【Ministry of Commerce】Strengthening Export Controls on Dual-Use Items to Japan: ...

The rapid growth of the EV and energy storage industries is boosting demand for high-performance lithium batteries, driving the market for quality petroleum coke and synthetic graphite. The quality and particle size of calcined petroleum coke directly affect synthetic graphite performance, especially in anode production.

【Ministry of Commerce】Strengthening Export Controls on Dual-Use Items to Japan: Impacts on the Anode Materials Market

On January 6, 2026, the Ministry of Commerce issued Export Control Announcement No. 1 of this year. In accordance with the relevant provisions of the Export Control Law of the People's Republic of China and other laws and regulations, in order to safeguard national security and interests and fulfill international non-proliferation obligations, it decided to strengthen export controls on dual-use items to Japan.

I. Specific Announced Measures Are as Follows:

The export of all dual-use items to Japanese military users, military end-uses, and any other end-users or end-uses that contribute to the enhancement of Japan's military capabilities is prohibited.

Any organizations or individuals from any country or region that violate the above provisions by transferring or providing dual-use items originating from the People's Republic of China to Japanese organizations or individuals shall be held legally liable in accordance with the law.

This announcement shall come into formal effect as of the date of its release, January 6, 2026.

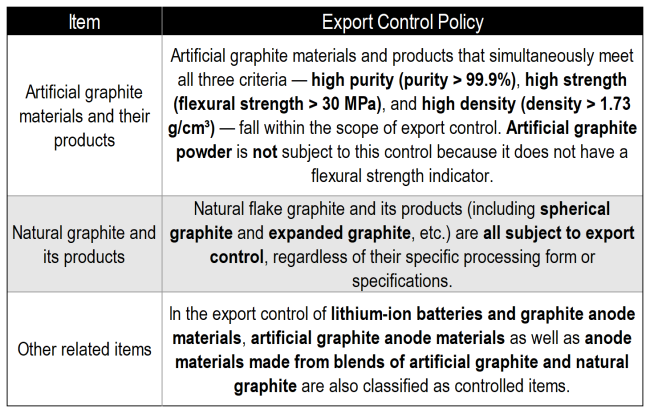

According to the relevant announcements issued on December 31, 2025 by the Ministry of Commerce and the General Administration of Customs, graphite products among the dual-use items subject to export control mainly include the following categories:

II. 2025 Export Analysis of Artificial Graphite and Flake Graphite

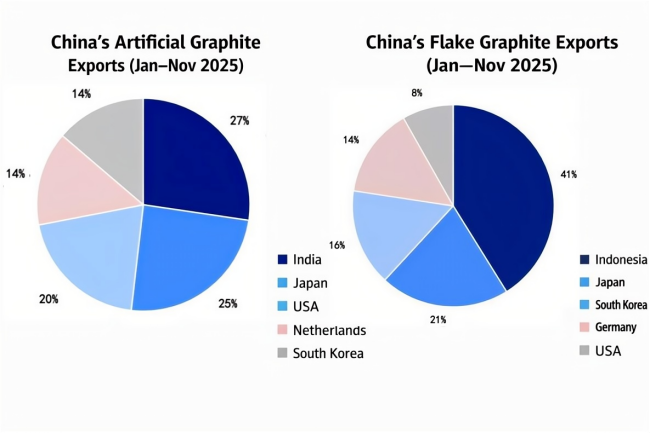

Figure Share of China's Main Export Destinations for Artificial Graphite & Flake Graphite, January–November 2025

Data source: Oilchem

For artificial graphite, the main export destinations from January to November 2025 were India, Japan, the United States, the Netherlands, and South Korea, among which exports to Japan accounted for 25%.

For flake graphite, the main export destinations from January to November 2025 were Indonesia, Japan, South Korea, Germany, and the United States, among which exports to Japan accounted for 21%.

III. Impacts of Export Controls on Artificial Graphite Exports to Japan

Under the export control policy, artificial graphite materials with purity exceeding 99.9%, flexural strength exceeding 30 MPa, and density exceeding 1.73 g/cm³ are subject to licensing management and may not be exported without approval. These items are mainly used in high-end lithium batteries, aerospace, and other advanced fields rather than ordinary industrial applications. Therefore, the policy focuses on preventing strategic risks rather than imposing a comprehensive export ban.

The impact on Chinese enterprises is mainly reflected in the following aspects:

Short-term operational challenges:

The complexity of export procedures will increase. Enterprises must apply for export licenses, and the approval cycle may be extended, leading to delivery delays or higher compliance costs. Small and medium-sized enterprises with limited export experience will be more heavily affected, while leading enterprises with mature compliance systems will be less impacted.

Globalization strategy to hedge risks:

Enterprises that have already established overseas production capacity can directly serve local markets and avoid export restrictions. Such localized supply chains can also reduce transportation costs and improve overall resilience.

Indirect impact on Japan and the global supply chain:

As an important importer of Chinese graphite (with 93.7% of its graphite materials dependent on China), Japan will face short-term supply shortages and rising costs, which may affect its new energy vehicle and related industries.

Feel free to contact us anytime for more information about the Anode Material market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies