【Graphite Electrode】Prices Continue to Decline ↘️, Lacking Positive Factors, Weak Demand,...

【Graphite Electrode】Prices Continue to Decline ↘️, Lacking Positive Factors, Weak Demand, Market Expected to Remain Stable in the Near Term

Market Overview

The graphite electrode market has continued its downward trend recently, mainly due to the bearish impact of falling upstream low-sulfur petroleum coke prices. At the same time, downstream demand for graphite electrodes remains weak, particularly from steel mills. Current production at steel mills is below expectations, leading to limited demand for graphite electrodes and fewer new tenders. Under pressure from losses, there are still instances of low-price sales and substandard products in the market, which have had a slight impact on transaction prices in the low-end segment. Actual transaction prices vary, and product quality differentiation has increased. With cost and demand both under pressure and low-priced products disrupting the market, the transaction focus in mainstream graphite electrode markets continues to move downward.

Price Range

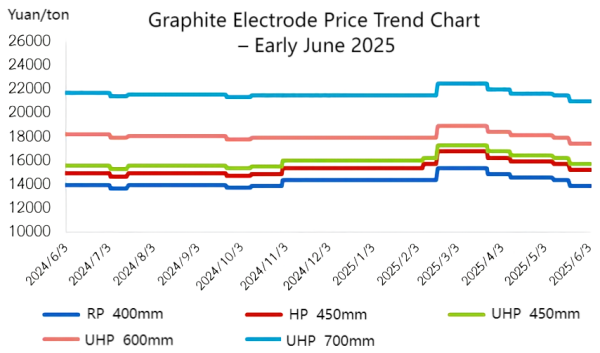

Mainstream prices for 300–600mm graphite electrodes:

(1) Regular Power (RP): RMB 13,500–15,200/ton

(2) High Power (HP): RMB 14,500–17,000/ton

(3) Ultra High Power (UHP): RMB 15,000–17,900/ton

(4) UHP 700mm graphite electrodes: RMB 20,500–21,400/ton.

Supply Side

Previously halted graphite electrode enterprises show low willingness to resume production. A few companies with low inventory levels have restarted operations to replenish stocks. However, due to weak market demand and few new orders, some companies have taken production reduction measures to ease inventory pressure.

Production among mainstream enterprises remains relatively stable. Overall, supply still exceeds demand in the graphite electrode market.

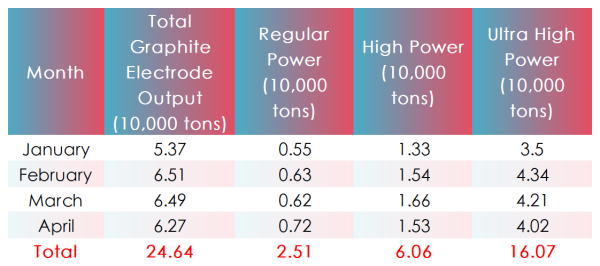

As of this month, according to incomplete statistics, China's total graphite electrode production capacity stands at 2.341 million tons, a reduction of 38,000 tons compared to the beginning of the year.

Cost Side

Graphite electrode production costs have declined slightly compared to earlier periods.

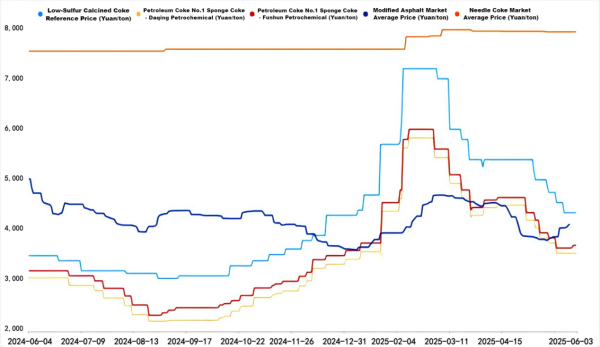

Petroleum coke trading remains sluggish. Major refiners' low-sulfur coke auction prices continue to drop. As of today, the average low-sulfur petroleum coke market price is RMB 3,525/ton, down 1.40% from last week.

The needle coke market remains weak, with insufficient orders. As of today, the average price of calcined needle coke is RMB 7,927/ton, unchanged from last week.

No new deals have been reported in the coal tar pitch market, and players are awaiting coal tar price movements. As of today, the average coal tar pitch price is RMB 4,068/ton, up 5.03% from last week.

Overall, fluctuations in raw material prices are mixed but limited, and comprehensive graphite electrode production costs have not changed significantly.

Demand Side

Overall demand from downstream markets for graphite electrodes is average.

(1) Steel Sector: The construction steel market is fluctuating downward, with narrowing profit margins for steel mills. Coupled with poor terminal demand, steel mills are operating at persistently low levels. As the market enters the traditional off-season, expectations for increased steel mill operations are low, and rigid demand for graphite electrodes is limited.

(2) Non-Steel Sector: The silicon metal market has seen a sharp decline, with slow recovery in operations and an overall downward production trend, resulting in weak demand for graphite electrodes. The yellow phosphorus sector has relatively stable operations and purchases graphite electrodes as needed.

Export Side

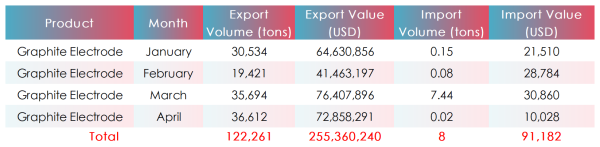

From January to April 2025, China exported a total of 122,300 tons of graphite electrodes, a year-on-year increase of 5.82%. Major export destinations include the UAE, Iran, and South Korea.

While China-U.S. tariffs are expected to be lifted in phases, China's graphite electrode exports to the U.S. represent only a small proportion of total exports, so the overall impact on future graphite electrode exports is limited.

Market Outlook

1. Supply Side

The graphite electrode market is performing poorly, and production enthusiasm among producers remains weak. Some enterprises are producing intermittently based on orders to replenish basic inventory. There may be further production cuts in the future.

2. Demand Side

Steel mill operations are below expectations, with limited graphite electrode procurement and tighter profit margins. Some steel enterprises are less inclined to operate. Demand for graphite electrodes is unlikely to improve significantly next week.

3. Cost Side

Raw material prices are fluctuating, but with limited amplitude. No major changes in cost structure are expected in the short term. Future costs are likely to remain stable with minor fluctuations.

Comprehensive Outlook

The graphite electrode market lacks strong bullish factors. Low-priced products will remain active in the market. Mainstream graphite electrode prices are expected to remain stable in the near term.

Feel free to contact us anytime for more information about the Graphite Electrodes market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies