【Graphitization】Average Price Slips 2% MoM in June, with Potential for Further Decline

【Graphitization】Average Price Slips 2% MoM in June, with Potential for Further Decline

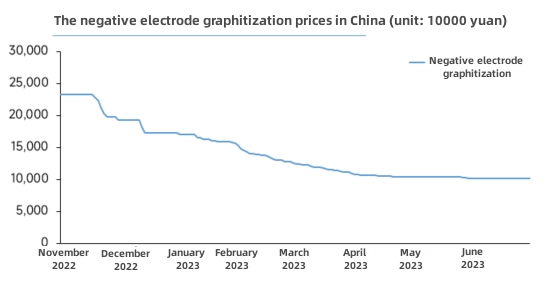

In June, the average monthly price of graphitization was 10,150 RMB/ton, down 2% compared to the previous month and 63% year on year.

Source: SMM

Although some manufacturers increased their quotations this month, the actual transaction prices remained weak due to the current supply-demand imbalance.

Demand-side: In recent years, the release of graphitization capacity and the improved economics of artificial graphite have led to an increased share of artificial graphite applications. Terminal demand for artificial graphite steadily recovers this month, and due to the anticipation of power restrictions in the main graphitization production areas in July and August, some negative electrode manufacturers have started early stocking. Overall, there has been a slight increase in graphitization demand this month.

Supply-side: In June, the independent monthly capacity of graphitization was 43,600 tons, and the supporting monthly capacity was 155,500 tons, bringing the total graphitization capacity to 199,000 tons. It is expected that in July, the independent monthly capacity of graphitization will be 43,600 tons, and the supporting monthly capacity will be 165,900 tons, resulting in a total graphitization capacity of 209,500 tons.

The current supply-demand mismatch of artificial graphite has triggered a new round of price decline in the industry. For integrated negative electrode manufacturers, increasing the proportion of self-supplied graphitization is crucial for cost reduction. Meanwhile, for some new entrants in the negative electrode market, prioritizing the release of graphitization capacity through contract manufacturing becomes the preferred option. Therefore, from the perspective of new capacity structure, supporting graphitization capacity is still on the rise. In contrast, independent graphitization enterprises have slowed down their expansion pace due to the low prices of contract manufacturing in the previous period, but this month, graphitization production has seen a slight increase due to downstream demand recovery and some manufacturers' early stocking.

Price forecast: Demand-side is still steadily recovering, while on the supply side, although the main production areas in July and August are subject to power restrictions, graphitization capacity is still being released. Moreover, the current market's newly added demand is unlikely to absorb existing capacity. Additionally, some negative electrode manufacturers have accumulated semi-finished graphitization stocks, leading to limited impact on graphitization supply from the power restrictions.

In the context of reducing costs at the terminal, negative electrode manufacturers continue to transmit cost pressures upstream. Combined with ample supply capacity, it is expected that graphitization prices may continue to experience weakness in the future. Any inquriies about the graphitization market, feel free to contact us.

No related results found

0 Replies