【Petroleum Coke】Market Fully Rebounds, Prices Steadily Rise

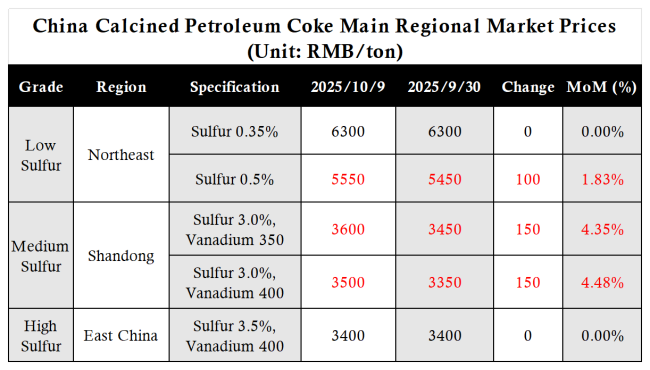

Calcined petroleum coke, with its high carbon content, low sulfur, and low impurities, plays a vital role in modern manufacturing, especially in the aluminum and steel industries.

【Petroleum Coke】Market Fully Rebounds, Prices Steadily Rise

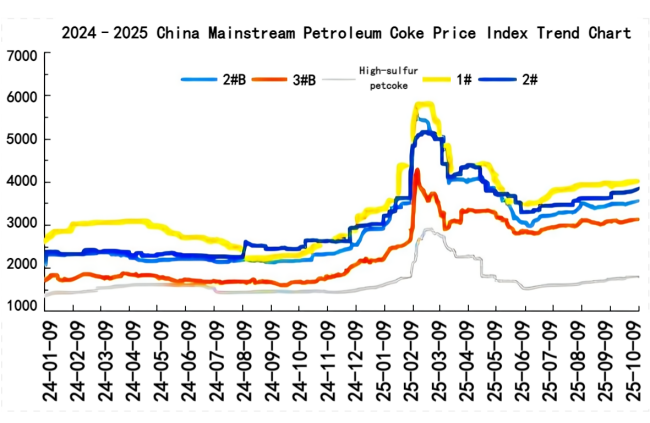

China Petroleum Coke Index Analysis

According to data estimates, on October 9, China's mainstream petroleum coke 2#B index was 3568.33, up 43.33 from the previous working day; the 3#B price index was 3140.0, up 16.67; the high-sulfur coke market index was 1807.5; 1# price index was 4030, up 30; 2# price index was 3858.5, up 83.5 compared to the previous working day.

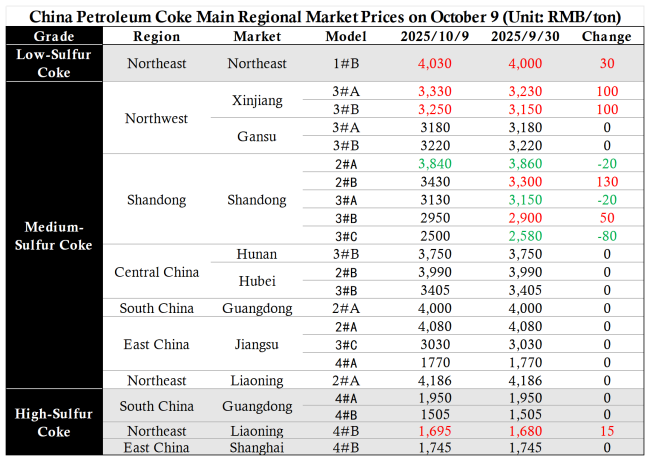

China Petroleum Coke Main Regional Market Prices

During the National Day holiday, trading sentiment in the petroleum coke market was active, with good sales performance in the local refinery market. Overall, prices mostly rose with few declines. After the holiday, today the domestic petroleum coke market showed mainstream coke prices trending strong, with a moderate trading atmosphere. Local refineries mainly focused on active sales, with mixed price movements. In Shandong, active sales dominated, with coke prices both up and down: 2#A, 3#A, 3#C were quoted at 2,500–3,840 CNY/ton, down 20–80 CNY/ton from the previous working day; 2#B, 3#B were quoted at 2,950–3,430 CNY/ton, up 20–120 CNY/ton. In East China, Shanghai 4B was quoted at 1,745 CNY/ton, with most market participants maintaining a stable mindset. Refinery sales were good, with downstream just-in-time purchases dominating. In Northeast China, trading was moderate, with 1# coke quoted at 4,030 CNY/ton, up 30 CNY/ton from the previous working day.

Outlook

Recently, trading in the local refinery market has been active, and refinery transaction prices continue to rise. On the supply side, port unloading operations remain stable, and spot inventories continue to decline. Domestic coke production has slightly increased compared to pre-holiday levels but remains at a low level. On the demand side, the carbon market is mainly driven by just-in-time purchases, with some companies actively restocking after the holiday, providing solid support for raw material shipments; the anode material market is cautious in procurement, keeping raw material purchasing sentiment relatively stable. In the short term, the petroleum coke market is expected to remain broadly stable, with some regions of sulfur coke having upward potential. Future developments need attention to in-plant operations and downstream demand follow-up.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies