【India Petroleum Coke】Market Under Pressure, Demand Weak

Calcined petroleum coke, with its high carbon content, low sulfur, and low impurities, plays a vital role in modern manufacturing, especially in the aluminum and steel industries.

【India Petroleum Coke】Market Under Pressure, Demand Weak

Indian buyers resist high-priced offers; cement industry demand remains sluggish

High-price petroleum coke drives the market toward cheaper thermal coal

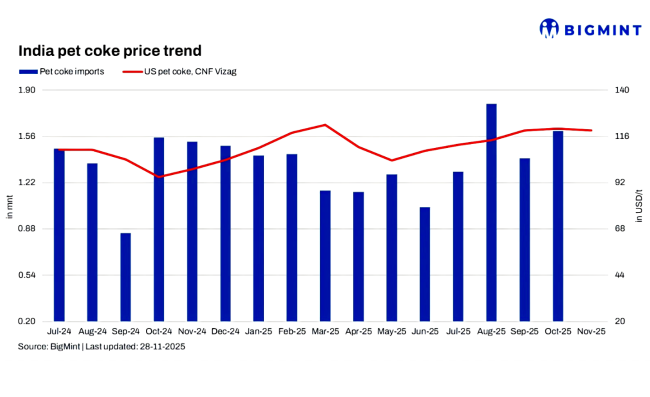

India Petroleum Coke Price Trend: U.S. Petcoke, Visakhapatnam Port CNF

This week faced downward price pressure with limited trade activity. The core issue is the severe standoff between buyers and sellers: suppliers raised offers driven by recovering Chinese demand and rising freight rates, while Indian buyers—facing weak domestic demand—firmly rejected them and turned to cheaper alternatives such as high-calorific-value thermal coal. India's CFR price fell to USD 115.50/ton, down USD 1.50/ton week-on-week.

Price and Market Trends

Market sentiment: Buyer-dominant (bearish). Large bid–offer gaps result in stalled trading

Demand: Indian cement plants operate at only 70%–75% capacity, demand weak, worsened by sellers' high offer levels

Alternative fuels: Buyers actively procure South African and U.S. Appalachian NAPP high-calorific-value thermal coal as cheaper substitutes.

U.S. NAPP coal at Kandla/Tuna ports: 9,875 INR + GST, equivalent to USD 102–103/ton CFR

New offers for U.S. NAPP coal: USD 112–113/ton CFR, while buyers bid USD 108–109/ton CFR

Trading activity: No confirmed deals in the Indian market this week

Price gap: The bid–offer spread remained around USD 6–9/ton throughout the week, preventing transactions

Offer range: Buyers bid USD 110–117/ton, sellers maintain USD 117–121/ton

Market Drivers

Weak cement industry: Post-monsoon construction recovery fell short of expectations; demand remains depressed; cement plant operating rates far below capacity

Buyer resistance: Indian buyers reject high-priced offers, delay procurement, and expect future price declines

Fuel switching: Elevated petroleum coke prices make South African high-GCV coal and U.S. NAPP coal more economical for cement and other industries

Chinese competition: Surging Chinese demand for U.S. petcoke, with Chinese buyers bidding higher than India, is a key factor pushing seller offers

Freight increase: U.S. Gulf Coast to India East Coast freight rose for the third consecutive week to USD 47.50/ton, increasing landed cost

Domestic supply: India's domestic petcoke output remains stable, reducing urgency for imports

Market Outlook

Market participants expect demand to improve in the coming weeks, as January–March is traditionally the peak season for the construction industry. But to conclude deals, either Indian buyers must raise their bids or global pressures must ease to allow sellers to reduce prices. Increased supply after Saudi refineries resume operations may also help rebalance the market.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies