【 Import/Export 】Graphite imports surged in October, export controls stimulated overseas inventories

【Import & Export】Surge in Graphite Imports in October,

Export Controls to Accelerate Overseas Stockpiling

1. Import and Export Data

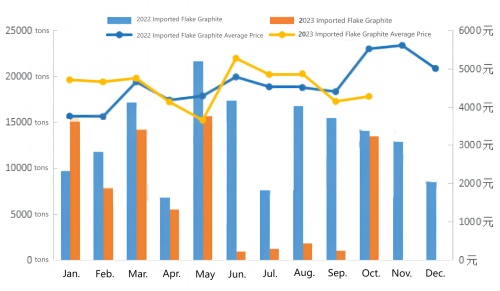

According to the latest customs data, in October 2023, China imported 13,500 tons of flake graphite, a 4.08% YoY decrease but a 1160.16% MoM increase. Specifically, imports from Madagascar were 3,409 tons, and from Mozambique were 10,067 tons. Please refer to the Semi-graphitized petroleum coke specifications.

With the resumption of production at Mozambique's Balama graphite project and domestic production areas gradually entering the winter shutdown rhythm, there was a significant MoM increase in graphite imports, and the import average price remained stable.

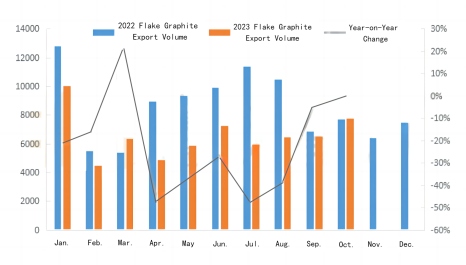

In October 2023, natural flake graphite exports were 7,760 tons, a 0.65% YoY increase and a 19.12% MoM increase. The top three exporting countries were South Korea, India, and Japan.

In late October, the Ministry of Commerce issued a notice on optimizing and adjusting temporary export control measures for graphite items. This move may accelerate the pace of overseas manufacturers stocking up, and a significant increase in graphite exports is expected in November.

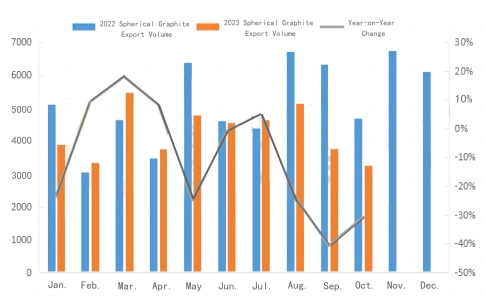

The export of spherical graphite in October was 3,262 tons, a 30.85% YoY decrease and a 12.79% MoM decrease. The United States, Japan, and South Korea still occupy the major share of exports, with an average export price of about 20,700 CNY/ton, with little change MoM.

Affected by expectations of reduced raw material supply, overseas companies gradually entered the winter stock-up period. Coupled with the introduction of export control measures, it is expected that there will be an increase in spherical graphite exports in November.

2. China Domestic Market Overview

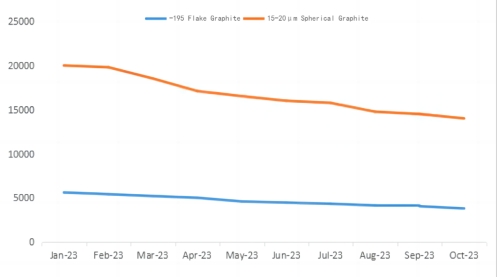

In October, the flake graphite market overall remained weak. Flotation lines in Jixi and Luobei maintained normal production. The Minmetals Group's graphite beneficiation project has officially started, but due to the shrinking downstream demand, most manufacturers' production enthusiasm is not high.

In recent weeks, various places in Heilongjiang have experienced snowfall, leading to a slight reduction in production output by manufacturing companies and a noticeable increase in transportation time. With a significant decrease in downstream stocking demand compared to last year, spherical graphite enterprises maintain cautious procurement. The refractory material market sentiment remains relatively low, and it is expected that some enterprises will gradually enter the winter shutdown period.

On the other hand, the operating rate of domestic spherical graphite production enterprises is still hovering at a medium to low level, mainly focusing on executing contract orders. Due to the impact of the policy restricting graphite exports, some enterprises have seen an increase in orders this month. However, downstream negative electrode material enterprises have strong demands for price reductions, putting pressure on spherical graphite enterprises' costs, and the price center is approaching the bottom. Any inquiries about graphitized products, feel free to contact us.

No related results found

0 Replies