【EAF】Losses Persist, Operating Rate and Capacity Utilization Likely to Continue Declining

Graphite electrodes are the essential consumables in EAF steelmaking. Due to their outstanding electrical conductivity and excellent high-temperature resistance, they play a critical role in ensuring efficient and stable furnace operation, thereby improving steel production capacity and product quality.

【Electric Arc Furnace】Losses Persist, Operating Rate and Capacity Utilization Likely to Continue Declining

As of September 3, a survey of 87 independent electric arc furnace (EAF) steel plants in China showed an average operating rate of 73.21%, down 1.88% week-on-week, up 1.69% month-on-month, and up 23.98% year-on-year; capacity utilization was 55.74%, down 0.80% week-on-week, down 1.16% month-on-month, and up 23.04% year-on-year. Entering September, finished steel demand has not shown structural improvement. In the short term, finished steel remains in a supply-demand mismatch, coupled with further declines in ferrous metal markets. Losses at some EAF steel enterprises have deepened, production remains under pressure in the short term, leading to both operating rates and capacity utilization falling.

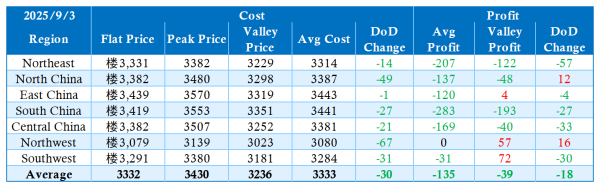

Independent EAF Construction Steel Plant Cost Survey (September 3, 2025) (Unit: RMB/ton)

Among the 76 sampled plants, 9 were not in production and therefore not included in the survey, leaving 67 independent EAF construction steel plants covered. This week, both costs and profits of EAF steel plants declined. Details are as follows:

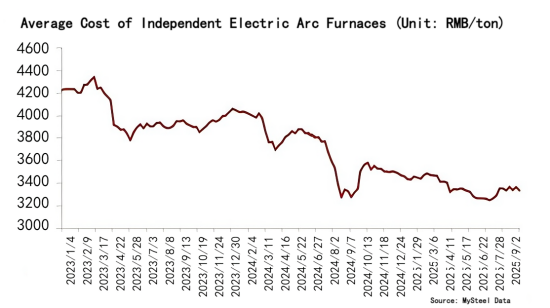

Cost: This week, the average cost of independent EAF construction steel plants surveyed was RMB 3,333/ton, down RMB 30/ton week-on-week. Scrap prices fell this week, while steel bases' risk-averse sentiment increased. Expectations for the traditional "Golden September" peak season did not materialize. In some regions, steel plants' scrap arrivals remained acceptable, and inventories slowly increased. Combined with weak production conditions at steel enterprises, scrap demand did not recover, resulting in a clear decline in EAF costs.

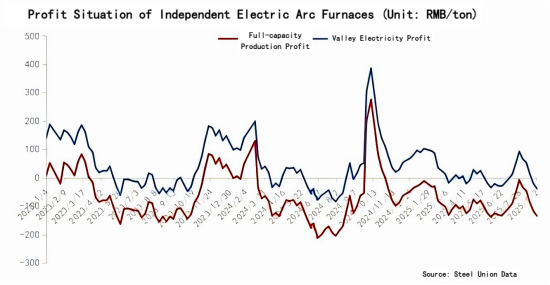

Profit: This week, the average profit of independent EAF construction steel plants surveyed was -RMB 135/ton, with valley electricity profit at -RMB 39/ton, down RMB 18/ton week-on-week. In most regions, EAF steel enterprises saw significant profit declines. Without supportive macroeconomic factors, supply and demand are gradually returning to fundamentals. Steel inventories are difficult to reduce effectively, and the expected boom of "Golden September" has not appeared. Prices may continue to fall. In North China and Northwest China, scrap costs fell significantly, widening the rebar-to-scrap spread, leading to a short-term profit recovery. However, the outlook remains severe, and expectations of EAF production cuts may persist.

Overall: This week, EAF steel plant profits continued to decline, losses remained unresolved, and operating rates and capacity utilization continued to fall. From the consolidated data, apart from the Northwest and Southwest regions where valley electricity production still generated some profit, and East China where valley electricity showed marginal profitability, other regions continued to face growing production pressure due to losses. In addition, current tax risks are weighing more heavily on upstream and downstream scrap enterprises. The cancellation of tax subsidies in many regions has increased costs for scrap processing and trading companies, putting greater pressure on steel enterprises' procurement. If conditions do not improve, rising costs will continue to constrain both upstream and downstream performance, and losses may persist. In the short term, EAF operating rates and capacity utilization are expected to continue declining.

Feel free to contact us anytime for more information about the EAF Steel market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies