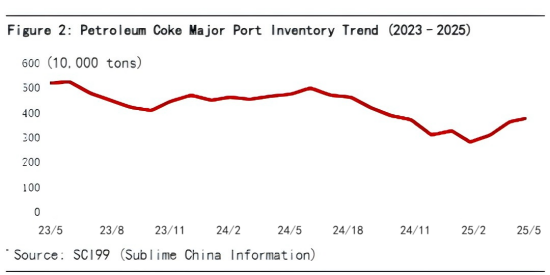

Inventory Pressure: High Port Stockpiles

As of May 22, domestic port inventories rose to 3.75 million tons. High-sulfur coke faces downward price pressure due to inventory build-up.

Ahead of and following the Dragon Boat Festival, traders are expected to accelerate destocking to accommodate incoming shipments, possibly causing price inversions and a bearish outlook.

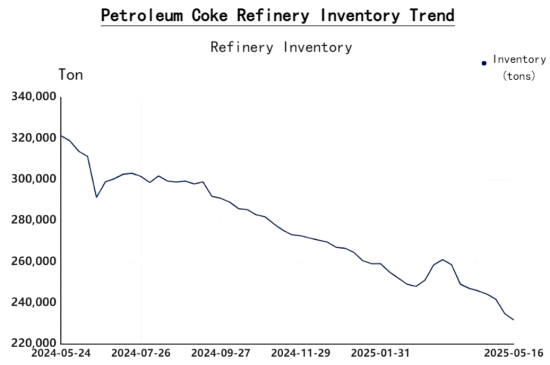

Refinery Inventory

In Shandong, refinery inventories remain high, affecting sales and prices. Nationwide, some refineries are lowering prices to boost shipments. Overall refinery stock levels remain moderate to low.

Market Outlook for June

The petroleum coke market is likely to remain weak and stable. Supply-demand imbalances persist, with price fluctuations short-term affected by refinery destocking and downstream restocking behavior.

Supply Side:

Domestic refinery maintenance has limited impact on total output; overall supply is expected to rise slightly. Eased U.S.-China tariffs may revive U.S. petroleum coke imports, but actual arrivals and timing remain key.

Demand Side:

Post-holiday downstream restocking may occur, but with expectations of prebaked anode price reductions, demand from key sectors (calcined coke, anode materials, graphite electrodes) may stay weak, with mainly rigid demand procurement.

Inventory Side:

High port stockpiles remain the main pressure point. Port inventories are expected to be consumed during June.

Price Forecast (June):

Low sulfur coke (approx. 0.5% S): RMB 3000–3400/ton

Medium sulfur coke (S 2.5%, V around 400): RMB 2300–2500/ton

High sulfur, high vanadium coke (approx. 4.5% S): RMB 1300–1500/ton

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies