【Negative Electrode Materials】Analysis of the 2023 H1 Market

【Negative Electrode Materials】Analysis of the 2023 H1 Market

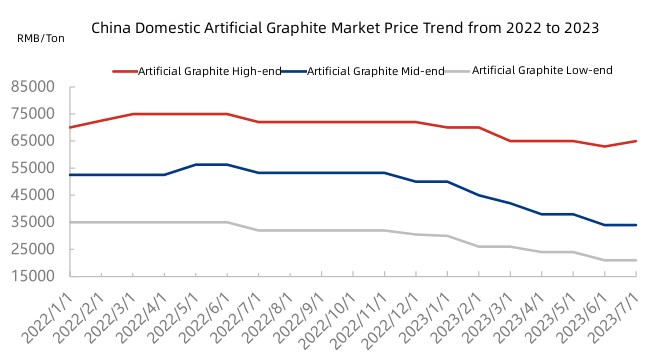

In the first half of 2023, the domestic market for artificial graphite negative electrode materials continued its downward trend. Prices of mid-range artificial graphite products have dropped from 50,000 CNY/ton at the beginning of the year to the current 34,000 CNY/ton, while prices of low-end products have decreased to 21,000 CNY/ton. The negative electrode market shows a significant polarization, with low to mid-range artificial graphite prices approaching the cost end, while high-end product prices have a large price range. The supply and demand imbalance in the negative electrode market is evident, leading to intense price competition and pressure in the low-end product segment.

Since April, downstream battery manufacturers have increased production, but mainly to consume existing inventory. Currently, there is no positive support from the cost side, and the slow recovery of downstream demand, combined with the continuous cost reduction efforts in the industry, makes it unlikely for negative electrode material prices to rebound in the short term.

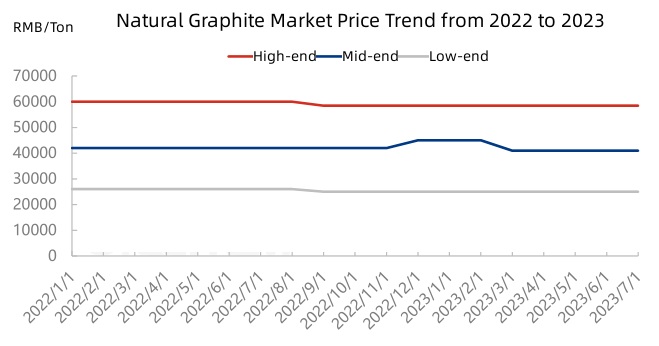

In the first half of 2023, the price of natural graphite negative electrode materials remained stable. As for raw materials, the price of natural flake graphite has fallen by 937 CNY/ton, and spherical graphite has dropped by 4,741 CNY/ton. Currently, most negative electrode companies are still in the destocking phase, with less than half of the companies operating, and some have shifted production to other sectors. With the gradual improvement in end-user demand and the release of new production capacity on the raw material side, there is a certain level of positive support for natural graphite negative electrode materials, and it is expected that prices will remain stable in the later period.

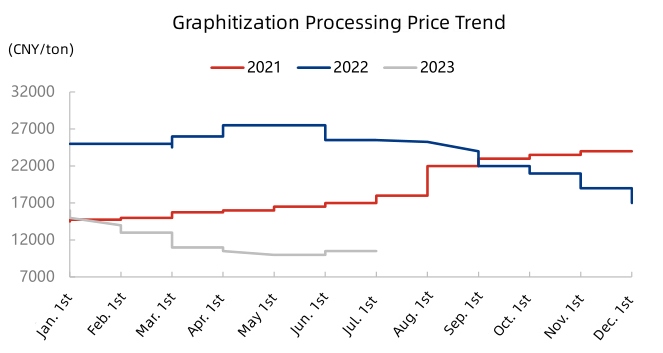

Since 2023, due to weak downstream demand, graphitized carburant production rates have been low, resulting in prices dropping from 14,000 CNY/ton to around 10,000 CNY/ton in some regions, leading to profit inversion for some graphitized carburant manufacturers. As the demand for negative electrodes gradually improves, there has been a slight increase in graphitized carburant orders. However, price increases are constrained in the short term due to the proximity to cost prices and the difficulty of further price reductions. Thus, the graphitized carburant prices remain steady.

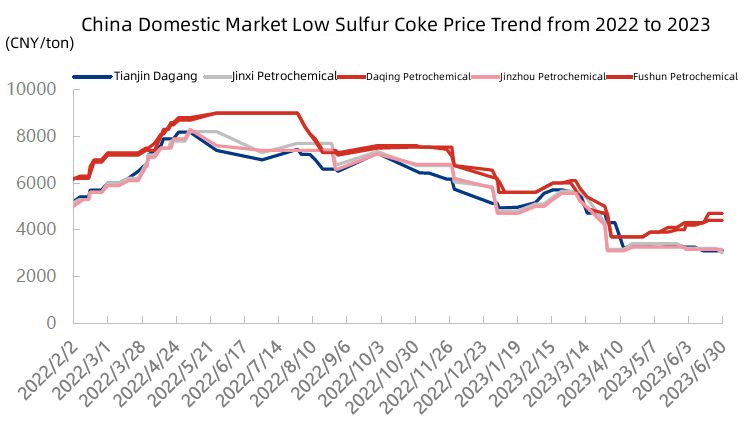

In the first half of 2023, the domestic low-sulfur petroleum coke market experienced fluctuations in prices. After the Spring Festival, downstream graphite cathode and graphite electrode sectors actively stocked up, leading to increased shipments from calcined coke enterprises and supporting the petroleum coke market, with prices rising between 500 to 850 CNY/ton. However, since March, the market trading has slowed down as the stocking period ended, coupled with continuous imports of petroleum coke, resulting in sufficient domestic supply and weakening downstream purchasing enthusiasm. As a result, low-sulfur coke prices experienced a significant drop in early April, hitting the lowest point in the first half of the year. However, in May, with the arrival of the peak period for delayed coking unit maintenance in some domestic regions, such as Taizhou, Huizhou, and Daqing, the supply-demand imbalance of low-sulfur coke has eased, and coupled with downstream restocking demand, there was a slight rebound in low-sulfur coke prices.

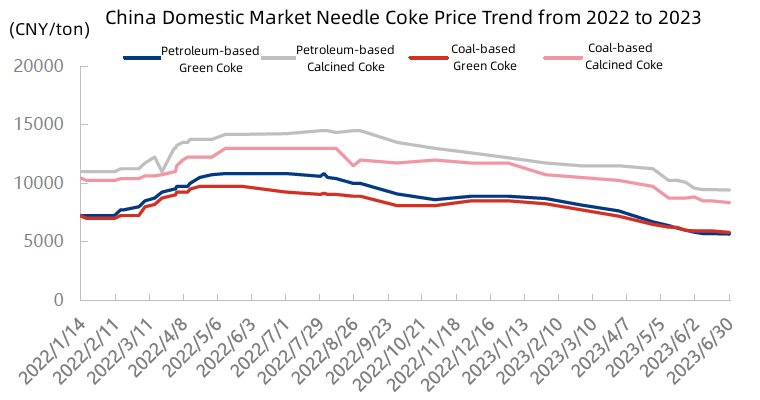

In the first half of 2023, the overall trend in the needle coke market showed a downward trend. The average price of coal-based raw needle coke was 7,153 CNY/ton, down by 14.6% compared to the same period last year, and the average price of oil-based raw needle coke was 7,171 CNY/ton, down by 20.9% compared to the same period last year. As for calcined needle coke, the average price was 10,036 CNY/ton, down by 9.9% year-on-year, and for oil-based calcined needle coke, the average price was 10,896 CNY/ton, down by 15.5% year-on-year. The downward trend in needle coke prices during the first half of the year is mainly due to weak end-user demand. At the end of 2022, battery manufacturers, including negative electrode material suppliers, were overly optimistic about demand prospects, resulting in a large accumulation of semi-finished and finished products in inventory. As a result, the demand for needle coke in the new energy supply chain decreased significantly during the first half of this year. Additionally, the downstream graphite electrode sector also performed poorly, with arc furnace steel mills operating at a loss since April, and combined with the slow recovery in the steel industry's demand, the production of graphite electrodes remained sluggish, leading to cautious raw material procurement. Therefore, the entire needle coke market in the first half of the year faced pressure from oversupply, resulting in continuous price suppression. For more information on the artificial graphite market, feel free to communicate with us.

No related results found

0 Replies