【Negative Electrode Materials】Market Price Trends

【Negative Electrode Materials】Market Price Trends

Negative Electrode Materials: Limited New Orders, Weakening Trend

1. Current Focus

1)The Chinese government has approved applications for exporting spherical graphite materials and finished graphite negative electrode materials to major battery industry manufacturers in South Korea. The approval includes exporting spherical graphite materials required for lithium battery negative electrode material production to POSCO Future M, a battery material production subsidiary of the steel giant POSCO Group. It also approved the export of finished graphite negative electrode materials to major South Korean battery companies such as LG New Energy, SK Innovation, and Samsung SDI.

2)PetroChina's petroleum coke prices have risen across the board, with Daqing at 3010 CNY/ton, Fushun at 3140 CNY/ton, Jinxian at 2740 CNY/ton, and Jinzhou at 2650 CNY/ton. Learn more about the price of graphitized petroleum coke.

2. Current Market Situation

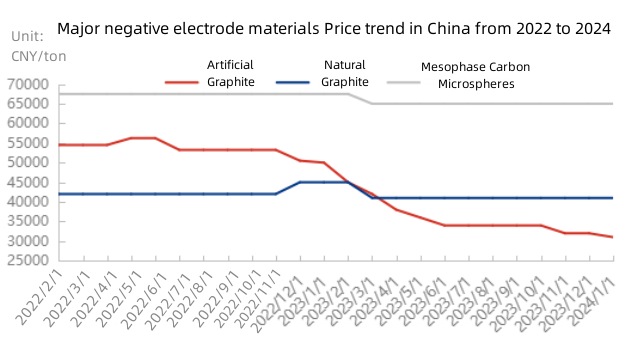

Source: Oilchem

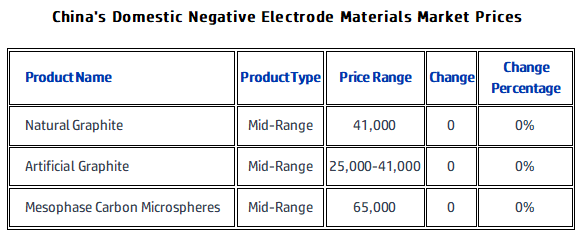

For mainstream negative electrode materials, natural graphite is priced at 40,000-42,000 CNY/ton, artificial graphite at 25,000-41,000 CNY/ton, and mesophase carbon microspheres at 65,000-70,000 CNY/ton.

3. Current Production and Sales Dynamics

1) Supply: Most negative electrode material companies have reduced production, sold inventory, and alleviated supply pressure.

2)Demand: Slow growth in energy storage and power, with battery cell factories reducing inventory before the end of the year, resulting in fewer orders for negative electrode materials.

4. Related Product Market

1)Petroleum Coke: The current domestic petroleum coke market maintains a stable and upward trend. In terms of mainstream prices, the latest round of bidding and pricing from CNOOC's refineries resulted in petroleum coke transaction prices remaining stable compared to the previous round. Refineries have smooth shipments, and the production and sales are generally balanced with low refinery inventories.

2)Needle Coke: The downstream demand is not highly active, and the needle coke market overall has weak transaction activity, with prices stabilizing. Mainstream prices for raw coke are 4800-5300 CNY/ton, and for calcined coke, prices are 6500-7800 CNY/ton.

5. Future Predictions

Limited new orders in the market, moderate enthusiasm for manufacturers to start production before the holiday, focusing on inventory control, weak trend in negative electrode material prices. More information on negative electrode market, feel free to communicate with us at any time.

No related results found

0 Replies