【Petroleum Coke】2025 Market Review and 2026 Market Outlook

Calcined petroleum coke, with its high carbon content, low sulfur, and low impurities, plays a vital role in modern manufacturing, especially in the aluminum and steel industries.

【Petroleum Coke】2025 Market Review and 2026 Market Outlook

Market Overview

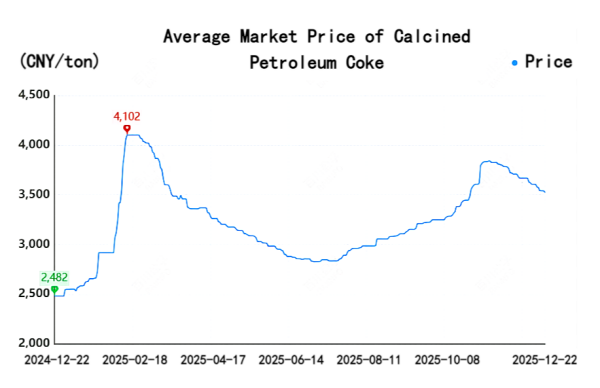

In 2025, the petroleum coke market experienced significant volatility. Changes in the supply–demand balance caused sharp price fluctuations, forming an "M-shaped" trend of rise – fall – rebound.

In the early stage, supply was lower than demand, pushing prices upward. As arrivals increased and prices began to fall, the earlier price surge combined with expectations of tariff increases triggered a surge in petroleum coke imports, reversing the supply–demand balance and dragging prices downward. In the second half of the year, demand recovered slowly, while refinery maintenance increased, leading prices to rebound gradually.

Overall supply performance in 2025 was mixed. On one hand, domestic refinery maintenance and production cuts increased, and total petroleum coke output in 2025 fell 6.49% year-on-year. On the other hand, affected by tariffs and market conditions, port inventories remained relatively high. From January to November, total imports reached 13.9916 million tons, up 15.75% year-on-year. Downstream demand performed well: carbon materials, as a traditional downstream sector, provided a solid base of demand, while anode material orders continued to grow from the beginning of the year. Coal supply remained high and prices stayed weak, offering limited support to the coke market. Demand for high-sulfur fuel coke weakened. Affected by tariffs, shot coke costs increased and prices rose actively.

Key Market Influencing Factors

In 2025, no new delayed coking units were added, while domestic refinery maintenance increased. By December, 74 maintenance events had occurred, leading to a year-on-year decline in total output. Besides routine maintenance, some major refineries reduced production due to marine fuel production or feedstock restrictions, tightening low-sulfur coke supply. Due to Sinopec feedstock adjustments, part of high-sulfur coke output was converted into medium-sulfur coke, causing uneven changes in medium- and high-sulfur supply. Local refineries also reduced output due to poor profitability and feedstock shortages.

Port inventories remained low at the beginning of the year and reached an annual low in March before starting to accumulate. At the same time, overseas low-sulfur coke faced maintenance or transportation issues, limiting arrivals to Chinese ports and keeping inventories low. Combined with reduced domestic refinery supply and aggressive downstream stockpiling, overseas tender prices for low-sulfur sponge coke surged, and domestic prices followed rapidly.

As prices rose sharply, high-priced port inventories were gradually released. After downstream users completed their stockpiling, they could not accept high prices, leading to a wait-and-see attitude and reduced purchasing, which caused prices to fall. Meanwhile, supply of high-sulfur coke declined, allowing prices to follow the rebound.

From the third quarter, some domestic low-sulfur coke refineries entered maintenance. Meanwhile, downstream anode material and steel carbon producers increased procurement, driving prices higher. Medium- and high-sulfur coke and imports followed. Some local refineries adjusted prices due to quota changes or shipment rhythms, but overall average prices were higher than in Q2, though upside was limited by downstream affordability.

By mid-to-late November, anode material producers controlled year-end inventories and reduced purchasing. Although major anode material producers maintained full production and rigid demand for petroleum coke, inventory pressure from the battery sector was transmitted upstream, limiting acceptance of high-priced raw materials. Purchases became cautious, mainly in small and frequent lots. Support for low- and medium-sulfur coke weakened and prices softened.

Since Q1, both China and the US introduced multiple industrial and trade policies. US mid- and high-sulfur shot coke imports surged in Q2 due to earlier price rises and tariffs, rapidly increasing port inventories. Combined with weak coal markets and poor non-carbon downstream demand, shipments of high-sulfur shot coke were under pressure. In Q3, silicon producers restocked, inventories were drawn down, and favorable tariff news boosted US coke trading and spot prices.

Price Performance

In 2025, China's petroleum coke prices followed a "rise – fall – rise" pattern.

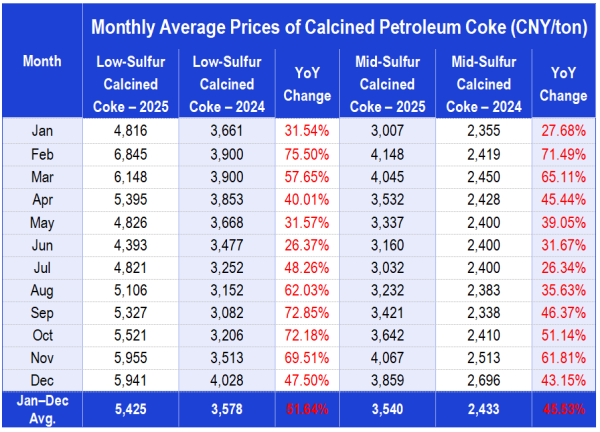

Main price ranges in 2025:

Low-sulfur coke (S ≤ 1.0%): 2,920 – 6,000 CNY/ton

Medium-sulfur coke (around 3.0% S, V ≤ 400): 2,150 – 3,760 CNY/ton

High-sulfur coke (around 3.5% S, V > 400): 1,350 – 2,973 CNY/ton

High-sulfur coke (around 5.0% S, V > 600): 1,103 – 2,530 CNY/ton

Sponge Coke

1. Low-Sulfur Petroleum Coke

In 2025, the low-sulfur petroleum coke market experienced significant volatility, showing a pattern of sharp rise – volatile decline – steady mild rebound, with prices up 710–950 CNY/ton compared with the start of the year.

At the beginning of the year, refinery maintenance reduced supply, port inventories were low, and downstream anode and carbon producers accelerated stockpiling, pushing prices to yearly highs. From March, arrivals increased and domestic output recovered, while downstream stockpiling ended, sending prices into decline. By mid-year, prices fell to psychological support levels. Later, anode material replenishment, overseas energy storage orders, strong domestic power demand, and steady carbon demand lifted prices slightly.

From January to February, refinery maintenance and limited imports tightened supply, driving strong price increases. From March, high prices caused buyers to slow purchases, inventories built up, and prices fell. In April, refinery maintenance provided short-term support, but imports arrived and prices continued to weaken. In the second half, downstream inventories fell, boosting purchases and lifting prices. By November, downstream inventory control and high prices led to cautious buying and price pullbacks.

In 2025, six domestic low-sulfur producers conducted maintenance, involving 8.3 million tons/year of capacity. Imports from Brazil and Argentina increased from April, raising port inventories. Overall, supply shifted from tight to loose.

2. Medium- and High-Sulfur Petroleum Coke

The medium- and high-sulfur market showed an M-shaped trend, with price fluctuations of 70–1,130 CNY/ton.

Early in the year, refinery shutdowns and restocking lifted prices. From mid-February, high prices reduced buying, leading to declines. In April–May, weak demand kept prices falling. From mid-June, prices rebounded on low-sulfur price increases and better shipments. Q3 maintenance supported supply. By mid-November, cautious buying caused prices to fall again, with limited rebound potential.

Shot Coke

Weak southern fuel demand and soft coal prices limited power plant use. Cement and fertilizer bought only on rigid demand. High-sulfur shot coke inventories took time to digest after heavy arrivals, and tariff changes limited market scale.

Supply

In 2025, China produced 30.0259 million tons of petroleum coke, down 6.49% year-on-year, with external sales of 25.5005 million tons.

The decline was due to maintenance, marine fuel production, feedstock adjustments, high-sulfur to medium-sulfur conversion, local refinery reductions, frequent quality fluctuations, and production shifts to needle coke. October feedstock shortages further reduced output.

Imports in 2025 are estimated at 14.9 million tons, up 11.2%. January–November imports reached 13.9916 million tons, up 12.69%.

Early 2025 imports were stable, but February price and tariff hikes drove US imports higher, with heavy arrivals in April–May. Imports eased in mid-year due to losses, then recovered later with policy changes and strong spot prices.

Demand

Downstream carbon demand rose slightly, while non-carbon demand weakened, reducing total demand.

Sponge coke demand in 2025 is estimated at 45.95 million tons, down 3.03%.

Electrolytic aluminum prices ranged 19,530–24,150 CNY/ton, peaking in November. Aluminum production remained high, supporting coke demand.

Calcined petroleum coke and anode markets were stable. Anode material plants adjusted production early in the year but ramped up in Q3–Q4 with strong terminal demand, supporting coke prices.

Graphite electrode production remained stable with limited purchasing. Silicon metal production rose in September, increasing coke demand in Q3.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies