【Anode Materials】Key Factors Driving Changes in Anode Material Demand in 2025

The rapid growth of the EV and energy storage industries is boosting demand for high-performance lithium batteries, driving the market for quality petroleum coke and synthetic graphite. The quality and particle size of calcined petroleum coke directly affect synthetic graphite performance, especially in anode production.

【Anode Materials】Key Factors Driving Changes in Anode Material Demand in 2025

In 2025, anode material output is expected to grow by 37% year on year. The expansion of the anode material market is primarily driven by downstream demand. During different periods in 2025, demand on the anode market side is stimulated by different policy factors.

I. Increased Tariffs on China Lead to an "Off-Season That Is Not Weak"

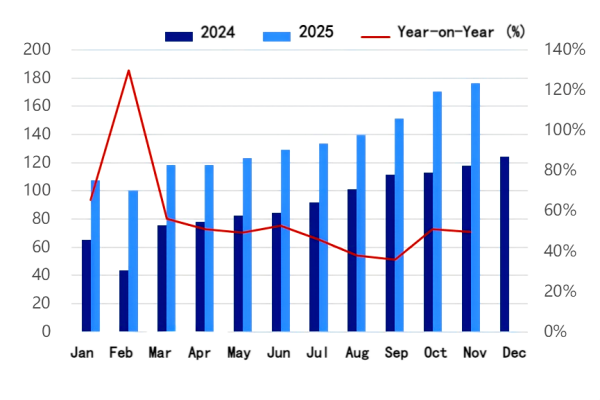

Figure 1: Comparison of Monthly Output of Power and Other Batteries, 2024–2025 (GWh)

Data source: Oilchem

From January to November, the monthly output of power and other lithium batteries reached 1,468.8 GWh, representing a year-on-year increase of 52.2%. In terms of monthly growth rates throughout the year, the year-on-year growth from January to March was at the highest level of the year, and the anode material market exhibited a clear "off-season that is not weak" pattern. This was mainly influenced by tariff increases. As a new U.S. president was set to take office in April and planned to raise tariffs on Chinese products, downstream lithium battery manufacturers placed orders in advance. As a result, anode material demand increased significantly year on year as early as the first quarter.

II. Impact of Document No. 136 on the Energy Storage Market

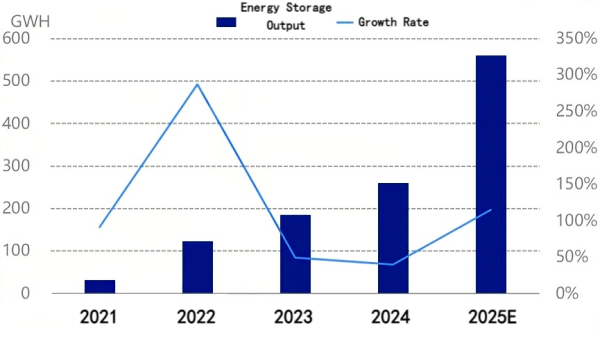

Figure 2: Energy Storage Battery Output, 2021–2025 (GWh)

Data source: Oilchem

In 2025, China's energy storage battery output is forecast to reach approximately 560 GWh, with a year-on-year growth rate as high as 115%. This marks the fastest growth year in the past five years, second only to the energy storage market boom in 2022. The issuance of Document No. 136 clearly states that full electricity generated by new energy sources should be integrated into the market, with on-grid electricity prices fully determined by the market mechanism. It also stipulates that no unreasonable costs should be allocated to new energy sources, that energy storage should not be set as a prerequisite for project approval, grid connection, or power dispatch of new energy projects, and that mandatory energy storage configuration should not be imposed. As a result, the energy storage market has shifted from policy-driven to market-driven development. This transition promotes the transformation of energy storage from an auxiliary facility into an independent profit-generating entity, forcing the industry to build market-oriented survival capabilities.

III. Halved Purchase Tax Policy for New Energy Vehicles

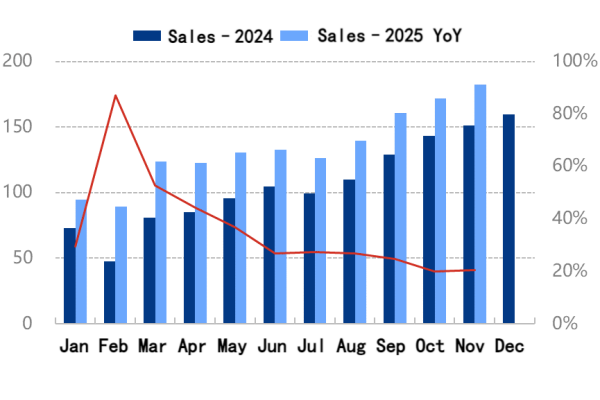

Figure 3: New Energy Vehicle Sales in 2025 (10,000 units)

Data source: Oilchem

According to the Ministry of Finance's Announcement on the Continuation and Optimization of the Purchase Tax Reduction and Exemption Policy for New Energy Vehicles, new energy vehicles purchased between January 1, 2024 and December 31, 2025 are exempt from vehicle purchase tax, with a maximum tax exemption of RMB 30,000 per new energy passenger vehicle. For vehicles purchased between January 1, 2026 and December 31, 2027, the vehicle purchase tax will be levied at half the standard rate, with a maximum tax reduction of RMB 15,000 per vehicle. Taking a vehicle priced at RMB 300,000 as an example, the original payable tax would be RMB 30,000. Before 2026, this amount can be fully exempted, while after the policy is halved in 2026, only RMB 15,000 can be exempted. Therefore, before the purchase tax policy expires in 2025, new energy vehicle sales are expected to increase significantly. From January to November 2025, total new energy vehicle sales reached 14.734 million units, up 31.67% year on year. The boost in end-user demand has effectively driven demand in the anode material market.

IV. Graphite Export Controls as a Countermeasure

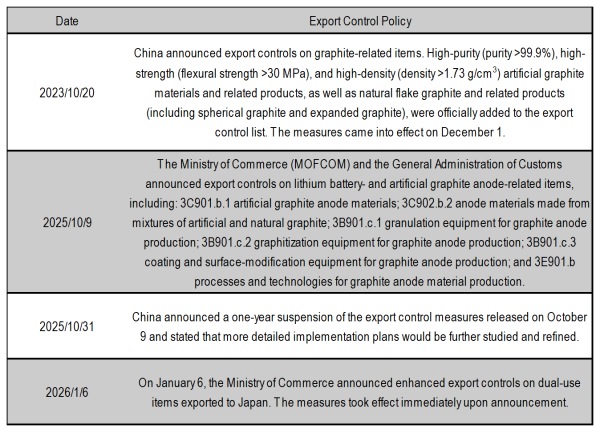

Table: China's Export Control Policies on Graphite Products

Data source: Oilchem

Since 2023, China has implemented export controls on graphite products multiple times. The controlled items are mainly used in high-end lithium batteries, aerospace, and other advanced fields, rather than in ordinary industrial applications. The focus is on preventing strategic risks rather than imposing a comprehensive export ban. At the same time, graphite control measures also serve as a form of countermeasure by China. More than 99% of global battery-grade spherical graphite is produced in China, and overseas dependence on Chinese graphite is high. The European Union has launched an anti-subsidy investigation into Chinese new energy vehicles, and the United States has tightened restrictions on China's semiconductor industry. As a key player in the global graphite industry, China's implementation of export controls on graphite, a critical raw material for many strategic emerging industries and an essential component of new energy batteries, represents a countermeasure toward Europe and the United States. In the short term, these measures may affect the export volume of graphite products to some extent. However, since most of China's graphite products are absorbed by domestic demand, the overall impact of the control measures on total anode material demand is relatively limited.

Feel free to contact us anytime for more information about the Anode Material market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies