Explanation of needle coke consumption structure and price trend

Explanation of needle coke consumption structure and price trend

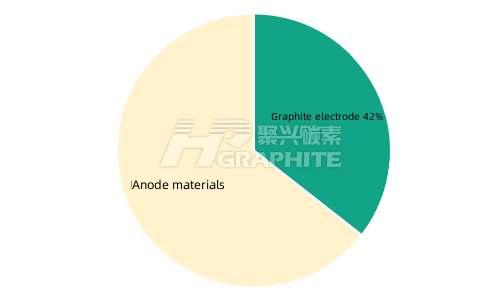

Downstream consumption structure

The first half of 2022

China's needle coke downstream demand structure

Mainly made of graphite electrode and anode material

Proportion:

Anode material 58%

Graphite electrode 42%

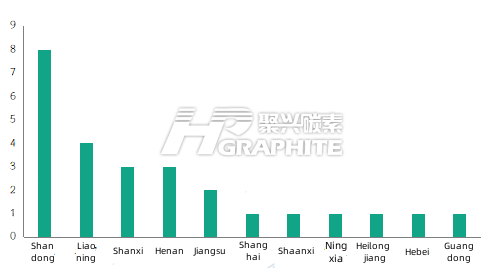

Enterprise distribution:

The first half of 2022

China's needle coke manufacturers distribution

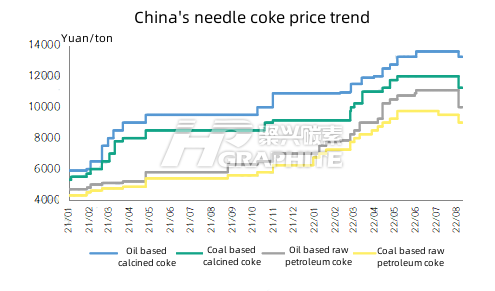

Market price

China's needle coke price trend

Recent market analysis

01. Supply aspect

Needle coke market production operation maintain a medium level, and the coal based and oil based needle coke continued to differentiate.

In July 2022, needle coke market operating rate was 58.99%, down 6.63% month-on-month, including 63.16% for oil based needle coke and 42.00% for coal based needle coke.

In July 2022, needle coke output was 122,000 tons, including 39,000 tons of calcined coke, 83,000 tons of raw petroleum coke, 80,000 tons of oil based needle coke and 42,000 tons of coal based needle coke.

02. Demand aspect

Needle coke demand performance is ordinary. Affected by the downtrend of Fushun Daqing petroleum coke, downstream anode materials and graphite electrodes procurement attitude is cautious, and wait-and-see sentiment increased. Anode materials are generally purchased on demand, and graphite electrode market is weak. Needle coke demand is ordinary, and the procurement is mainly based on rigid demand.

03. Future forecast

Needle coke mainstream mainstream prices are expected to be strong operation, and individual orders may weaken.

Raw material prices pushed up slightly, needle coke cost surface still has some support, the demand side performance is ordinary, and the anode material manufacturers have depressed prices. In addition, the related product petroleum coke price has been adjusted downward, the market wait-and-see mentality intensified, the overall demand side performance is general.

Estimated price operation range: calcined petroleum coke is 10500-15000 yuan/ton; Raw coke is 8500-10500 yuan/ton. For more information about needle coke market, please contact us.

No related results found

0 Replies