【Low-sulfur Calcined Petroleum Coke】How's the Trend at the Beginning of the New Year?

【Low-sulfur Calcined Petroleum Coke】How's the Trend

at the Beginning of the New Year?

2023 has come to an end, and with the beginning of the new year, the low-sulfur calcined petroleum coke carburant (CPC) raw material market, influenced by processing technology, has seen a reduction in market supply. With the potential for a decrease in the supply of low-sulfur coke and an impact on prices, is there an expectation for the low-sulfur CPC market prices to rise again?

Data Source: Oilchem

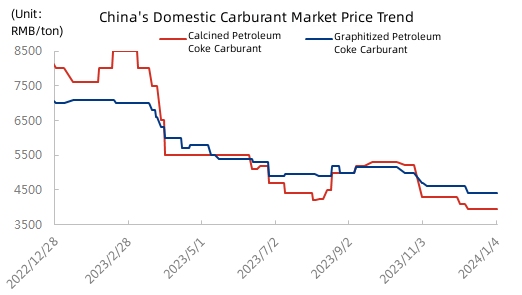

In terms of prices: As of the time of writing, the market price of low-sulfur CPC is 3950 yuan/ton, a decrease of 50 yuan/ton or 1.25% compared to the previous period; a decrease of 4050 yuan/ton or 50.63% compared to the same period last year. The price of raw material low-sulfur coke in the market remains at a high level in the first quarter due to market stocking on the demand side, but starting from the second quarter, the market price of petroleum coke gradually returns to rationality, continuously undergoing adjustments. The price of low-sulfur CPC also gradually approaches the mainstream market price until now, alternating with the market price of graphitized petroleum coke carburant (GPC).

Data Source: Oilchem

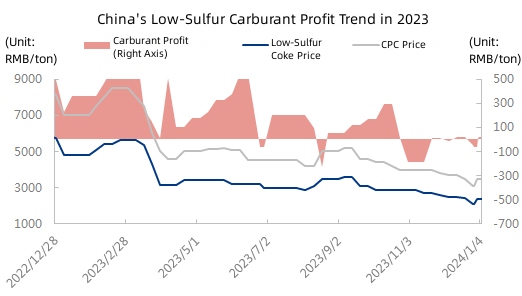

In terms of profits: According to data statistics, the theoretical profit of the low-sulfur CPC market is 20 yuan/ton, an increase of 80 yuan/ton or 133% compared to the previous period; a decrease of 340 yuan/ton or 94.4% compared to the same period last year.

Data Source: Oilchem

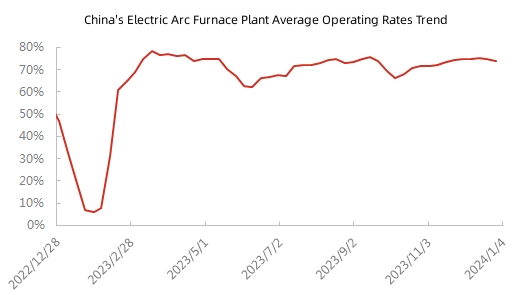

In terms of demand: China's independent electric arc furnace (EAF) startup rate and capacity utilization rate have slightly decreased. Currently, most EAF steel mills are still in a profitable state, so some choose to increase production, slightly increasing the working hours. The recent weather conditions have intensified, causing some steel mills in certain regions to reduce working hours for environmental reasons. Based on the recent situation, the startup rate and capacity utilization rate of independent EAF plants may continue to decline.

Overall, with demand fluctuations and poor profitability in the low-sulfur carburant market, coupled with potential upward expectations in raw material prices, it is expected that the market for low-sulfur CPC may have a narrow upward trend. More market analysis on calcined coke in 2024, feel free to communicate with us at any time.

No related results found

0 Replies