【Petroleum Coke】Prices Fluctuate and Rise in Transactions

【Petroleum Coke】Prices Fluctuate and Rise in Transactions

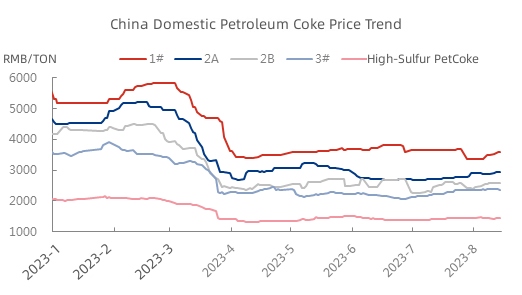

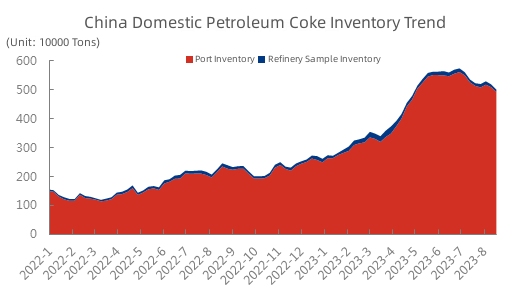

Since August, China domestic petroleum coke market has seen overall robust trading. Stable procurement attitudes downstream have led to a rapid depletion of petroleum coke stocks in refineries and ports, causing transaction prices to fluctuate and rise. The market is now more than halfway through the third quarter. What trends will petroleum coke and graphitized petcoke (GPC) prices take next in response to changing market supply and demand?

Recently, the mainstream domestic petroleum coke market has witnessed a positive trading atmosphere. Strong initial demand from downstream enterprises has bolstered the market, resulting in an upward trend in prices for petroleum coke in some refineries.

According to market data and statistical analysis, the average price of low-sulfur petroleum coke in China is 3257 yuan/ton, representing a 2.2% increase compared to the previous period. Demand in the negative electrode material market has performed well, and graphite electrode manufacturers have shown increased willingness to procure, benefiting the shipment volume from oil refineries owned by PetroChina. As some refineries are undergoing production cuts, the overall shipment performance for low-sulfur coke from China National Offshore Oil Corporation (CNOOC) remains stable. The entry of carbon enterprises into the market for inquiries has driven the fluctuation and rise of refinery coke prices.

The market price of medium-sulfur petroleum coke continues to climb to 2463 yuan/ton, marking a 103 yuan/ton or 4.36% increase compared to the previous period. Due to adjustments in raw material specifications and the continuous increase in sulfur content in petroleum coke, some regional refineries in Shandong have switched to producing shot coke, leading to a reduction in supply in the medium-sulfur petroleum coke market. Some PetroChina refineries along the Yangtze River have well-performing petroleum coke indicators, motivating negative electrode manufacturers to purchase actively and thus sustaining a continuous rise in the price of medium-sulfur petroleum coke along the Yangtze River.

The market for high-sulfur petroleum coke has remained relatively stable with minor fluctuations. Major refining plants have enjoyed good production and sales of petroleum coke, resulting in a slight upward trend in some coke prices. In contrast, the shipment pace in regional refineries has slowed down. With cautious attitudes among general-purpose calcined coke manufacturers, and active refinery shipments pushing the sales volume, some coke prices have experienced a slight decline.

Market Outlook:

Due to frequent changes in petroleum coke raw material specifications, it is anticipated that the supply of medium and low-sulfur petroleum coke may decrease, while the proportion of high-sulfur general-purpose coke supply continues to rise. Although domestic demand remains robust, downstream enterprises and traders are approaching the market with caution. Additionally, the advantages of some imported petroleum coke over domestic resources are evident, which could put downward pressure on the prices of certain domestic general-purpose coke.

The petroleum coke market is primarily characterized by consolidation. Guided by dual influences of supply and demand, domestic refinery coke prices are expected to experience minor and moderate fluctuations. Petroleum coke shipments from ports remain strong, and there remains a possibility of slight upward movement in some coke prices. Contact us to learn about the market price trend of graphitized petcoke.

No related results found

0 Replies